Secure Trust Bank Plc (LON:STBS) is an established ‘challenger’ with a record of organic profitable growth. The Everyday Loans Group sale provides substantial regulatory capital for organic and potentially inorganic growth. The move into mortgages will further diversify lending. Despite a record of rapid loan book expansion, an ROE/COE valuation model suggests the market is reluctant to make full allowance for profitable employment of the surplus.

2015 results

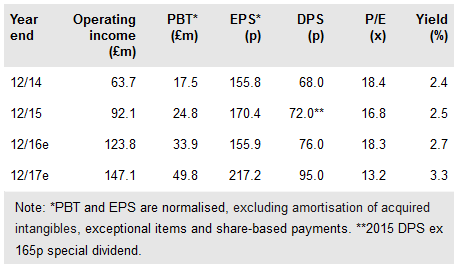

Secure Trust Bank (STB) has continued the strong pace of growth in the loan book seen in recent years with continuing activities (excluding Everyday Loans Group, ELG) ahead 82% in 2015 and five-year compound growth of 64%. Revenue and profit before tax were up 39% and 40% respectively. Growth in the loan book meant that the common equity tier 1 ratio declined from 18.7% to 13.6%. Adjusting for the ELG sale and the proposed 165p special dividend, the ratio would have been 18.4%, providing scope for substantial further loan growth to replace ELG’s profit and more. The ordinary dividend was increased by 6% to 72p.

To read the entire report Please click on the pdf File Below