London Forex Report: US services sector showed signs of contraction, posting evidence that economic momentum is losing steam in the first quarter of 2016. Meanwhile in UK, concerns over Brexit intensified and will likely have repercussions on economic growth in the first half of this year, before Britons vote to stay or leave the EU. Dallas fed chair Robert Kaplan said that he does not expect the US to enter recession this year and that his outlook of leaving rates on hold for an extended period if necessary will be reflected in March economic projections. USD strengthened in early trade but the USD Index eased 0.03% to 97.45, tumbling on rallies in minor components CAD and CHF as well as easing risk-off sentiment following strong rebound in oil prices.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR rebounded from 1.0960 to an intra day high of 1.1018 as risk appetite became better due to the rally in oil prices. The euro dropped 0.2 percent against Swiss franc to trade at 1.0865, its weakest since January13 as the demand for safe havens was boosted. Since the euro is getting dragged down by the concerns over the Brexit issue, investors now prefer the yen and Swiss franc instead of euro when they are seeking a safe haven currency.

Technical: While prior pivotal support at 1.1050/70 acts as intraday resistance, bears target prior range support at 1.08. Only a close over 1.1150 eases immediate downside pressure.

Interbank Flows: Bids 1.0950 stops below. Offers 1.1150 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

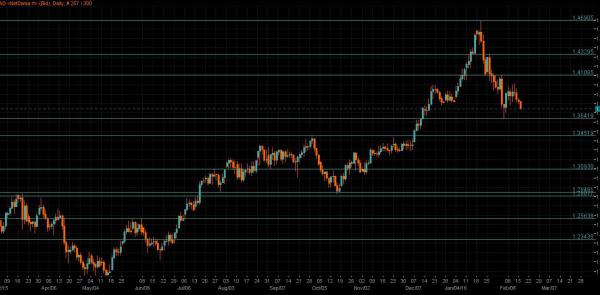

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: While the data bag from the UK came in mixed, concerns on a Brexit intensified and will likely have repercussions on economic growth in 1H before Britons vote to stay or leave EU. Housing market remained robust, with report from BBA showing that the number of home loans surged to 47,509 in January compared to 43,660 in December. The increase was driven largely by purchases before the implementation of new stamp duty in April.

Technical: While 1.4040/60 acts as resistance, expect a continued grind lower for a test of the next major monthly downside objective at 1.37. Only a close over 1.4250 eases immediate downside pressure.

Interbank Flows: Bids 1.39 stops below. Offers 1.4040 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: Owing to fears of a possible British exit from EU and unstable global stock markets, risk appetite remains on the ropes, which drove the JPY broadly higher. Against the JPY, USD went to nearly three-month low of 111.04. Markets await Japanese Consumer Price Index due tomorrow, which may give some hints whether BoJ will act or not in the next meeting held on March 15.

Technical: 111 bids buffer the decline in USD/JPY setting up a potential double bottom base for a more meaningful corrective phase. Confirmation of a broader correction will come with a close over 113.30. Failure at 111 opens psychological 110 as the next downside objective.

Interbank Flows: Bids 111 offers below. Offers 113.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Sentiments among small businesses in Japan improved in February. The confidence index ticked up 0.7 points to 47.9 in February. Other releases affirmed softer growth in Q4, dragged by deterioration in economic conditions. Final prints of the leading index edged down from 103.2 in November to 102.1 in December, while coincident index fell from 111.9 in November to 110.9 in December.

Technical: While 124.80 offers intraday resistance, expect a continued grind lower to print fresh lows and test bids at the psychological 120 en route to a weekly downside objective at 118/117. Only a close over 126.60 eases bearish bias.

Interbank Flows: Bids 122 stops below. Offers 124.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD dropped below the 0.72 handle to reach intraday lows of 0.7143 as US Services PMI for February posted a reading of 49.8, below the 50 threshold while implying a contraction in the US services sector. The data release had added concerns over the growth of the largest economy, weighing on the sentiment-linked AUD. Australia’s Q4 Private Capital Expenditure rose 0.8% QoQ, better than a negative growth of 3.1% expected by the markets

Technical: Expected retest of offers above .7240 attracts near-term profit taking. While .7150 supports intraday expect a test of range resistance at .7300. Only a failure at.7050 pivotal support threatens bullish bias

Interbank Flows: Bids .7150 stops below. Offers .7300 stops above

Retail Sentiment: Bullish

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Oil futures pared losses after the US EIA reported a 3.5 million-barrel climb in crude oil supplies, well below the 7.1 million-barrel increase reported by the American Petroleum Institute. USD/CAD dropped sharply to reach as low as 1.3674 before touching intraday high of 1.3859. With little data from Canada on the deck, movements in oil markets and technical factors are expected to drive USD/CAD into the weekend.

Technical: While USDCAD trades sub 1.3850, downside pressure remains the driver, with bears fully focused on a retest of 1.3630 bids ahead of 1.3530. A close over 1.3850 suggests a retest of 1.40 offers in broader range trade.

Interbank Flows: Bids 1.3630 stops below. Offers 1.3850 stops above

Retail Sentiment: Bullish

Trading Take-away: Neutral