Donald Trump was elected the 45th president of the United States on Tuesday, defying most polls and pundits. The market response was almost as surprising as the election result itself. A sharp-sell in the after-hours trading gave way to a big rally later.

Investors are hopeful that higher fiscal spending, fewer regulations and lower taxes could boost growth and stoke inflation, leading to a steeper yield curve. A conciliatory acceptance speech by Trump and the republican sweep of the congress could mean easing of political gridlock and faster passage of reforms.

The Dow rallied 5.4% last week--its biggest weekly gain in almost five years. The S&P 500 index and the NASDAQ were up about 3.8% for the week.

Certain areas of the market have done much better than others, while safe haven assets like bonds and gold have sold-off. (Read: Trump Win Sparks Sell-Off in Bonds—Short with These ETFs)

Here are some charts that show how the investing landscape has changed after Trump’s election. For the purpose of comparison, I have also charted the one-week performance of SPDR S&P 500 (NYSE:SPY) ETFs (SPY).

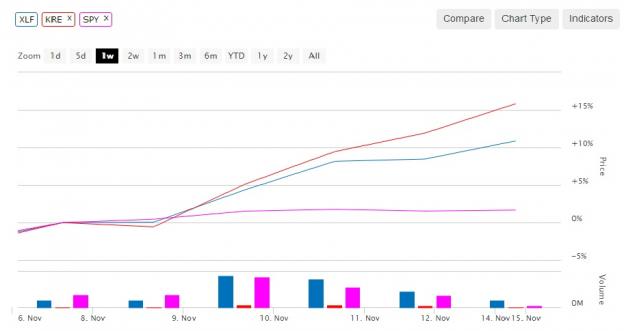

Financials Select Sector SPDR Fund (XLF)

Trump has called for repealing the Dodd-Frank Act, which was enacted in the aftermath of the financial crisis, and imposed stricter regulations on banks. Higher interest rates also benefit banks.

Financial stocks have surged to levels not seen since Lehman collapse on hopes for more supportive regulatory environment and higher interest rates.

XLF is up about 11% in the last week, while the SPDR S&P Regional Banking ETF (KRE) has done even better, rising almost 16%.

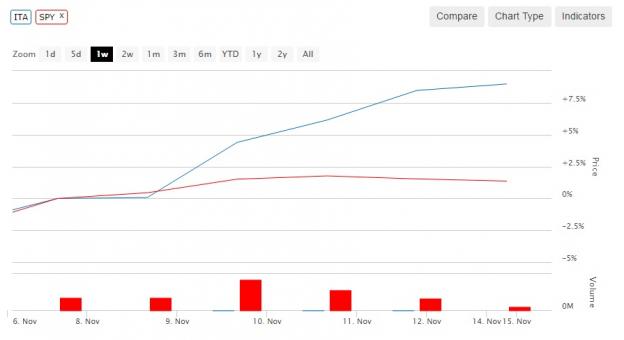

iShares US Aerospace & Defense ETF (ITA)

Defense companies are likely to benefit from Trump’s proposals for a massive increase in defense spending. He is expected to boost US military spending by $500 billion to $1 trillion.

As a result, defense stocks have been spearing after election. ITA is up about 9% in the past week.

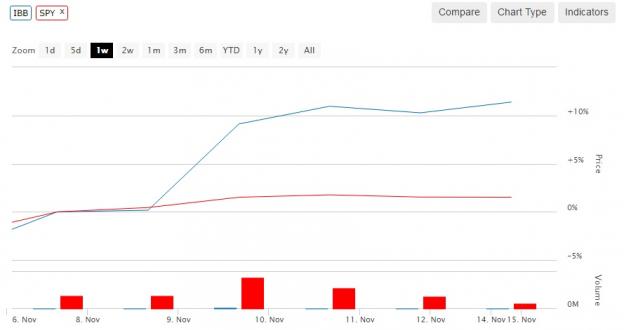

iShares Nasdaq Biotechnology ETF (IBB)

Pharma and biotech stocks have been big gainers in a relief rally. Rising chances of a Hillary Clinton victory had weighed on these sectors over the past few months as her presidency could have pressured profit margins of biotech and drug companies.

IBB is up about 11%. (Read: 5 Reasons to Buy 5 Low P/E Biotech ETFs)

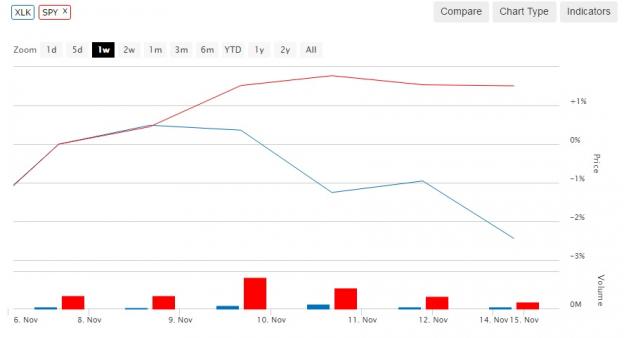

Technology Select Sector SPDR Fund (XLK)

Trump’s proposed trade and immigration policies could hurt big technology companies. At the same time, his corporate tax repatriation plans could benefit technology companies that hold a lot of cash overseas. They could repatriate that cash and use it for investments, dividends and buybacks.

