A number of days ago, Dutch commented how there’s nothing bearish-looking about the stock market. This permabear has to agree. Of course, this is not to say I’m buying stocks – you know me better than that! – but there certainly isn’t any core failure going on that I can point to as evidence that all holy hell is going to break loose.

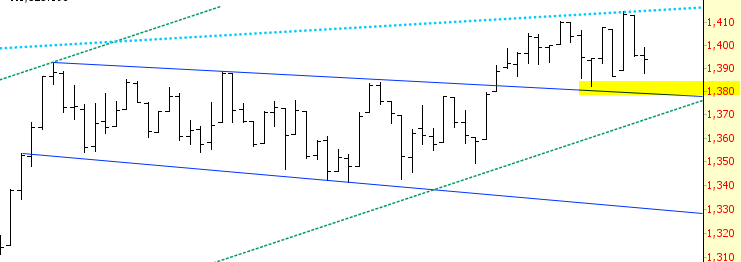

Let’s take a look at a few charts. First of all, here’s the Russell 2000. As you can plainly see, it has been in a solid channel uptrend ever since the February 11 2016 bottom. We are getting close to the midline of this channel. This is somewhat similar to the position we were in during the couple of months preceding the election. Our friends in Gainesville keep talking about a Wave 4 that’s about to hit, and I’m inclined to agree (but that’s just my book talking).

For this to happen, however, we first need to break back into the smaller channel in which we had been trading for a number of weeks. I’d put that level at about 1380. In other words, we need to get below the lowest level we’ve seen over the past couple of weeks as the first step to a true breakdown (even a modest one).

The Dow Transports’ strength lately also is clearly on Team Bull. For a solid two years, the $TRAN couldn’t beat its old high, but that’s over now. It’s joined the party.

Volatility, too, has gotten the life beaten out of it. As a card-carrying contrarian, this is fine by me, because it just means that any market weakness will be that much bigger of a surprise. I have no doubt in my mind that at some point a serious “surge” will take place in the VIX, pushing us at least to the upper teens. We haven’t had decent volatility for over four months now!

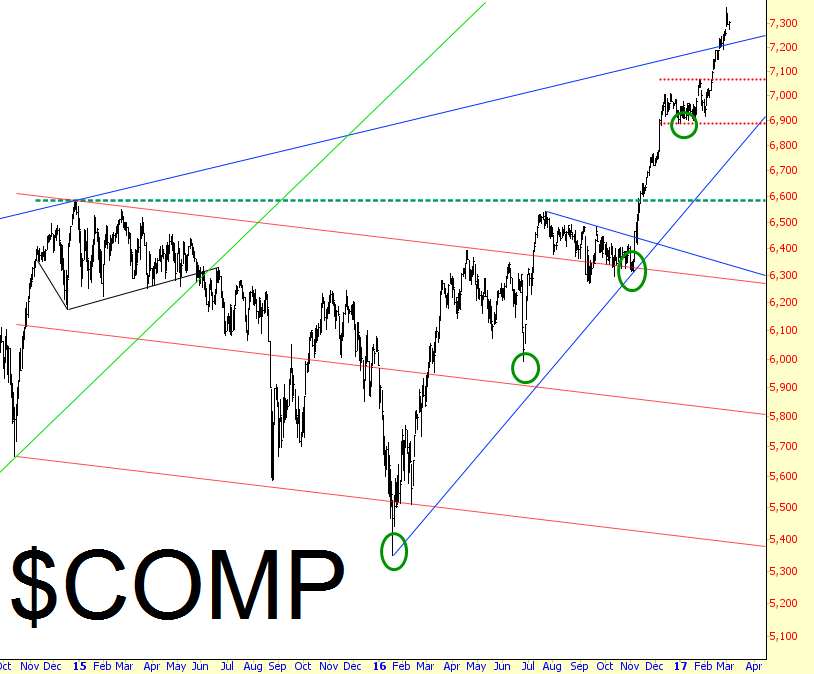

Lastly, the Dow Composite captures the essence of the market for the past fourteen months: a steady series of (1) explosively strong moves higher followed by (2) periods of rest or very modest diminishment. The circles below indicate the drumbeat of higher lows over this extended period.

Trump has, of course, been pointing to the equity markets as evidence of his wonderfulness, and we can all accept this very simple fact: a man with an ego this huge, and this fragile, is going to do everything – everything – in his power to keep equities going up. As Trump himself might say, “Believe me…….”, when his words can’t keep this clown show going higher anymore, it’s truly all over, because he’s going to pull out all the stops.