Ever since the 2008-2009 financial crisis, every time the stock market has experienced a -5%, -10%, or -15% correction, industry pundits and media talking heads have repeatedly sounded the “Double Dip Recession” alarm bells. As you know, we have yet to experience a technical recession (two reported quarters of negative GDP growth), and stock prices have almost quadrupled from a 2009 low on the S&P 500 of 666 to 2,378 today (up approximately +257%).

Over the last nine years, so-called experts have been warning of an imminent stock market collapse from the likes of PIIGS (Portugal/Italy/Ireland/Greece/Spain), Cyprus, China, Fed interest rate hikes, Brexit, ISIS, U.S. elections, North Korea, French elections, and other fears. While there have been plenty of “Double Dip Recession” references, what you have not heard are calls for a “Double Dip Expansion.”

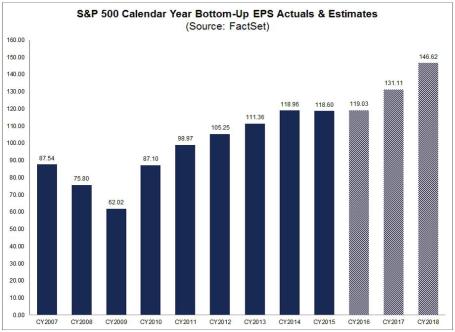

Is it possible that after the initial 2010-2014 economic expansionary rebound, and subsequent 2015-2016 earnings recession caused by sluggish global growth and a spike in the value of the U.S. dollar, we could possibly be in the midst of a “Double Dip Expansion?” (see earnings chart below)

Source: FactSet

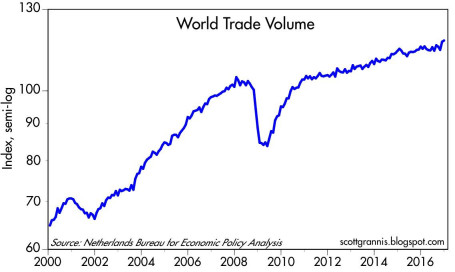

Whether you agree or disagree with the new political administration’s politics, the economy was already on the comeback trail before the November 2016 elections, and the momentum appears to be continuing. Not only has the pace of job growth been fairly consistent (+235,000 new jobs in February, 4.7% unemployment rate), but industrial production has been picking up globally, along with a key global trade index that accelerated to 4-5% growth in the back half of 2016 (see chart below).

Source: Calafia Beach Pundit

This continued, or improved, economic growth has arisen despite the lack of legislation from the new U.S. administration. Optimists hope for an improved healthcare system, income tax reform, foreign profit repatriation, and infrastructure spending as some of the initiatives to drive financial markets higher.

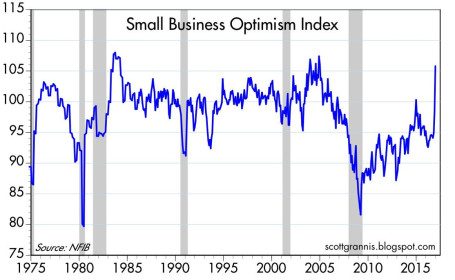

Pessimists, on the other hand, believe all these proposed initiatives will fail, and cause financial markets to fall into a tailspin. Regardless, at least for the period following the elections, investors and companies have perceived the pro-business rhetoric, executive orders, and regulatory relief proposals as positive developments. It’s widely understood that small businesses supply the largest portion of our nation’s jobs, and the upward spike in Small Business Optimism early in 2017 is a welcome sign (see chart below).

Source: Calafia Beach Pundit

Yes, it is true our new president could send out a rogue tweet; start a trade war due to a tariff slapped on a critical trading partner; or make a hawkish military remark that isolates our country from an ally. These events, along with other potential failed campaign promises, are all possibilities that could pause the trajectory of the current bull market. However, more importantly, as long as corporate profits, the mother’s milk of stock price appreciation, continue to march higher, then the stock market fun can continue. If that’s the case, there will likely be less talk of “Double Dip Recessions,” and more discussions of a “Double Dip Expansion.”

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.