Investors have been avoiding technology stocks, sending XLK down about 3% last week.

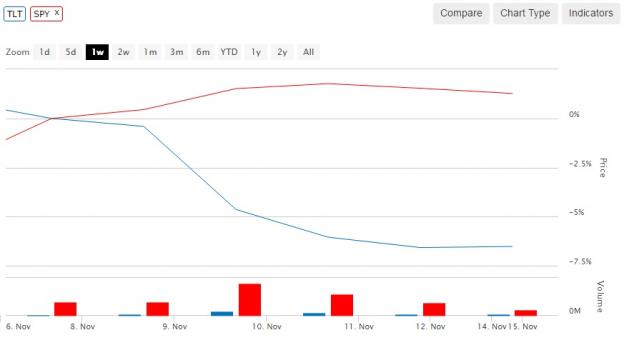

iShares 20+ Year Treasury Bond ETF (TLT)

It was a painful week for bonds and in fact, investors have started questioning whether the 30-year rally in bonds is finally coming to an end as inflation picks up and interest rates start to rise.

The yield on the 10-year Treasury note jumped from 1.78 on Tuesday to 2.21 this morning. Yields on German Bunds and UK Gilts are also much higher.

TLT fell almost 7% last week.

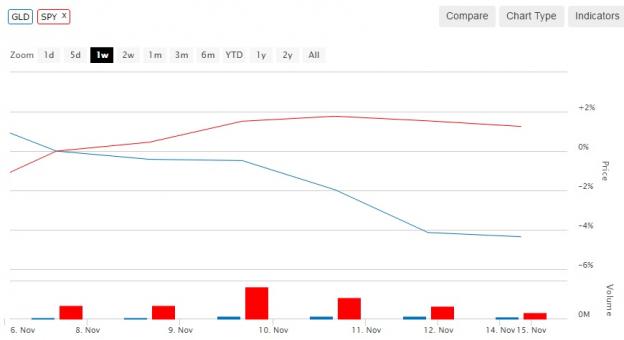

SPDR Gold ETF (NYSE:GLD) (GLD)

Gold fell 3.3% on Friday—its biggest daily loss in three years, and is down 8.5% from the high reached after election. A stronger dollar and risk-on sentiment continue to weigh on the precious metal.

GLD is down almost 5% in the past week. (Read: 6 Stocks & ETFs to Avoid on Trump’s Win)

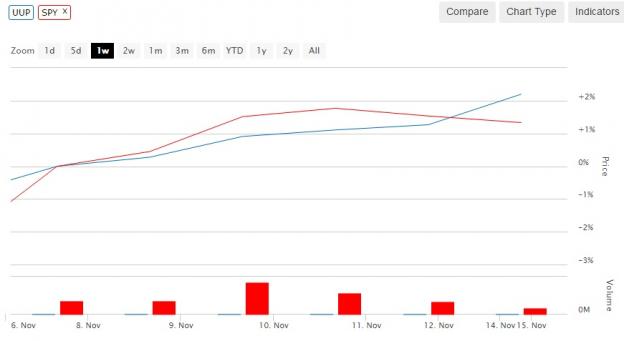

PowerShares DB US Dollar Bullish Fund (UUP)

The dollar rose to its eight-month high against currencies of major trading partners, on expectations of higher economic growth and interest rates.

UUP is up 2.2% in the past one week.

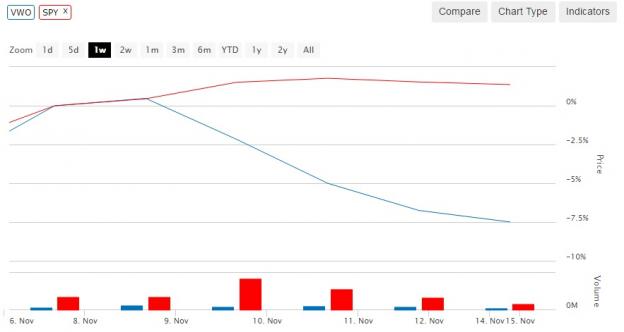

Vanguard FTSE Emerging Markets ETF (VWO)

Many investors had flocked to emerging markets in search for yield and growth in the last few months. But the trend may reverse if economic growth in the US picks up and interest rates start rising.

VWO is down more than 7% as investors continue to dump emerging market stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

SPDR-SP 500 TR (SPY): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

SPDR-KBW REG BK (KRE): ETF Research Reports

ISHARS-US AEROS (ITA): ETF Research Reports

ISHARES NDQ BIO (IBB): ETF Research Reports

SPDR-TECH SELS (XLK): ETF Research Reports

ISHARS-20+YTB (TLT): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Trump Effect: 8 Must-See ETF Charts

Published 11/14/2016, 01:49 AM

Updated 07/09/2023, 06:31 AM

The Trump Effect: 8 Must-See ETF Charts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.