Gap Inc. (NYSE:GPS) just released its third quarter fiscal 2016 financial results after the bell, posting adjusted diluted earnings of 60 cents per share and revenues of $3.8 billion. GPS is a #2 (Buy) on the Zacks Rank, and is down 3.19% to $29.73 per share in after-hours trading.

Matched earnings estimates. The company reported adjusted diluted earnings of 60 cents per share, matching the Zacks Consensus Estimate of 60 cents per share.

Beat revenues estimates. The company saw revenue figures of $3.8 billion, just edging past our consensus estimate of $3.773 billion but decreasing 2% year-over-year. Gap notes that the translation of foreign currencies into U.S. dollars positively impacted its reported revenues for Q3 by about $17 million.

Gap’s total comparable sales fell 3% in the quarter. For Gap Global, comps were down 8%. For Banana Republic Global, comps were also down 8%. For Old Navy, comps increased by 3%.

Looking ahead to full year 2016, Gap expects its diluted EPS to be in the range of $1.41 to $1.50. The company reaffirmed its adjusted diluted earnings per share to be in the range of $1.87 to $1.92, excluding the negative impact of restructuring costs.

“I’m pleased to see improved product across our brands, as well as areas of healthier merchandise margins, even against the backdrop of challenging traffic trends during the quarter,” said Art Peck, chief executive officer, Gap Inc.

“As we move into the holiday season, our teams are sharply focused on execution and delivering great experiences across the portfolio,” Peck continued. “Looking forward, we remain dedicated to utilizing our scale advantage in supply chain, as well as through knowledge sharing, in order to drive product innovation across brands and categories.”

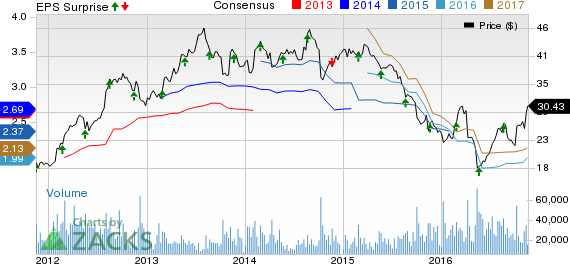

Here’s a graph that looks at Gap’s price, consensus, and EPS surprise:

The Gap, Inc. is a global specialty retailer which operates stores selling casual apparel, personal care and other accessories for men, women and children under the Gap, Banana Republic, and Old Navy, and Athleta brands. The company designs virtually all of its products, which in turn are manufactured by independent sources, and sells them under its brand names.

Stocks that Aren't in the News…Yet

You are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. Many of these companies are almost unheard of by the general public and just starting to get noticed by Wall Street. They have been pinpointed by the Zacks system that nearly tripled the market from 1988 through 2015, with a stellar average gain of +26% per year. See these high-potential stocks now >>

GAP INC (GPS): Free Stock Analysis Report

Original post

Zacks Investment Research