Precious metals expert Michael Ballanger compares the current state of the precious metals market to one year ago.

'Tis one week 'til Christmas and all through the Street

Brokers are begging for the Donald's next tweet.

With benchmarks all causing the advisors such fear

They all need a jumpstart to rescue the year.

This time last year, despite an absolutely brutal year for the precious metals and my beloved gold miners, I was genuinely excited as that $1,045 gold print in early December along with the multiyear low in the commercial net short position (at -2,911 contracts) was going to be THE bottom for our sector and one that could be bought for multiyear advances—and once the miners went through one final capitulatory regurgitation in mid-January unconfirmed by the physical metals, it was obvious to me that it was then time to go "ALL-IN" as I did with the VanEck Vectors Junior Gold Miners ETF (NYSE:GDX) for that exhilarating move from $18 to $52. Direxion Daily Junior Gold Miners Bull 3X Shares (NYSE:JNUG) was a split-adjusted tenbagger from the January lows to the late-August peak but at Christmas 2015, I felt really good about the outlook for this year, 2016.

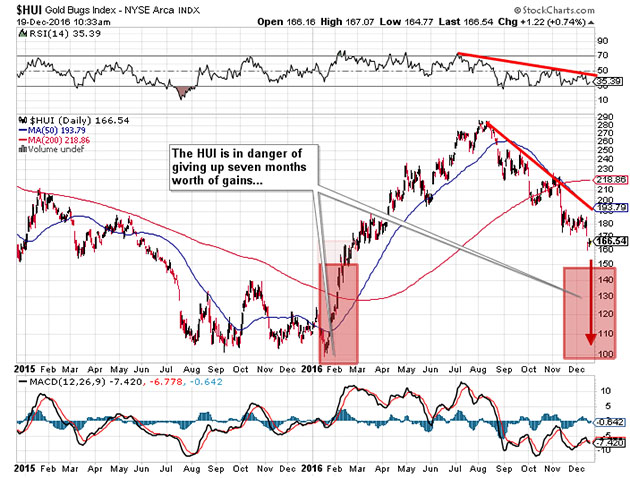

Alas, here we are closing out the year with the HUI ARCA Gold BUGS 47% from the mid-year high at 286 and still a mere 25% of the 2011 peak at 635. After grooming themselves for a magnificent year of outperformance back in August, the script I had been preparing complete with curtain calls and victory laps has been transformed into yet another December assault of tax-loss selling and portfolio rebalancing bringing pressure down upon the throats of the miners, big and small.

After the Trump victory, what should have been a December of portfolio managers chasing gold and silver stocks turned into a December where portfolio managers were chasing the banks because higher interest rates brought about by the post-election surge in yields were "bullish." Well, yes, I get it that the steeper the yield curve, the bigger the margin for the lenders, but how on earth does Bank of America get marked up by 20% because the 10-year prints a 2.48 yield? Higher borrowing costs, by the way, are NOT good for business especially if borrowers are shutting their doors because higher borrowing costs are crippling their customers' purchasing power.

I guess what really irks me this Christmas is that the miners were given a seven-month reprieve in 2016 after a near-sixty-month bear market of the "granddaddy" variety, in which we witnessed not just "falls from Grace," but rather total annihilation of projects, balance sheets, hopes, dreams and retirement plans over a very long and drawn out time frame. After bear markets of the magnitude of the last one, the new bulls tend to have big advances initially and then a pause/correction that typically flushes out all of the late longs and allows the early investors to replace peripheral positions before going for the next major advance.

As we close out 2016, the HUI is actually sitting on the precipice of a large gap zone representing the initial lift-off from the lows at 99.17 to around 150; if we don't grab in here, tax-loss selling right up until the 31st could easily vaporize the 2016 gains made nine months ago. Now, am I forecasting that? No. However, I am calling it to everyone's attention so that if it actually happens, I can cherry-pick it from today's missive and tell everyone that I "nailed it" (like all the other gurus do).

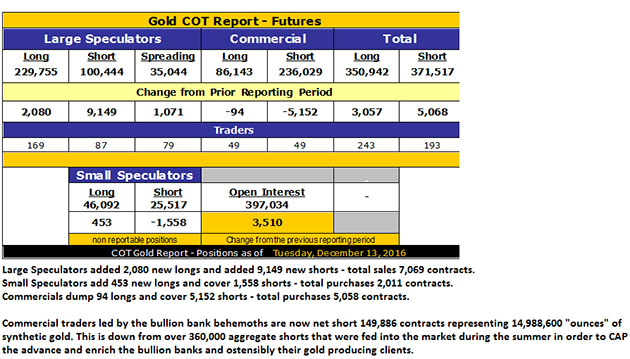

Friday's COT was no surprise in that it was before the big smash last week and while you can see that the open interest numbers are flattening out, that would appear to be because the Large Speculators have started to short the market as compared with last August when they were net long 294,000 contracts versus today at 129,000. So it looks like the Commercials are playing bat catchers to the Large Spec pitchers as long liquidation prevails going into year end.

I think that with the Commercials STILL short a ton of paper "gold" versus this time last year, that it is still too early to expect that we are in as good a shape in terms of the COT structure today as we were on December 4th of last year with the Commercial Cretins at -2,911 contracts and the Large Specs massively short instead.

Some of the brilliant minds out there say that gold will be weak right up until Trump's inauguration but I think it will all be pretty much over by end-of-month. One sad thing is for certain from where I sit: the explosive cannon shot that the miners experienced in the winter of 2016 is going to be a very tough act to follow.

The good news for me is that the base metals have finally rolled over with copper now finally in retreat and taking Freeport-McMoran Inc (NYSE:FCX) with it. I bought a fistful of January puts that are now finally in-the-money and as I wrote when I first posted the trading idea, I continue to think that the Trump Trade will get largely reversed after month-end when people's gains are moved to 2018 and are probably at a lower tax rate. If that's the case, then FCX could easily check back to the 200-dma at $11.56 but it could also be headed to its pre-election level around $10.50. If that happens, the January $14 puts will be between $2.50 and $3.50 and a decent return from the $1.25 paid three weeks ago.

There is no question that gold sentiment is similar to last year in its extreme bearish consensus so there is no doubt that we could and probably will get a really sharp countertrend rally in the miners in early January. However, until the regulators can finally put an end to this horrific process whereby the bullion banks have a total carte blanche to issue as many contracts as they desire under the guise of "hedging," prospective gold investors are simply going to say "Nope, not playing."

Because of the interventions and collusions and bank-coordinated gangs attacks such as we are now witnessing via all of the Deutsche Bank evidence coming to the surface, it is actually having a negative effect on sentiment because as much as the revelations are creating transparency, they are also scaring prospective investors at the same time. The prevailing wisdom that is emanating from the trading desks is "Wow, if they can get away with that, why would anyone put money into the gold and silver markets?" Bullish sentiment for gold is 4%, which is 1% higher than the all-time low from 2014.

The more things change. . .

Disclosure:

1) Michael Ballanger: I, or members of my immediate household or family, own puts on the following companies mentioned in this article: Freeport McMoRan Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.