On June 24th, when it became clear that the majority of UK citizens wants the country to leave the European Union, the FTSE 100 fell sharply to 5741. However, it has been recovering ever since and is currently trading above 6680.

Once again, trading the news did not prove to be the way to make money in the markets, since the majority of experts were expecting the crash to continue. Now, following a rally of nearly 1000 points, it is understandable to believe the uptrend is likely to go even higher. But the next chart shows why this is probably not going to happen as well, according to the Elliott Wave Principle.

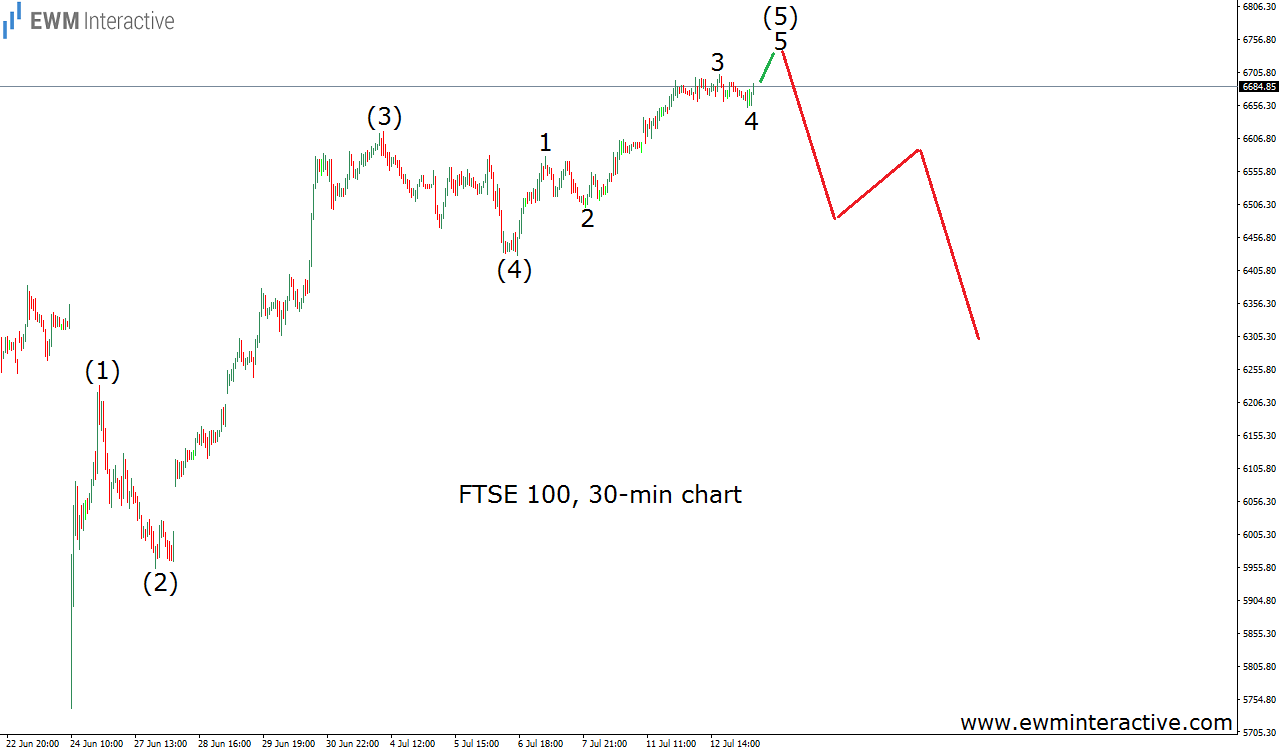

The 30-minute chart of FTSE 100 makes the entire advance from 5741 visible. It looks like a textbook five-wave impulse, where wave (5) seems to be approaching its termination point. The Wave principle states that every impulse is followed by a three-wave correction in the opposite direction.

In other words, once wave (5) is over, a significant decline should begin. That is why we do not believe you should be buying this index right now, no matter how tempting it might look after such a strong rally in such a short time. The anticipated pullback should reach the support area of wave (4), meaning that levels around 6430 could be seen, at least.

A bearish reversal might be just around the corner in FTSE 100. Keep that in mind.