Popeyes Louisiana Kitchen Inc (NASDAQ:PLKI) is one expensive stock, especially for a restaurant: trailing P/E of 36.2, forward P/E of 28.9, price/sales of 5.5, and price/book of 187.4. PLKI most recently reported 4.7% year-over-year revenue growth and -1.9% earnings growth. (Data from Yahoo Finance).

According to briefing.com, year-over-year revenue growth has stagnated in the low single digits for the past 4 quarters. So, it is understandable that the stock was stuck in neutral for two years. Yet the valuation and recent performance were no obstacle for traders scrambling for shares of PLKI on the heels of buy-out rumors.

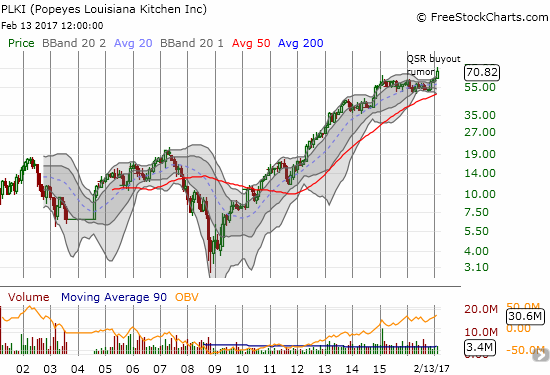

Popeyes Louisiana Kitchen, Inc. (PLKI) broke out to a new all-time high on buyout rumors.

Popeyes Louisiana Kitchen, Inc. (PLKI) was essentially stalled from 2015 to 2016 but overall has had an incredible post-recession run-up.

On Monday, February 13, 2017, a rumor originating from Reuters hit the airwaves: the owner of Tim Horton’s and Burger King, Restaurant Brands International Inc (NYSE:QSR), is interested in buying PLKI. Price negotiations are supposedly still underway and a deal is not certain. Those caveats did not stop traders from bidding up PLKI as much as 14.7% before settling at the close with a 7.2% gain.

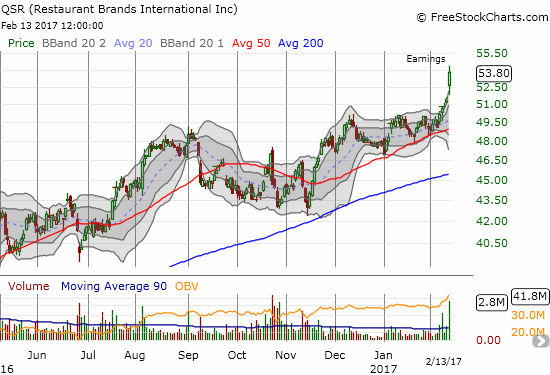

The timing of the rumor is curious because it came right on the heels of QSR reporting earnings and 9 days ahead of PLKI’s earnings report. QSR closed the day up 4.6% and a new all-time high in a very positive reaction to that earnings news.

Restaurant Brands International Inc. (QSR) soared to a fresh all-time high on strong post-earnings buying interest.

With both stocks jumping on the same day with overlapping news, I immediately thought about a pairs trade going short both stocks. They should not both go up if a deal closes soon, and the gains on the day were likely excessive for at least one of the stocks.

If no deal occurs, PLKI could easily reverse all of its post-rumor gains and then some. If a deal does close, QSR will likely decline relative to the amount paid for PLKI. PLKI is now a company with a 1.5B market cap. QSR has a market cap of 24.8B, total cash of 1.3B, and debt already a healthy-sized 8.8B. Back in 2014, QSR was formed by the $11B acquisition of Tim Horton’s; it was a deal that required $3B of preferred equity from Warren Buffett’s Berkshire Hathaway Inc. (NYSE:BRKa)

With PLKI soaring well above its upper-Bollinger Band (BB), going short was an easy trade given the context: the stock was extremely over-extended on a short-term basis, especially with speculative rumors as rocket fuel. I wanted to buy call and put options for a hedged trade, but the options market for PLKI barely exists.

So I decided on going for a pairs trade pitting PLKI against QSR. I shorted PLKI and bought put options on QSR. However, when PLKI sold off sharply into the close, I decided to take profits. Those profits paid for the QSR put options. I will next look to fade the next surge in PLKI.

The exact ratios for this pairs trade are difficult to estimate. I am guessing QSR is willing to pay a maximum premium of 25% from last week’s close. Before today’s surge, PLKI was up 20% since reporting earnings in November. At the time, Maximum Group raised its price target on PLKI to $63 (a target PLKI almost achieved that same day). A 25% premium from last week’s close of $66.04 puts PLKI at $82.50 tops and a market cap of $1.7B.

If the market discounts QSR’s market cap by that exact amount, then QSR would decline 6.9%. Add in acquisition risk and the expense of more debt for a potential post-deal downside of about 10%. I bought put options with a $50 strike price which would roughly double if QSR fell to the estimated $48. I will next work backward from that potential profit to determine how much risk I want to take shorting PLKI. Now that I am sitting at neutral on the pairs trade, I can be patient with my next entry going short PLKI (hopefully on another rumor-fueled surge).

Be careful out there!

Full disclosure: long QSR put options