The Canadian dollar is almost unchanged on Friday, following strong gains in the Thursday session. Currently, USD/CAD is trading at the 1.33 level. On the release front, employment indicators will be in the spotlight on Friday, highlighted by US Nonfarm Payrolls and the Canadian Employment Change. Traders should be prepared for some movement from USD/CAD on Friday.

There was the usual drama and fluctuations in oil prices ahead of another OPEC meeting, but this time there was a surprise ending. OPEC announced that it had reached a production cut agreement. One of the major sticking points had been Iran’s insistence to maintain output at pre-sanction levels. Saudi Arabia swallowed hard and accepted Iran’s demand, paving the path for a production agreement by OPEC since 2008. US crude has surged 16.6% this week, buoyed by the agreement to cut oil production. The deal should reduce the worldwide glut of oil and stabilize oil prices, on the assumption that OPEC members do not cheat on their production quotas. The Canadian dollar is sensitive to oil prices, and the sharp jump in oil prices boosted the currency on Thursday.

Friday’s spotlight is on US and Canadian employment reports. The markets are braced for a weak Canadian Employment Change, with a forecast of -16.5 thousand. Meanwhile, the US labor market has been red-hot and is close to capacity. Solid job numbers have boosted market expectations for a rate hike next week, which is considered a virtual certainty (the markets have priced in a rate hike at over 90%).

Traders will want to keep a close eye on today’s indicators, as any unexpected readings can have a sharp impact on the currency markets. We could see mixed numbers, with Nonfarm Payrolls expected to improve to 177 thousand, while Average Hourly Earnings, which measure wage growth, is expected to dip to 0.2%. On Thursday, unemployment claims were unexpectedly high, climbing up to 268 thousand, the highest level since July. Still, the 4-week averages continue to point to very low levels for jobless claims.

USD/CAD Fundamentals

Friday (December 2)

- 8:30 Canadian Employment Change. Estimate -16.5K

- 8:30 Canadian US Unemployment Rate. Estimate 7.0%

- 8:30 Canadian Labor Productivity. Estimate 1.1%

- 8:30 US Average Hourly Earnings. Estimate 0.2%

- 8:30 US Nonfarm Employment Change. Estimate 177K

- 8:30 US Unemployment Rate. Estimate 4.9%

- 8:45 US FOMC Member Lael Brainard Speech

- 13:00 US FOMC Member Daniel Tarullo Speech

*All release times are EST

*Key events are in bold

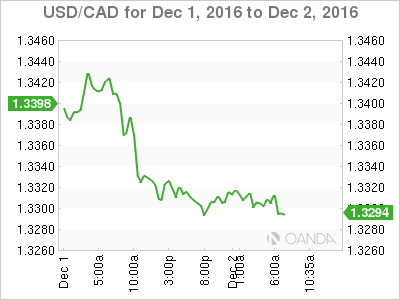

USD/CAD for Friday, December 2, 2016

USD/CAD December 2 at 6:30 EST

Open: 1.3306 High: 1.3319 Low: 1.3284 Close: 1.3304

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3026 | 1.3120 | 1.3253 | 1.3371 | 1.3457 | 1.3551 |

- USD/CAD has shown limited movement in the Asian and European sessions

- 1.3253 is providing support

- 1.3371 is the next line of resistance

Further levels in both directions:

- Below: 1.3253, 1.3120 and 1.3026

- Above: 1.3371, 1.3457, 1.3551 and 1.3648

- Current range: 1.3253 to 1.3371

OANDA’s Open Positions Ratio

USD/CAD ratio is showing strong gains in positions. Currently, short positions have a slender majority (52%), indicative of slight trader bias towards USD/CAD resuming its downward movement.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.