- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Higher Costs Weaken El Pollo Loco's (LOCO) Q4 Earnings?

El Pollo Loco Holdings, Inc. (NASDAQ:LOCO) is scheduled to report fourth-quarter 2017 results on Mar 8, after market close.

The company’s strong sales building strategies and consistent unit development are likely to reflect in the fourth quarter’s top line. However, the bottom line in the to-be-reported quarter might have been under high cost pressure.

Notably, shares of El Pollo Loco have lost 20.3% in the past year, underperforming the industry’s gain of 11.3%.

Let’s find out how the company will shape up in fourth-quarter results.

Sales-Building Efforts to Aid Top Line

El Pollo Loco is known for its various sales building efforts. The company’s relentless focus on providing excellent service, reasonable pricing and its advertising campaigns are expected to continue boosting revenues. Banking on menu innovation, limited-time offers and a strong brand positioning, the company witnessed sales growth in the last reported quarter. The trend is expected to continue in the to-be-reported quarter as well.

The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $95 million, mirroring 2.7% year-over-year growth.

In addition to these innovative strategies, El Pollo Loco has made significant progress with various technology initiatives, designed to provide convenience to loyalty customers. In June 2017, the company had initiated a partnership with Olo's Dispatch Delivery service, which covers 40% of El Pollo Loco’s system-wide locations. The technological and delivery initiatives are likely to boost comps in the fourth quarter.

Subsequently, the consensus estimate projects system-wide comps to grow 0.6% in the fourth quarter compared with 1.3% decline in the year-ago quarter. Comps at franchise restaurants are also expected to have grown 1.2% in the quarter to be reported, comparing favorably with the prior-year quarter’s 1.9% comps decline.

Elevated Costs to Dampen Earnings

The consensus estimate for fourth-quarter earnings is pegged at 10 cents, suggesting a 16.7% year-over-year decline.

The company’s higher labor costs, pre-opening costs of outlets and expenses related to the execution of various sales-building initiatives are expected to keep profits under pressure. Increasing costs are expected to more than offset the benefits from revenue growth.

Our Quantitative Model Does Not Predict a Beat

El Pollo Loco does not have the right combination of two main ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

Zacks ESP: The company has an Earnings ESP of 0.0%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The restaurant has a Zacks Rank #3.

Meanwhile, we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

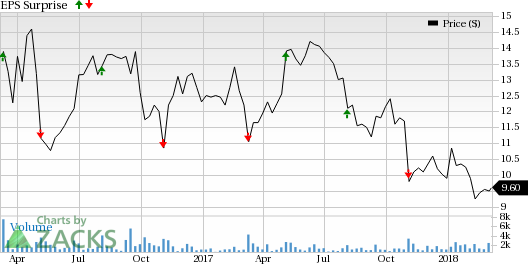

El Pollo Loco Holdings, Inc. Price and EPS Surprise

Stocks to Consider

Here are a few restaurant stocks, which according to our model possess the right combination of elements to post an earnings beat.

Chuy's Holdings (NASDAQ:CHUY) has an Earnings ESP of +1.94% and a Zacks Rank #2 (Buy). The company is expected to report quarterly numbers on Mar 8, 2018. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BJ’s Restaurants (NASDAQ:BJRI) has an Earnings ESP of +1.53% and a Zacks Rank #2. The company is anticipated to report quarterly figures on Apr 26, 2018.

Cheesecake Factory (NASDAQ:CAKE) has an Earnings ESP of +0.23% and a Zacks Rank #3. The company is expected to report quarterly numbers on May 2, 2018.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

The Cheesecake Factory Incorporated (CAKE): Free Stock Analysis Report

BJ's Restaurants, Inc. (BJRI): Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY): Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.