Shareholders of WW Grainger (NYSE:GWW), an Illinois-based Fortune 500 industrial supply company, did not particularly enjoy the last four years. The stock reached an all-time high of $276 per share in September, 2013, but fell below $165 by late-August, 2017 for a 40% decline in less than 4 years. The last four months tell a different story, though. Last week, GWW climbed to almost $232 for a 40% recovery from the lows. An investor, who bought the same amount of shares at the 2013 high and the 2017 bottom, would just be breaking even now. But should we expect the current rally to continue?

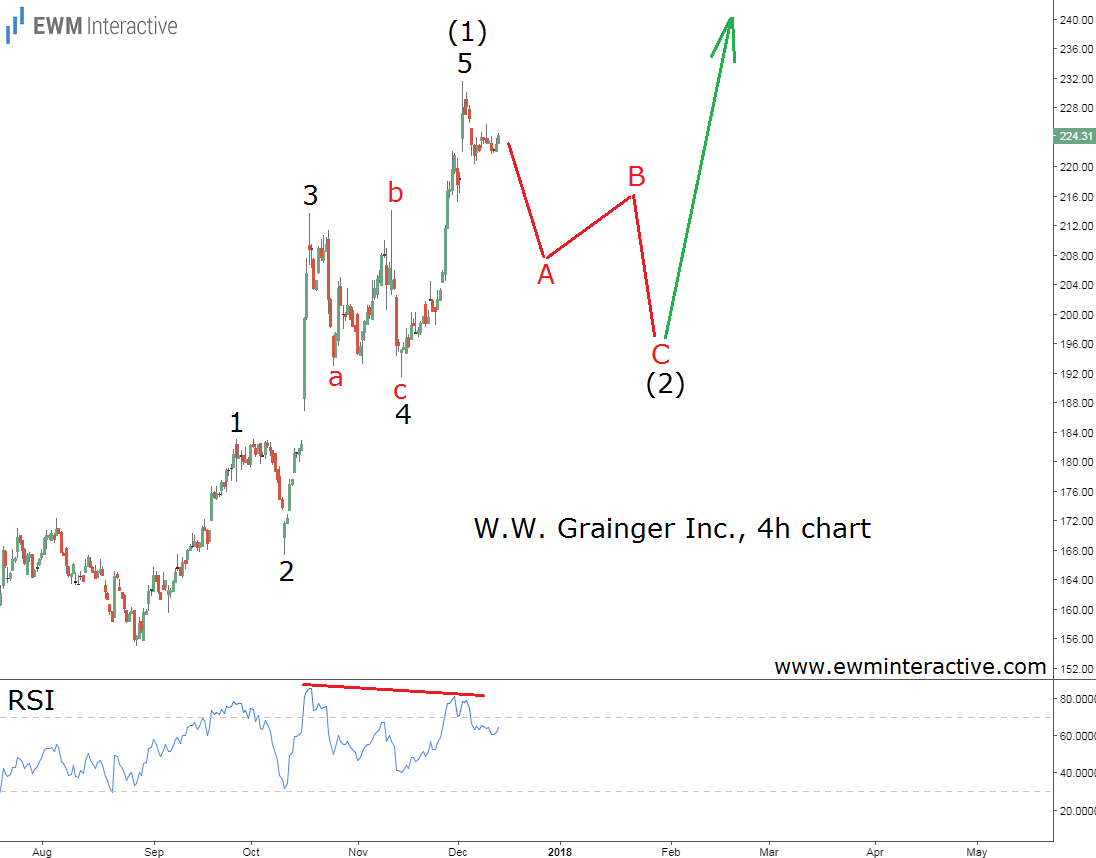

If this Elliott Wave analysis is correct, the answer is yes, we should. Not right away, though, because the weekly chart of WW Grainger stock shows that the recovery from $165 is a textbook five-wave impulse. This pattern indicates that the larger trend is pointing north. On the other hand, every impulse is followed by a three-wave correction in the opposite direction, before the larger trend resumes. So, instead of jumping in the bulls’ wagon, investors should first expect a short-term pullback to drag the stock price back to the support area of wave 4 of (1) near $200 per share. The Relative Strength Index also reinforces the short-term negative outlook by visualizing a bearish divergence between waves 3 and 5 of (1).

WW Grainger is a profitable, low-debt, high-return company, founded 90 years ago, in 1927. It is definitely a company long-term investors could rely on. But the price paid directly impacts the return of the investment. In this respect, the lower the better. The anticipated three-wave correction could erase 10% of the company’s market capitalization, but it should be seen as a buying opportunity, as long as the starting point of the impulse pattern at $165 holds.