Well, here we are. We’ve ignored it long enough, but with the first US presidential debate starting today, the Asian session markets are going to have to face it soon enough. Donald Trump winning the United States presidential election is a real possibility.

Global markets currently have their heads in the sand. There’s no other way to put it. It’s here, it’s real, and if it happens, things are going to get one hell of a mighty shake-up.

Wake up. Donald Trump, President of the United States of America could actually happen. Do those odds look familiar? Brexit type familiar?

There is a good piece from Bloomberg this morning, with this cracker of a quote from Credit Suisse:

Despite the impending Nov. 8 election, equity [volatilities] are not pricing in much of an election risk premium, with S&P weekly options expiring Nov. 11 trading at just 0.9 vol point premium to Nov. 4 expiry — that’s less than what was priced in for the Fed meeting last week.

Am I the only one to find that a little puzzling?

We spend our time on this blog focusing on where the biggest risk of a re-pricing will occur if market expectations are not met. Well, the fact that markets still flat out refuse to believe that Trump will even come close to the White House, is certainly an expectation with a real possibility of not being met.

Possibly bigger than any risk we’ve experienced for quite some time.

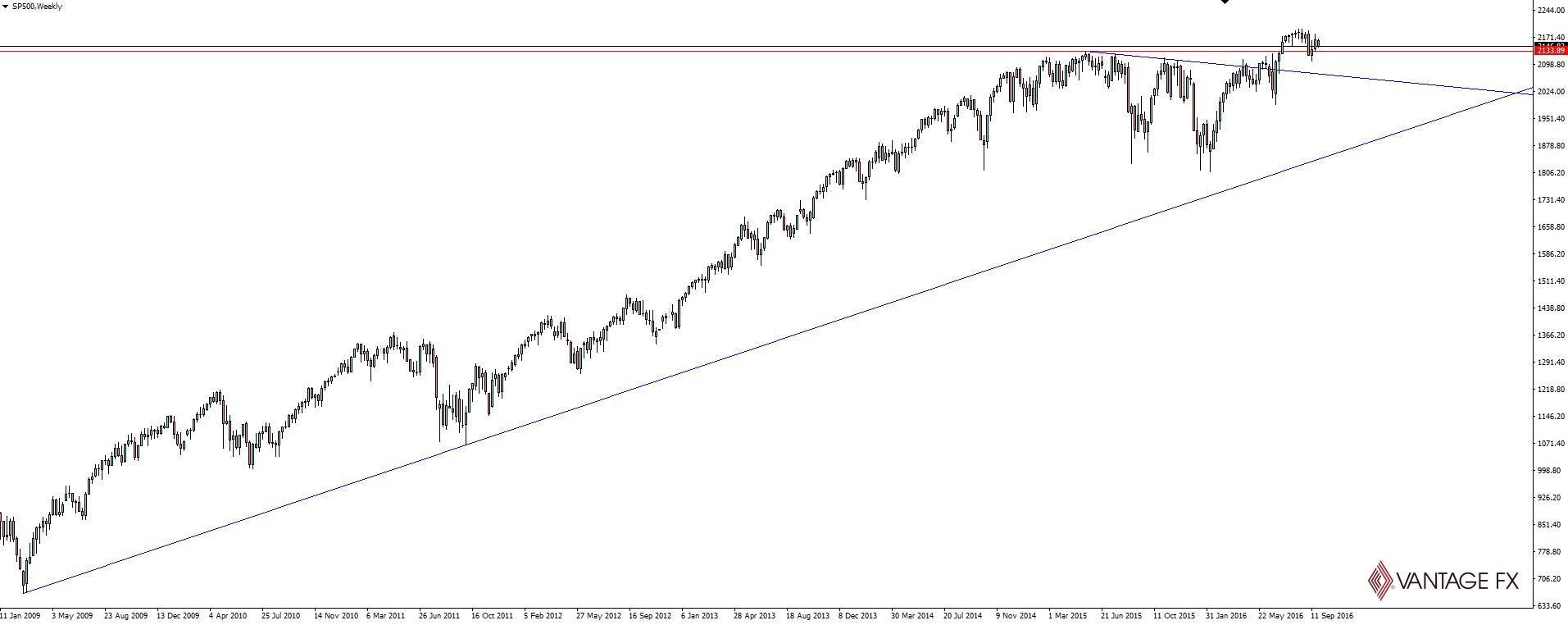

S&P 500 Weekly:

Click on chart to see a larger view.

