The Japanese yen has edged higher in the Tuesday session. In the North American session, USD/JPY is trading at 110.40. On the release front, today’s highlight in the U.S. is CB Consumer Confidence, which is expected to dip to 113.9 points. Japan will release Retail Sales, with the indicator expected to dip to 0.7%.

Donald Trump is used to getting his way in the private sector and on reality TV, but he had to swallow a bitter pill last week as he suffered his first major setback as president. His bill to replace the Affordable Care Act was pulled before it even went to a vote on the House floor, despite the Republicans enjoying a majority in Congress. This bruising defeat has sent the U.S. dollar sharply lower, and sent market jitters higher.

Trump’s administration has stumbled out of the starting gate, and after more than two months in office, he has yet to provide any details over even an outline of economic policy. The inquiry into the Trump administration’s links with Russia is gathering steam, and is another cause for concern for nervous investors. Trump has said he will now focus on tax reform, but he has his work cut out, trying to convince a skeptical Congress and general public that he can push his agenda through Congress.

On Monday, the Bank of Japan released a summary of the minutes of its policy meeting on March 16. There were no surprises, as policymakers said the BoJ’s ultra-easy monetary stance would continue as long as inflation remains well below the target of 2 percent. Japan’s economy has improved in recent months, boosted by a stronger manufacturing sector and an increase in exports, but domestic demand remains soft, resulting in weak inflation levels. We’ll get a look at consumer indicators this week, with the release of retail sales on Tuesday, followed by household spending and Tokyo Core CPI on Thursday.

Week Ahead Trump Administration Fails with Healthcare Bill

Tuesday (March 28)

- 8:30 U.S. Goods Trade Balance. Estimate -66.6B

- 8:30 U.S. Preliminary Wholesale Inventories. Estimate 0.2%

- 9:00 U.S. S&P/CS Composite-20 HPI. Estimate 5.7%

- 10:00 U.S. CB Consumer Confidence. Estimate 113.9

- 10:00 U.S. Richmond Manufacturing Index. Estimate 16

- 13:00 U.S. FOMC Member Robert Kaplan Speech

- 19:50 Japanese Retail Sales. Estimate 0.7%

*All release times are GMT

*Key events are in bold

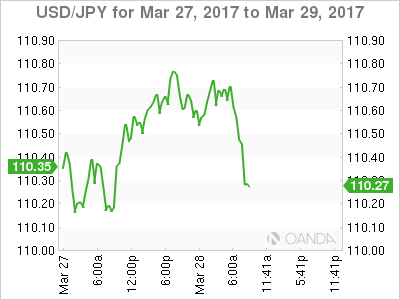

USD/JPY for Tuesday, March 28, 2017

USD/JPY March 28 at 8:05 EST

Open: 110.76 High: 110.83 Low: 110.36 Close: 110.41

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 107.49 | 108.54 | 109.77 | 110.94 | 112.57 | 113.80 |

USD/JPY was flat in the Asian session and has edged lower in European trade.

- 109.77 is providing support

- 110.94 is the next resistance line

- Current range: 109.77 to 110.94

Further levels in both directions:

- Below: 109.77, 108.54 and 107.49

- Above: 110.94, 112.57, 113.80 and 114.83

OANDA’s Open Positions Ratio

USD/JPY ratio is showing gains towards long positions. Currently, long positions have a majority (59%), indicative of trader bias towards USD/JPY reversing directions and moving higher.