How Ferrari (NYSE:RACE) Investors Will Take Advantage Of Lower Euro And Shaken European Market

Although European companies and financial firms posted declines and drop in stocks due to the recent result of the Italian referendum, some Italian companies have benefited from the news such as Italian sports car manufacturing giant Ferrari.

Following the referendum result, the euro recorded a 20-month low as the currency’s decline posted threats to a number of European stocks. This was due to a reform that would be brought about by a positive referendum result that would stabilize the funding of Italian banks. Financial firms such as UniCredit experienced a drop in their shares with the Monte dei Paschi di Siena facing a potential bailout. A billion-euro capitalization was originally going to made to avoid the risk of the bank being shut down.

The euro, meanwhile, is facing another decline despite posting a recovery to up to $1.0539 with the currency falling to 0.4% on worries that the European Central Bank might show a hawkish outlook. By Tuesday, a four-day rally was placed to a halt ahead of the ECB meeting this Thursday and along with the news of Italian Prime Minister Matteo Renzi’s resignation.

Despite the blow that a couple of stocks and banks has suffered, Ferrari investors have taken advantage of the lower euro as bought shares of the company rose up to 8 percent. This was due to the high demand for the export of the product from international buyers such as the United States. The buying level of the country for the product of the said company is also expected to go up as a stronger greenback would mean that more Americans would be having a stronger purchasing power to buy goods and products from foreign companies such as Ferrari which is well-loved by the country. The company also holds high numbers of exports outside Europe despite the weaker euro brought about by Italian PM Matteo Renzi’s resignation.

Ferrari’s Stronger Year Forecast

According to the most recent quarter earnings report of the company dating November 7, the Italian automobile company recorded an increase in their sales in China up by 15% while they have also recorded to have shopped a total of 1,978 vehicles for the period covering July to September. Although problems such as delayed shipments caused by their courier were faced, Ferrari did report that they have successfully been able to get sales on their models particularly the GTC4 Lusso, the recently launched LaFerrari Aperta, and the F12df.

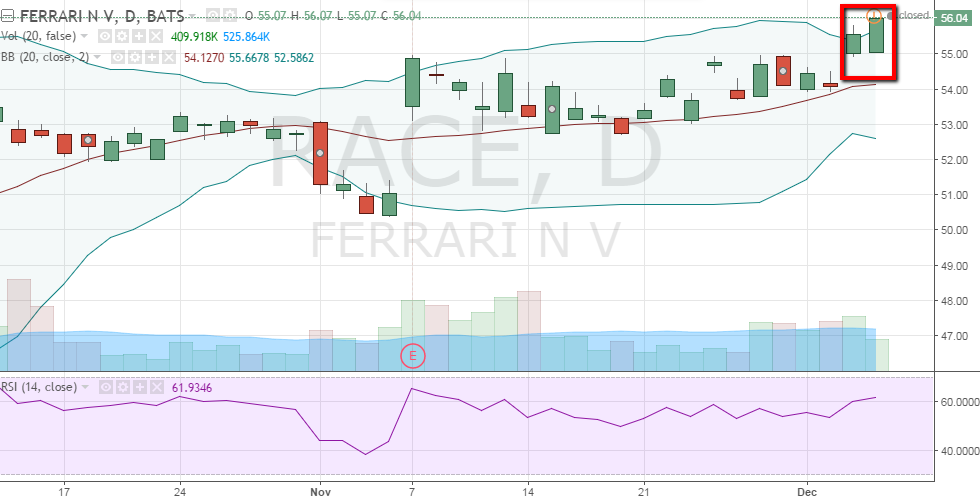

At the moment, Ferrari shares are trading at around 52.65 from the two recent sessions trading at around the 50-51 price level.

For the company’s third-quarter results, a higher profit recording at around 113 million euros or $126 million reporting a rise of 20% in their quarter earnings compared to the same period a year ago while Ferrari’s revenue also rose by 8% to 783 million euros. For the coming year, the company has released a forecast for their shipments to go up by 3% to an estimate of 8,000 units.

The company is also set to celebrate their 25th anniversary next year which will be celebrated with the introduction of their Ferrari 488 or the Ferrari Challenge racing series. The said car which has shown promising characteristics and attributes is set to give the company another good quarter as their recent success for the quarter was also driven by the Ferrari’s special models like the Aperta where all 200 units were sold in the first batch of their shipping. The said unit has reportedly have raised the company’s profit and overall revenue attesting to the company’s success in releasing limited and special edition units. Ferrari is currently holding a full-year forecast at more than three billion euros.