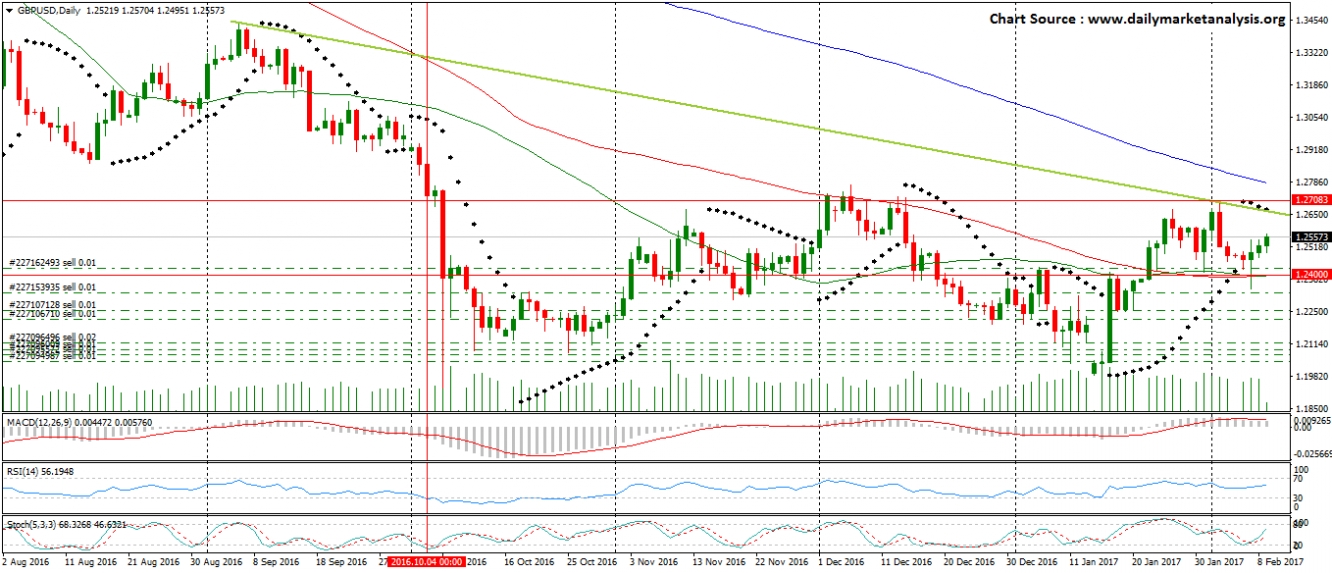

We are looking for a strong resistance level at 1.2630, then 1.2660 before the pair can erase its weekly gains, or else the pair can make a successful breakout from this level of 1.2660. With that in mind, pair will not achieve its weekly heights, but will also achieve some bullish momentum in the currency pair.

Not only this, but many stops that have been placed at the level of 1.2650 will get triggered. TP will also play a little role from this level, so 1.2650 is a key level as of now, then breaching 1.2650, followed by a bullish candle will take the pound to our second strong resistance level of 1.2700, which was previously a strong support level on 04 Oct, 2016.

Breaching this level led the pound to greater losses and so we expect to breach this level of 1.2700, followed by a bullish candle that will lead the pound towards greater gains but market changed little as of now. It made its new height on 06th Dec, 2016 of 1.2775 will be third strong resistance level to keep an eye on breaching this level followed by a bullish candle is a confirmation that bull is in control. Take a look at the below picture:

Now we are expecting the pound to stay intact with bears, because we see upside is very limited to the key level of 1.2550, then 1.2600, and then 1.2650. They can also be the best zones to go short on pound and to keep this in mind that the pound is still in recovering phase and we don't expect much of an upside move.

First Short Trade at – 1.2550 and TP – 1.2200 with the stop loss at – 1.2600

Second Short Trade at – 1.2750 and TP – 1.2200 with the stop loss at – 1.2800