- Economists expect German industrial production to increase again in December

- A mild rise in US job openings is on track for today’s December update

- Will Japan’s 10-year yield continue to rise and put distance over BoJ’s 0% target?

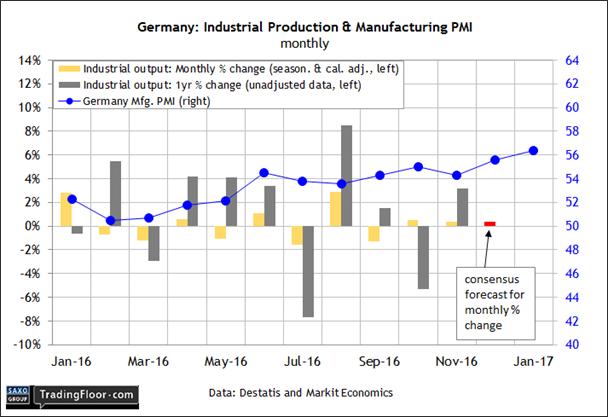

Germany’s economy is in focus today with the release of industrial production numbers for December.

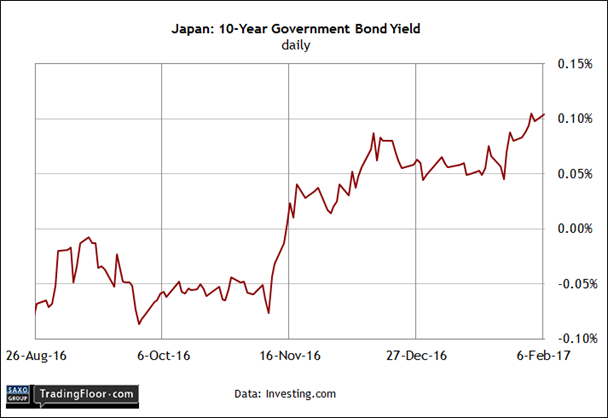

We’ll also see an update on US job openings for 2016’s close. Meantime, keep your eye on Japan’s 10-year government bond yield, which has recently climbed above the Bank of Japan’s 0% target.

Germany: Industrial Production (0700 GMT): Factory orders in Europe’s main economy roared back to life in December, surging the most in more than two years. The news provides more evidence that growth is picking up in the Eurozone’s heartland.

“All recent data point to a very strong start for 2017 in Germany and in the euro area after a very good fourth quarter,” noted an economist at Landesbank Baden-Wuerttemberg.

The latest survey numbers for the country’s manufacturing sector certainly point to a strong trend for this year’s first quarter.

The Germany Manufacturing PMI jumped to a three-year high in January, in part due to strong hiring.

“Germany’s manufacturing sector started 2017 in much the same way that it finished 2016, with growth accelerating,” an IHS Markit economist said last week.

“The sector’s impressive performance bodes well for GDP growth in the first quarter, building on the strongest expansion in five years across 2016 as a whole.”

The upbeat assessment should translate into a respectable rate of growth for today’s December report on industrial output. Not surprisingly, economists are looking for a 0.4% monthly increase in production, matching November’s rise.

Short of a major downside surprise, today’s results are set to provide another round of encouragement for assessing Germany’s economic outlook in 2017.

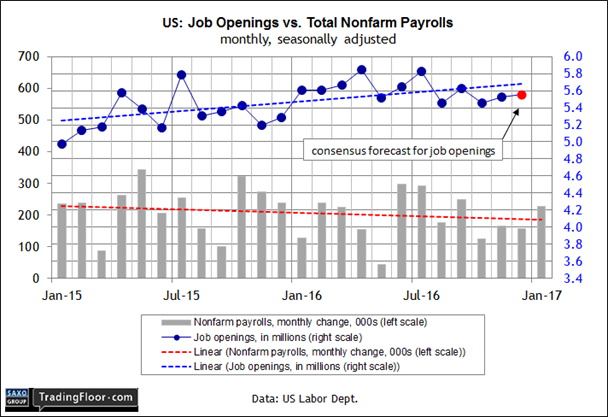

US: Job Openings & Labor Turnover Survey (1500 GMT): The labour market rebounded in January, posting the strongest gain in payrolls since last September.

But recent updates for job openings still point to a mixed outlook. Will today’s report tell a different story?

Yes…sort of. TradingEconomics.com’s consensus forecast sees job openings rising to 5.553 million (seasonally adjusted) for December, slightly above November’s gain and the highest since September. But that still leaves openings at a below-trend rate.

Overall, it’s appears that job openings have peaked. Meanwhile, the monthly change in payrolls, despite the latest rebound, appears to be trending lower, based on numbers for the past two years.

The two-year trend in job openings is still bullish, but it’s not unreasonable to wonder if the weaker readings in recent months signal regime shift in the near future.

Maybe, although yesterday’s release of the Federal Reserve’s Labor Market Conditions Index for January firmed up, with revised data showing moderately strong increases in recent months.

Based on this benchmark, job openings could be headed for a rebound too. If so, the outlook for the labour market will continue to improve.

Japan: 10-Year Government Bond Yield: The Bank of Japan’s (BoJ) target rate of 0% for the 10-year yield appears to be giving way as the benchmark rate trends higher.

The charitable interpretation is that the target has a range of 10 basis points on either side of zero.

Maybe so, but even by that standard it appears that the central bank is at risk of losing control over its stated policy objective for the 10-year yield.

In reaction to the pressure, the BoJ extended bond purchases for a second day on Monday, helping to stabilise the 10-year yield at roughly 0.9-0.10% as of mid-day trading New York time.

But that still leaves the rate close to its highest level in more than a year, raising questions about the central bank’s commitment to maintaining the 0% target.

Meanwhile, the Japanese yen has strengthened against the dollar this year, in part because of uncertainty about US policy in the wake of Donald Trump’s election.

The Japanese currency has climbed nearly 4% year to date against the greenback.

A weak-dollar policy is thought to be attractive to the Trump administration as a tool to boost exports and slow the Federal Reserve’s plans to raise US interest rates.

The question is whether the BoJ will react? A stronger yen, after all, will create new headwinds for the Japanese economy, which is still battling deflationary forces.

For the moment, the market seems to be in control of the 10-year yield. If this rate continues to rise, the yen will probably strengthen further - unless the the BoJ intervenes.

Indeed, the man who helped engineer a weakening of Japan’s currency in the 1990s tells Reuters that the dollar could fall below 100 yen by 2017’s close.

As long as the 10-year rate is moving higher, dismissing that forecast won't be easy.

Disclosure: Originally published at Saxo Bank TradingFloor.com