The Australian dollar has been strongly bullish of late as the pair has benefitted from sentiment swings from both, a weaker FOMC outlook, and a stronger iron ore market. However, despite the stunning rally of the past 24 hours, the bears are marshalling their troops and could be preparing for a short side push.

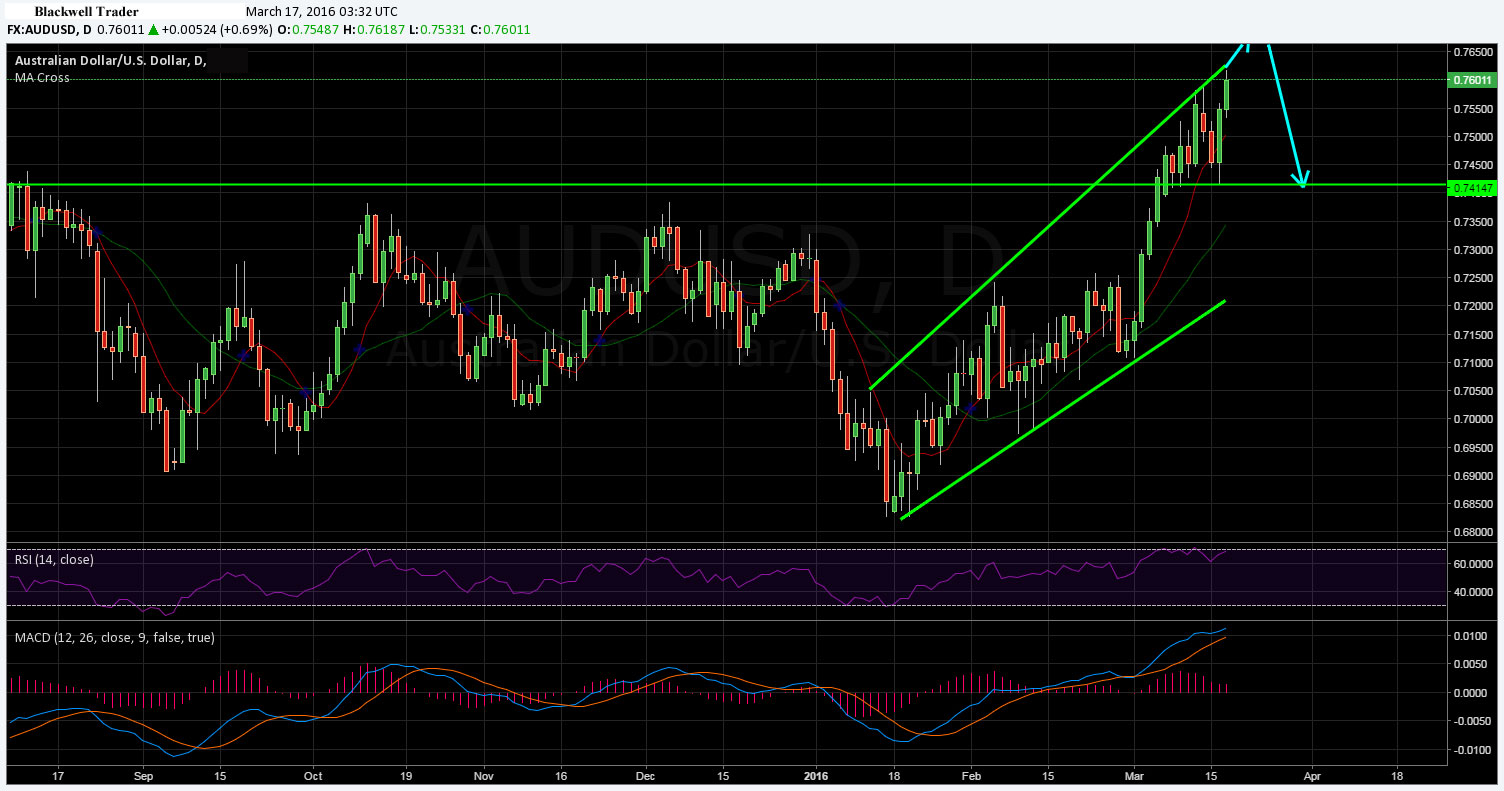

As the currency has continued to rise over the past few months a relatively strong channel has formed which has largely constrained its price action. Taking a look at the daily chart shows price action almost linear as it travels up the sharply bullish channel. However, the pair is now closing in on a key resistance level at 0.7600 that could, ultimately, be a bridge too far.

In addition, taking a look at the RSI oscillator shows the indicator has also followed the general trend direction and risen strongly. However, the indicator is now reaching in to over-bought levels which could predispose it for a strong pull back in the coming days. In fact, RSI has historically been relatively good at predicting short plays. The sharp pull backs to the bottom of the channel in October and December were also largely predictable given RSI’s over-bought nature.

Subsequently, keep a close watch on the pair in the coming days for any signs that a pullback is in progress. In fact, there is a real chance for a short play to materialise on extension from the 0.7580 -0.7600 level. This contention is further supported by the development of a Wolf Wave and the recent completion of an ABCD pattern.

However, keep a watch on the slew of US economic data which is due out in the next 24 hours. In particular watch for any fundamental weakness in the Philly Fed Manufacturing Index which could further depress the USD.