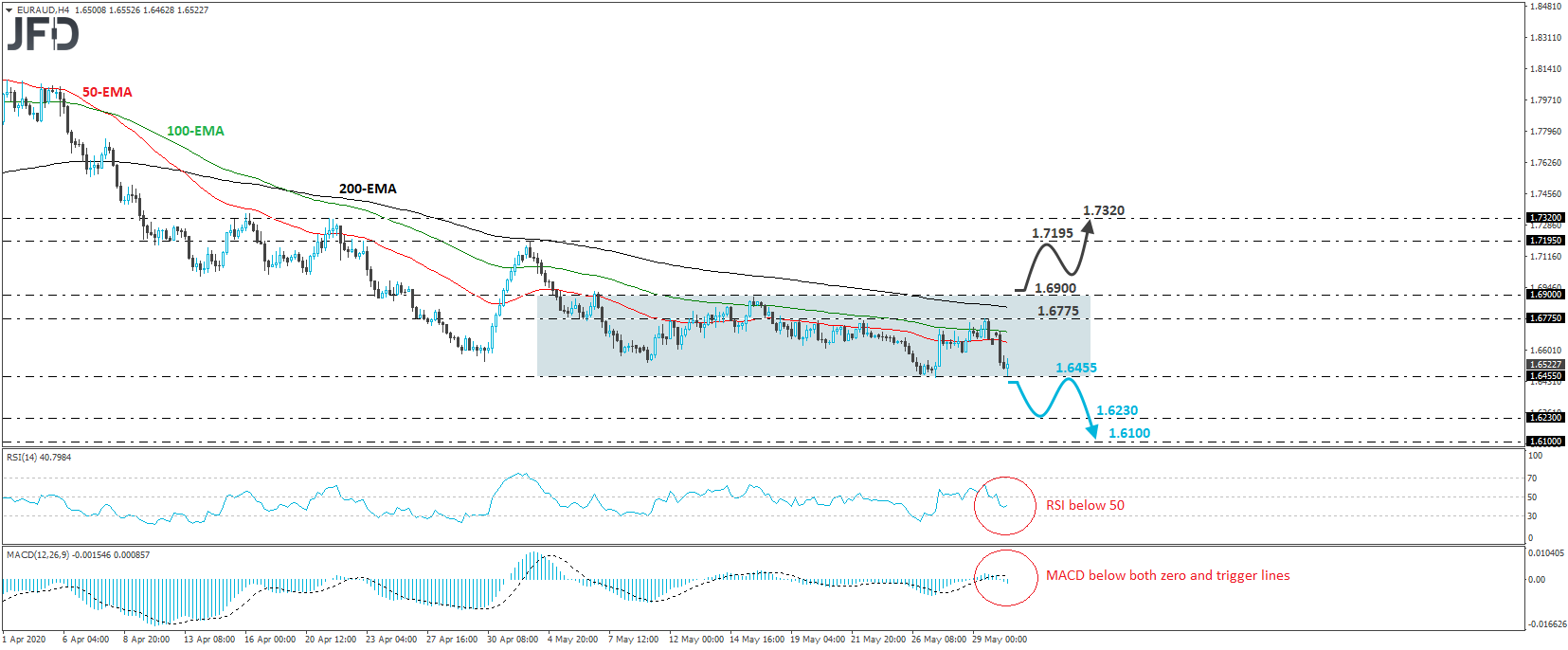

EUR/AUD traded lower on Monday, to find support near the 1.6455 level, which also stopped the rate from moving lower on May 26th and 27th. Overall, the pair has been trading in a trendless manner, between that support and the resistance of 1.6900, and thus we would adopt a flat stance for now with regards to the near-term outlook.

In order to start examining whether further declines are in the works, we would like to see a decisive dip below 1.6455. This would confirm a forthcoming lower low and may encourage the bears to pull the trigger for the 1.6230 zone, marked by the inside swing high of February 18th. If that level is not able to halt the slide, then we may experience extensions towards the 1.6100 hurdle, which provided strong support between February 13th and 19th.

Taking a look at our short-term oscillators, the RSI and the MACD, we see that they both detect negative momentum. The RSI runs below 50, while the MACD lies below both its zero and trigger lines. That said, although the MACD points to the downside, the RSI has just turned up, suggesting that a minor rebound may be looming before the next negative leg.

That said, the move that would make us comfortable with regards to the upside is a break above 1.6900. This may signal the upside exit out of the aforementioned range and could initially pave the way towards the high of May 4th, at around 1.7195. Another break, above 1.7195, may allow the bulls to put the 1.7320 area on their radars. That zone provided resistance on April 21st.