WTI Crude Oil Speculators added to bullish bets:

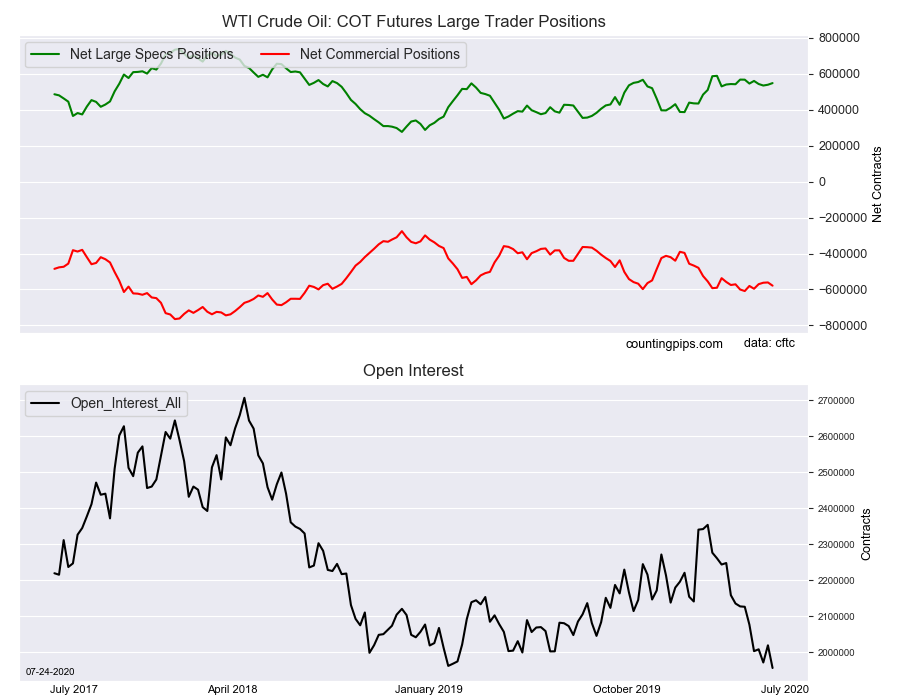

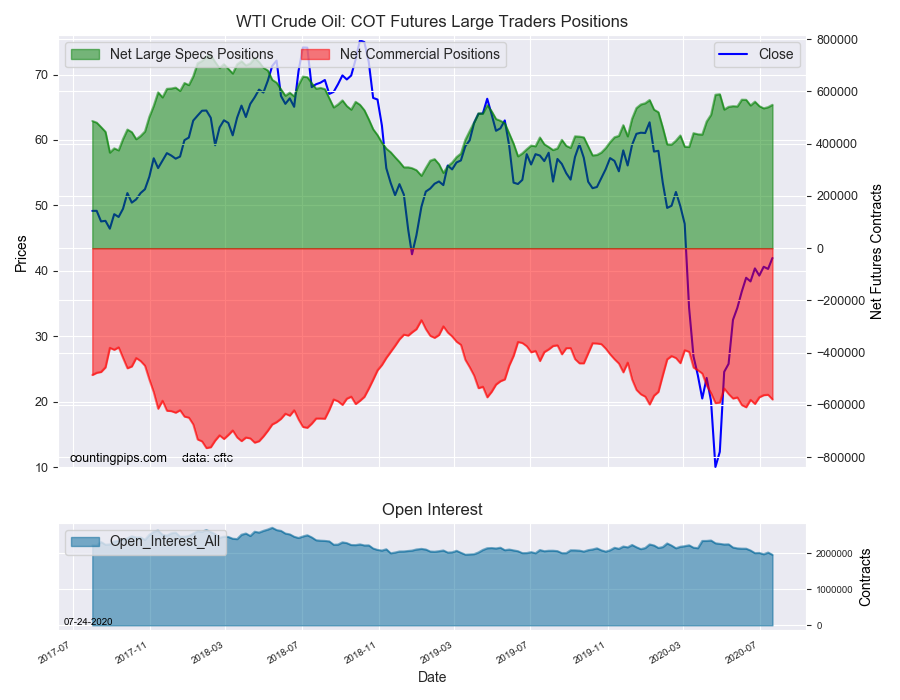

Large energy speculators raised their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 548,876 contracts in the data reported through Tuesday July 21st. This was a weekly change of 9,125 net contracts from the previous week which had a total of 539,751 net contracts.

The week’s net position was the result of the gross bullish position (longs) decreasing by -4,348 contracts (to a weekly total of 687,910 contracts) while the gross bearish position (shorts) lowering by -13,473 contracts for the week (to a total of 139,034 contracts).

Crude oil speculators raised their bullish bets this week for a second straight week. Prior to the past two weeks, speculator bets had fallen in four out of the five previous weeks and saw the overall bullish standing dip to the lowest level in nine weeks. Speculator bets have now risen by +13,559 contracts in these past two weeks. The overall bullish standing has continued to remain very bullish with the net position above the +500,000 contract level for fifteen straight weeks, dating back to mid-April.

WTI Crude Oil Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -578,656 contracts on the week. This was a weekly drop of -17,863 contracts from the total net of -560,793 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $41.96 which was an uptick of $1.67 from the previous close of $40.29, according to unofficial market data.