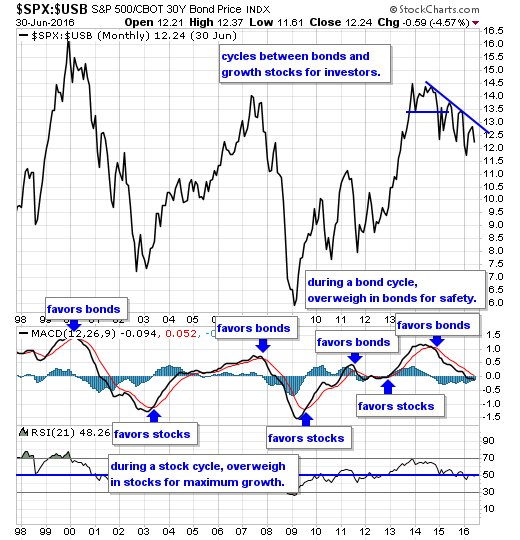

Our equity/bond model - This long term reliable investing model provides investors with simple decision making in the markets:

When the model favors stocks, investors should overweigh in equities for maximum growth.

When the model favors bonds, investors should overweigh in bonds for safety.

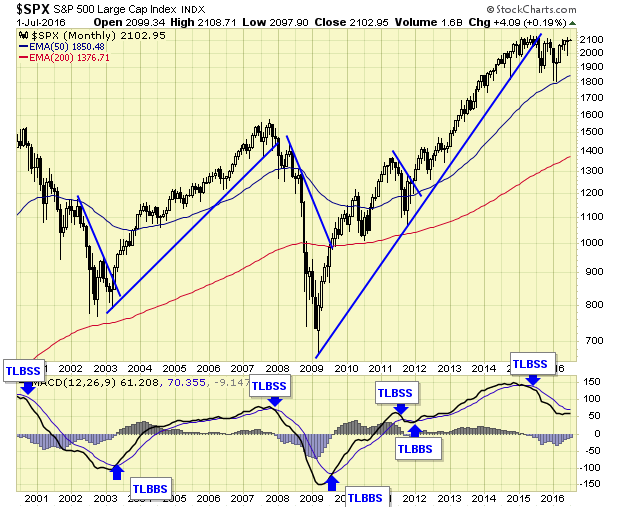

Our benchmark S&P 500 is on major sell signal, ending the major buy signal from early 2012.

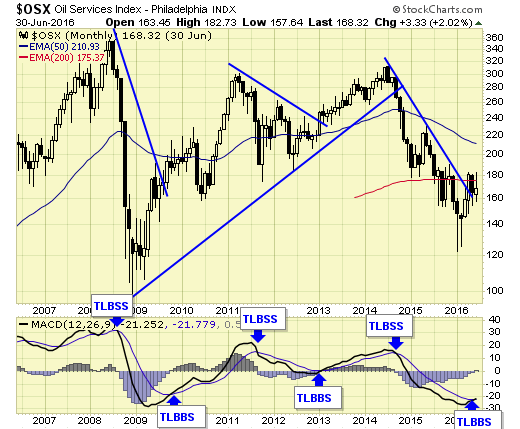

Oil sector is on a new major buy signal.

Investors can begin accumulating oil stocks/ETFs by cost averaging.

Summary

Current investing model favors bonds over equities, therefore, investors should overweigh their portfolios with bonds over stocks for safety.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple investing model which provides us with simple investing decision making. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets.

We also provide coverage to the precious metals sector.