Bearish sentiment has over taken what was a bullish environment that unfolded after last year's election. The sentiment change can be attributed to a number of factors, such as continued gridlock in Washington, U.S. bombing campaigns in several countries overseas, etc. Most of the return generated by the equity market over the past two years has occurred since the election in November of last year. In spite of what seems like pervasive investor bearishness in stocks, the S&P 500 Index is down only 3.0% from its high at the beginning of March as can be seen in the below chart.

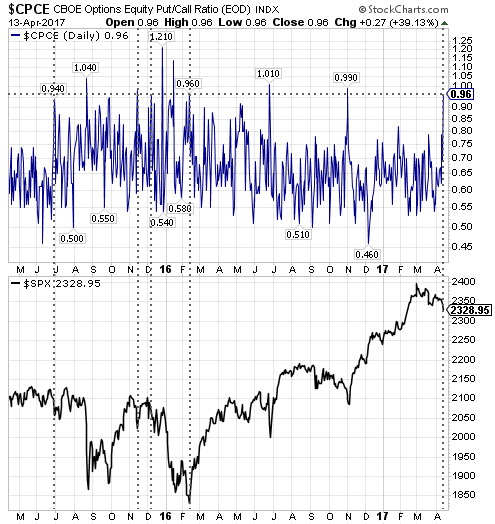

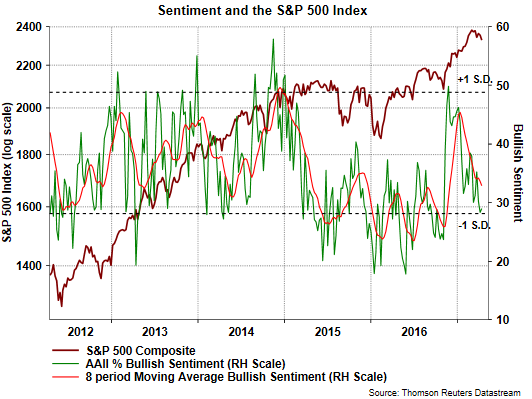

The single-digit pullback in stocks has resulted in the S&P 500 Index closing price falling below its 50-day moving average and is an indication of potential market weakness ahead. On the other hand, sentiment measures like the equity only put call ratio and the AAII sentiment survey indicate excess market bearishness as noted in the two below charts. These two sentiment measures are contrarian ones and are at levels suggesting a market turning point may be near. Both of these sentiment measures are more accurate at extreme levels. In the case of the equity P/C ratio, readings above 1.0 are indicative of an oversold market and the current .96 reading is certainly nearing that level.

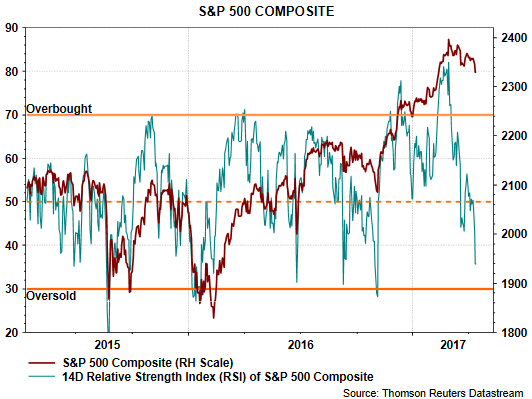

Also, the single digit market pullback has resulted in the Relative Strength Index nearing an oversold level as well.

The deterioration in a number of these sentiment readings coincides with the recent market weakness. The last graph in the chart below shows the On Balance Volume measure (OBV) is trending lower too. OBV is a cumulative indicator that adds volume on up days and subtracts volume on down days. The trend of the indicator is what is important to evaluate and the current trend shows more volume is occurring on down days versus up days. A change in this downward trend would be an indication that the market may be at a turning point and in this case a turn to the upside.