Low Inflation In Europe and Your Portfolio

Last December, we explained why central bankers are terrified of economies that slip into a very difficult to stop deflationary spiral. European policymakers are not yet terrified, but it is fair to say they are concerned about what has been persistent low inflation. From Reuters:

Euro zone price inflation fell unexpectedly in May, increasing the risks of deflation in the currency area and all-but sealing the case for the European Central Bank to act this week. Annual consumer inflation in the 18 countries sharing the euro fell to 0.5 percent in May from 0.7 percent in April, the EU’s statistics office Eurostat said on Tuesday.

Fed Casts A Wider Economic Net

Unlike the European Central Bank (ECB), the Federal Reserve has a “maximum employment goal”, which was added to The Federal Reserve Act in 1997 via the “dual mandate” clause:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”

ECB To Become More Like Fed?

With low inflation and somewhat stagnant employment opportunities, some in the eurozone are calling for a more Fed-like approach to European central banking. From Euronews:

Antonio Tajani, the European Commissioner for industry, has said the value of the euro against the dollar is currently too high, and there should be a rethink of the European Central Bank’s role so it focuses more on stimulating job creation. Tajani told a conference in Milan that the euro at just under $1.40 is hurting “the economies of Spain, Italy, France and, in the long run, Germany”. He wants the ECB to be more like the Federal Reserve in the US, focused not just on inflation but also on stimulus to reverse low unemployment.

ECB Set To Join Currency Wars

Since the ECB has to deal with input from 18 countries, they tend to move slowly when it comes to a major shift in policy. From The Wall Street Journal:

The European Central Bank is poised to join the currency wars. But investors shouldn’t expect a shock-and-awe campaign. The central bank is widely expected to further loosen monetary policy Thursday. This is likely to take the form of charging banks to hold money with the ECB and emphasizing that the central bank expects to keep borrowing rates near zero for a long time yet. It may also try measures to boost bank lending to companies.

A Weaker Euro Impacts The U.S. Dollar

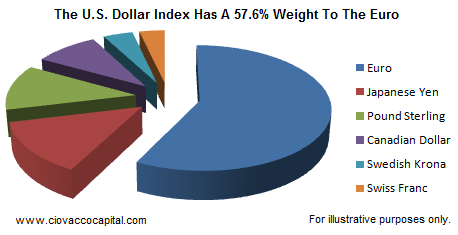

Currencies are valued in relative terms, which means if one country wants a weaker currency, it can put upward pressure on the currencies of other nations. For example, the U.S. Dollar Index (NYSE:UUP) is valued via the following inputs:

The 57.6% weight to the euro tells us if the ECB is successful in its quest for a weaker euro, it will impact the value of the dollar.

A Stronger Dollar Impacts Our Portfolios

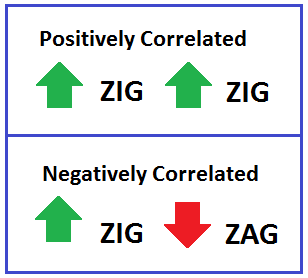

A weaker euro and stronger U.S. Dollar would impact numerous asset classes and commonly traded ETFs, which speaks to investment/ETF correlations. In the simplest form, if two ETFs are positively correlated, they tend to zig and zag together. If they are negatively correlated, when one zigs the other one tends to zag.

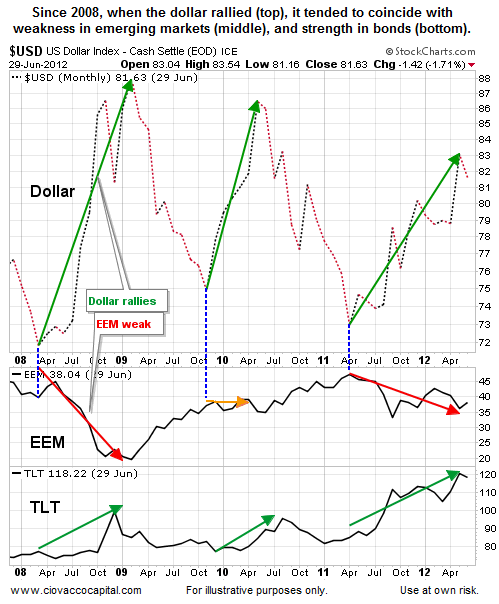

Bonds Tend To Zig, Emerging Markets Tend To Zag

Correlations can change over time, so it is not safe to assume anything. However, rallies in the U.S. Dollar (see top portion of chart below) have recently been associated with weakness in emerging markets (ARCA:EEM) and strength in long-dated U.S. Treasury bonds (ARCA:TLT).

Investment Implications – Understand vs. Anticipate

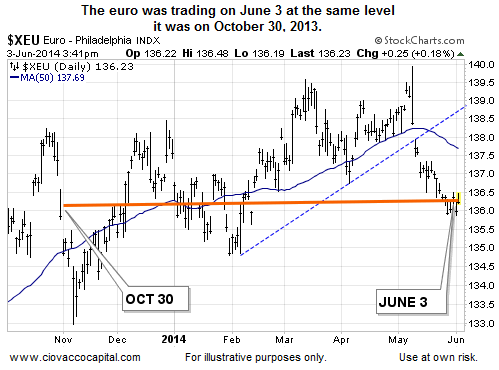

Given the ECB’s desire for a weaker euro, should we load up on Treasuries and avoid emerging markets? No, but we should understand how a weaker euro could impact the broader investment landscape and have contingency plans in place. As shown in the chart below, while the euro has been dropping in recent weeks, it has made little-to-no progress, up or down, over the past seven months.

The big events of the week are still ahead of us; the ECB’s policy announcement is due Thursday and the U.S. monthly labor report before the bell Friday. Depending on the market’s reaction, it is possible we will cut back on our bond exposure (TLT), and make another incremental bump to the equity (ARCA:SPY) side of the portfolio. If the ECB and the labor report convert some back to the fear trade, we are happy to keep our bond allocation as is. We will observe with a flexible mind and adjust as needed.