The much weaker-than-expected US payrolls print for May left markets reeling. US equities slipped while the USD fell sharply. But the most significant adjustments were the shifts in near-term pricing for the Fed. The probability of a June rate hike implied by Fed fund futures fell to 4% from a high of 34% last week. The likelihood of a July rate hike has also declined, to 27% from above 50%. Both JPY and EUR, given their sensitivity to the Fed Funds curve, saw the largest gains, but the USD was bleeding across the board. This was on the back of US payrolls lifting by a mere 38k in May, against the Bloomberg consensus of a 160k. The March and April readings were also revised lower, by a cumulative 59k. Oddly enough, NFP had been one of the bright spots for the US economy all year. Just when the majority of Fed voting members were siding with a summer rate hike, the US jobs report dashed that expectation and left the Fed with egg on their face once again.

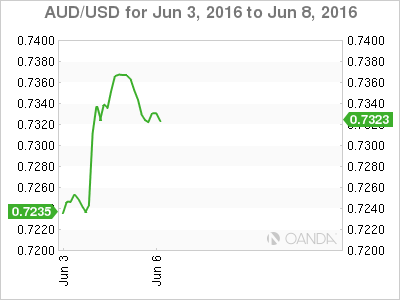

Aussie rallies (for now)

The Aussie dollar, which had been leading the major currency sentiment of late, rallied above 0.7360. Despite commodity currencies being sensitive to global growth concerns, the upside AUD correction may continue in days ahead.

However, there may be a few obstacles before that scenario may play out, namely tomorrow’s RBA OCR and the Fed’s Yellen’s speech later tonight. While tomorrow’s RBA rate decision could derail recent gains, it is unlikely the central bank will cut rates. This should make the path for near-term appreciation above 0.7400 as there are few major US economic indicators on the calendar to help contain the USD haemorrhaging.

Fed Chair Yellen’s speech later today will be the highlight of this week’s relatively light US economic calendar and takes on greater importance in the wake of the employment report misfire. Traders will be very keen to hear her comments as always. Whichever way she tries to harmonise recent Fed members (including her own) calls for near-term rate hikes, it is unlikely to derail the USD bear train. However, if the Fed does plan to raise rates shortly, it is expected she will make it clear in this speech. So Aussie traders are likely to tread lightly ahead of both Yellen and tomorrow’s RBA cash rate decision.

In early trade, the Aussie is trading softer but will likely remain firm on the back of shifting interest rate differential expectations vs. the USD.

In New Zealand, the primary focus will be on Thursday’s RBNZ MPS and OCR review. It is widely expected that the RBNZ will leave the OCR at 2.25% this month but retain an easing bias.

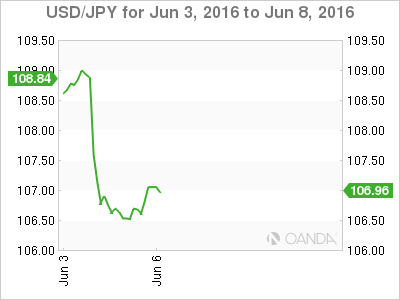

Yen – Bank of Japan backed into a corner

The Bank of Japan has a huge problem on its hands as the dismal US employment print not only derails a potential summer Fed hike but also increases the odds of the Fed remaining on hold through 2016, let alone two rate hikes. Employment has been the backbone of the US economy over the last year, and the employment report has been a lifeboat for the Fed when other fundamental indicators turn unsupportive. Where to from here?

Certainly, the Bank of Japan was hoping the Fed would do the heavy lifting and bail them out with a rate hike. However, the BoJ is now under added pressure after PM Abe indicated any large-scale fiscal stimulus will likely come in the autumn. Policy makers may have backed themselves into a corner with little ammunition to defend an assault on the 105 area if the market continues to reprice the Fed rate curve lower. With the market poised to retrace May’s USD advance, there appears little in the way of slowing a return to the May 3 low of 105.51 and a break could trigger expectations of a move towards 100 JPY.

Oil – OPEC’s grip loosens

No one expected OPEC to agree to a freeze as political infighting doomed the meeting from the start. It was the second consecutive policy failure reinforcing the perception that the market now dictates prices rather than having them guided by OPEC. Apparently, US shale production has changed the market landscape and the way energy markets now prices oil. It certainly appears that OPEC is losing its iron grip on market prices.

Yuan – how will China react to fading US rate hikes?

With a summer rate hike all but off the table, the market will be keenly interested in what degree the Chinese authorities fix the CNY stronger against the USD this week. Given the recent build up in Short CNH and CNY leading up to Friday’s NFP, we could see increased Yuan short covering if the fix moves aggressively lower. Traders will turn focus to The US/China Strategic & Economic Dialogue meeting on 6-7 June

The PBOC announced that as of July 15 the offshore RRR calculation will be the average Banks outstanding deposits, rather than the deposit level at the date of assessment. The direct market impact will be less offshore money market volatility at quarter-end and there will be less incentive for Banks to do a one-off quarter end reduction in CNH deposits to reduce overall their reserve requirements with the central bank.

PBOC SETS YUAN MIDPOINT AT 6.5497 V 6.5793 PRIOR; strongest setting since May 27

The USDMYR slumped to 4.08 at today’s open as fallout from Friday US non-farm payroll and diminishing odds of a summer US rate hike. AS well there’s less local pressure for a depreciation Yuan, providing support. But by no means is the Ringgit is not sitting on a bed of roses and far from retracing May’s highs below 4.00 USD/MYR.The underlying story is not getting any better and its may turn into a very unsettling few months as risk sentiment could substantially deteriorate if the US economy continues to show signs of further weakness.