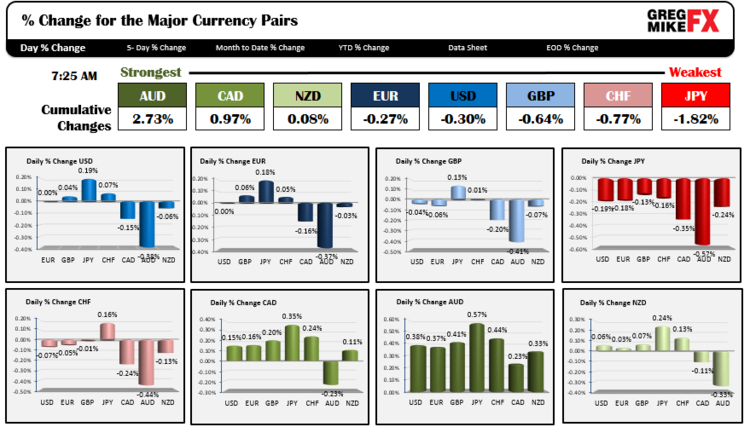

The below tables show a snapshot of the Winners and Losers of the major currencies in trading today and this week.

Winner: AUD

The markets seem to be accepting the tensions in Ukraine and Israel in stride and this has led to a move back higher in the AUD. The currency was hit hard toward the end of trading yesterday - especially versus the JPY and the USD - but has recovered all the losses back in trading today, The AUD tends also to be a beneficiary when commodity prices move higher and increased military tensions should be a benefit for hard commodities.

Loser: JPY

The JPY tends to be the safe haven currency in times of geopolitical tensions. Yesterday that was the case as the pair gained against all the major currencies and was the strongest currency of the day. Today is a different story as the gains turned to declines as downside momentum could not be maintained.

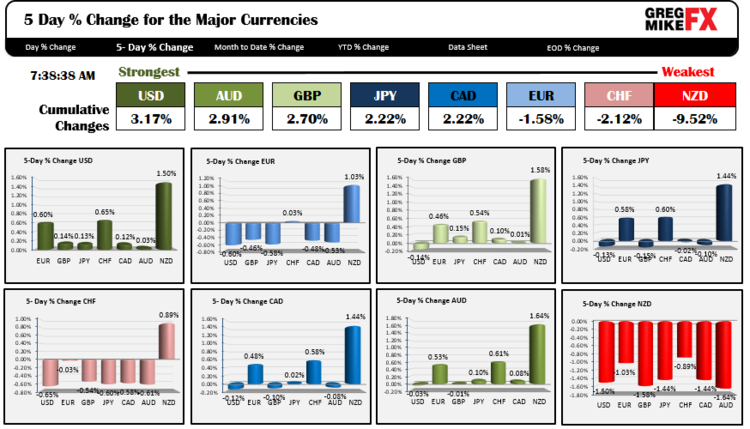

For the week (it is indeed Friday), the following chart shows the Winners and Losers vs last week's close.

Winner: USD

The USD has risen this week against all the major currencies - rising the most vs. the NZD, CHF and EUR. The economic data out of the US - sans the Building Permit and Housing Starts - was fairly positive and Yellen had moments of being a touch more complementary about the employment picture.

Loser: NZD

The NZD suffered this week on the back of lower CPI inflation for the 2nd quarter and negative technicals. The pair could not move above 2011 highs in last weeks trading and this week fell below trend line support and the 38.2% of the move up from the June low. It is recovering a bit today, however, on short some end of week short covering.

Disclosure: All information on this site is provided for informational and educational purposes only. Information provided is not to be misconstrued as trading advice. Past results are not indicative of future results. In addition trading in foreign exchange markets on margin carries a high level of risk, and may not be suitable for all individuals.The post is intended for clients and traders outside the US.