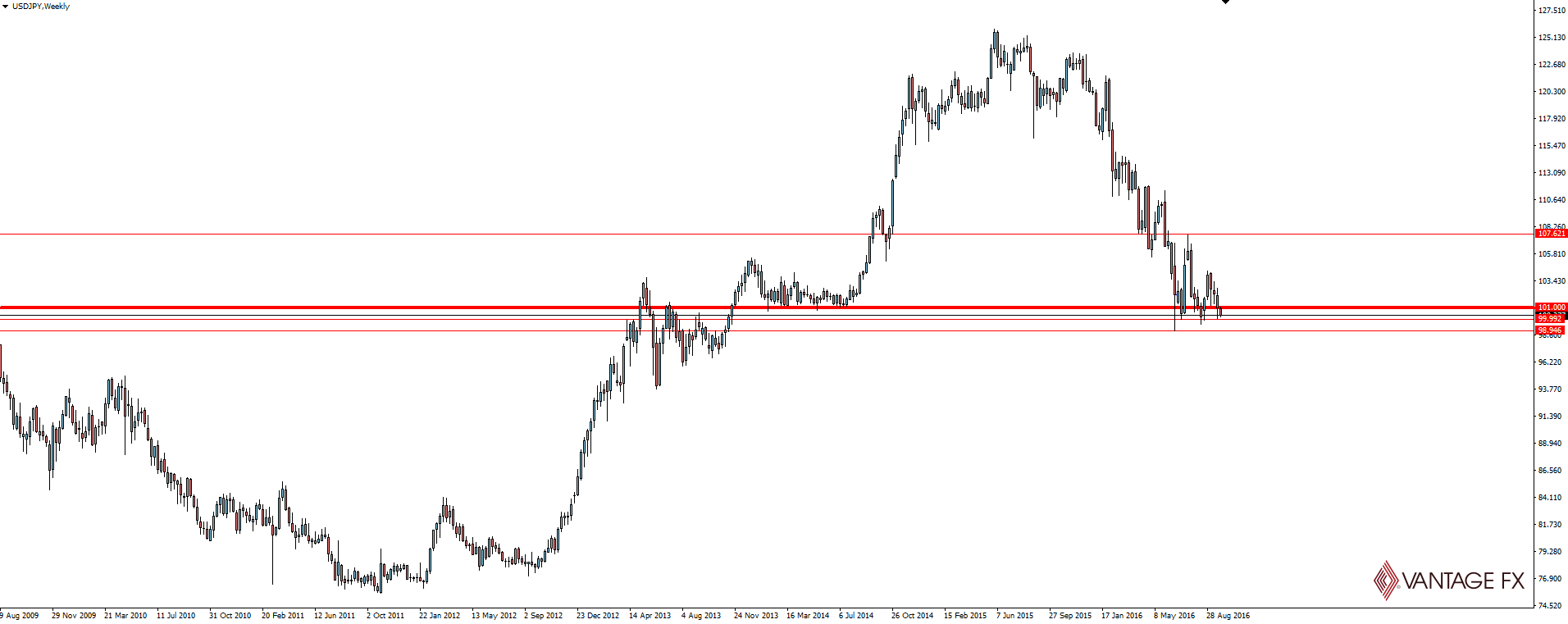

USD/JPY Weekly:

We’ll leave these two weekly charts here to refer back to, if the proverbial does in fact, hit the fan.

On the Calendar Tuesday:

USD CB Consumer Confidence

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.