Will Bitcoin continue rising ahead of November’s hard fork?

Bitcoin hit a new all-time high last week, breaking above the psychological USD 5000 barrier. At the time of writing, the cryptocurrency is trading near the 5800 level. Even though the catalyst behind this surge is not clear, it appears investors may be speculating that a hard fork (SegWit2x) planned for November will boost prices even further. Given the outcome of the latest hard fork in August, which saw BTC prices skyrocket, such speculation is to be expected. That said, we have to sound a note of caution. Although experience suggests BTC could continue gaining ahead of the fork on elevated expectations, a noteworthy part of the crypto-community is urging caution as the upcoming fork is fundamentally different from the previous one, implying that the result on prices may differ as well.

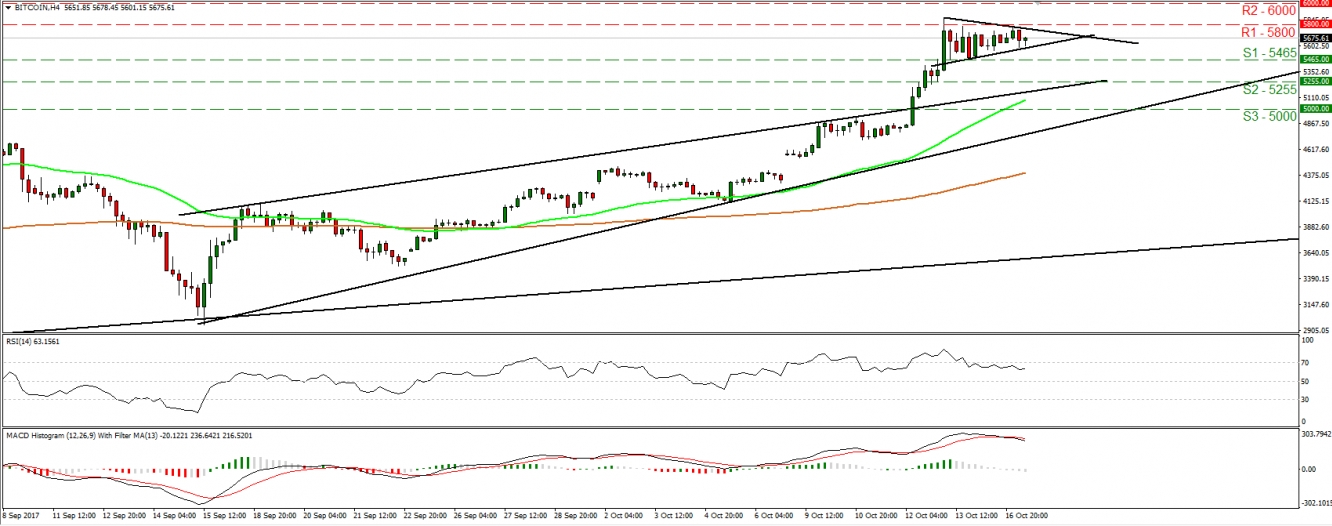

Bitcoin has been trading in a consolidative manner within a pennant formation since the 13th of October, after surging on the 12th. As such the short-term bias remains flat for now. Having said that though, the prevailing trend remains positive. The cryptocurrency continues to trade above the uptrend line drawn from the low of the 15th of September. Therefore, we believe that there is higher likelihood for the price to exit the pennant from the upside than to the downside. A decisive break above the 5800 (R1) resistance may signal the continuation of the prevailing trend and could initially aim for the round number of 6000 (R2).

The risk to that view is a downside exit from the pennant, which is somewhat supported by our momentum studies. The RSI lies below its 70 line and could head towards 50 soon, while the MACD has topped and fallen below its trigger line. However, even in this case, any potential retreat to may remain limited above the aforementioned uptrend line, and thus we would treat it as a corrective phase.

Switching to the daily chart, we see that Bitcoin continues to trade in an uptrend that is accelerating exponentially since the March.