Medical is one of the seven sectors in the S&P 500 cohort that is expected to witness earnings growth in the second quarter. The sector is likely to record earnings growth of 3.4% on revenue improvement of 7.7%.

As per the latest Zacks Earnings Trend report, overall second-quarter earnings for S&P 500 companies are expected to be down 3.4% year over year on 0.4% revenue decline.

Nursing Home, though a small component of the Medical sector, is expected follow the growth trajectory this earnings season.

Here, we take a look at three nursing home stocks scheduled to report their second-quarter figures on Aug 4:

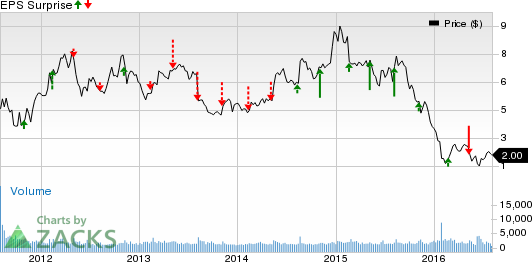

Nursing-Home operator Kindred Healthcare Inc. (NYSE:KND) is expected to benefit from exceptional performance at the hospital division. Moreover, continued growth at Home business and strong inpatient rehabilitation business are key positives.

Notably, in the hospital division, Kindred’s focus on enhancing its LTAC (Long-Term Acute Care) criteria is likely to strengthen the company’s market position. Meanwhile, an agreement to sell 12 LTACs to Curahealth is also a noteworthy development.

However, our proven model does not conclusively show that the company is likely to beat earnings, given the combination of a Zacks Rank #3 (Hold) and Earnings ESP of 0.00%. We note the Most Accurate estimate and the Zacks Consensus Estimate stand at 34 cents.

That is because, as per our model, a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 to beat estimates. Simultaneously, we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

We also note that the results at Kindred compared favorably with the Zacks Consensus Estimate in the last four quarters, with an average beat of 15.35%.

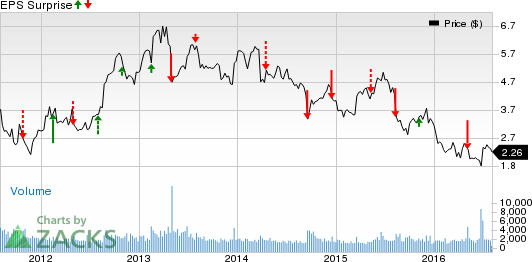

Genesis Healthcare Inc (NYSE:GEN) is one of the largest post-acute care providers in the U.S.

The company is expected to benefit from its unique clinical capabilities, strategic collaboration opportunities with acute care and managed care partners and strong market participation in the Medicare Shared Savings Program (MSSP).

Moreover, expansion into the markets of Pittsburg, Pennsylvania, and China are likely to enhance the company’s growth opportunities.

In spite of this, our proven model does not conclusively show that the company is likely to beat earnings, given the combination of a Zacks Rank #3 and Earnings ESP of 0.0%. We note that the Most Accurate estimate and the Zacks Consensus Estimate for the company stand at a penny.

Five Star Quality Care Inc (NASDAQ:FVE) operates and manages senior living communities in the U.S.

We believe that the strategic disposition program of Five Star, where the company has sold numerous communities (the majority of which were skilled nursing facilities), will boost growth for the company. The projects in South Carolina, Indiana, Tennessee and Arizona are also quite promising in our view.

Nevertheless, our proven model does not conclusively show that the company is likely to beat estimates, given the combination of a Zacks Rank #2 (Buy) and Earnings ESP of 0.00%. Notably, the Zacks Consensus Estimate and the Most Accurate estimate for the company are currently pegged at a loss of a penny.

KINDRED HLTHCR (KND): Free Stock Analysis Report

FIVE STAR QLTY (FVE): Free Stock Analysis Report

GENESIS HLTHCR (GEN): Free Stock Analysis Report

Original post

Zacks Investment Research