On ES I have two high probability setups looking for a retest of the high, which are the bull flag megaphone that has broken up and the failed ATH, though as ever during the last few weeks, crossing the few handles to that retest is taking a while. On SPX this is a backtesting of the daily middle band, which is holding so far. If SPX should break below it and confirm with another close the next day then the high would likely be in, but until then I’m still looking for that ATH retest. SPX daily chart:

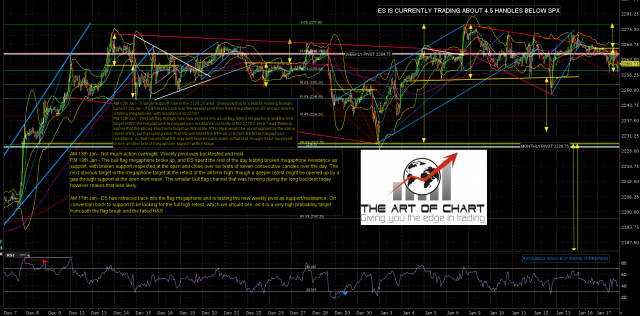

On the ES chart there is a promising looking double bottom setup here that could deliver the ATH retest, and a possible 60min buy signal is brewing. On a sustained break back over 2267/8 we should at last see that test. If seen we could see a fail there, but it might run up a bit higher to a 2300 test. ES Mar 60min chart:

One way or another, this high should be made in the next few days, and may have been made already.