- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

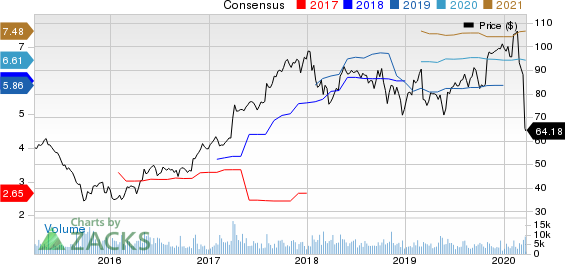

Why You Should Keep FMC Corp (FMC) Stock In Your Portfolio

FMC Corporation (NYSE:FMC) is poised to gain from strong demand for its herbicides and insecticides and its efforts to expand product portfolio and boost market position amid certain headwinds including raw material cost inflation.

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

Factors Aiding FMC

FMC is benefiting from higher demand for its products, its portfolio strength and new product launches, which is driving its revenues as witnessed in the last reported quarter.

In Latin America, FMC is witnessing healthy demand from sugarcane growers in Brazil as well as solid demand for herbicides in soybean applications in Argentina. Strong demand for herbicides and insecticides is also driving the company’s agriculture business in North America. It is seeing strength across Rynaxypyr and Cyazypyr insect control products in that region.

Strong demand for insecticides is also driving volumes in Asia. The company expects the global crop protection market to grow in the low-single digits in 2020 with strongest growth in Asia. It also expects growth in the crop protection market in Brazil to be driven by soybeans and corn.

Moreover, the company remains committed to expand its market position and strengthen portfolio. It is focused on investing in technologies and products as well as new launches to enhance value to the farmers. Product introductions are expected to support its results in this year. The company expects new products to contribute roughly 1.5% of overall volume growth in 2020.

FMC also remains committed to return value to shareholders leveraging healthy cash flows. It generated free cash flow of $302 million in 2019. FMC expects free cash flow of $425-$525 million in 2020.

The company, in late 2019, hiked its quarterly dividend by 10% to 44 cents per share. It also repurchased $400 million of shares in 2019 and expects to buyback $400-$500 million of its shares in 2020.

A Few Worries

FMC is exposed to challenges from higher raw material costs, partly due to supply disruptions in China amid the coronavirus outbreak. The company also faces headwind from higher tariffs.

The company witnessed an unfavorable impact of $25 million from raw material cost inflation and tariffs on adjusted EBITDA in the fourth quarter of 2019. Headwinds related to higher costs were $167 million in 2019. The company also sees $32 million cost headwind in the first quarter of 2020. FMC envisions raw material cost headwind to persist through the first half of 2020.

FMC also faces headwind from unfavorable currency translation. Currency had an unfavorable impact of 3% on its sales for full-year 2019. Unfavorable impact on adjusted EBITDA was $61 million for 2019. FMC sees currency headwind on EBITDA of $45 million for full-year 2020. Currency impact for the first quarter is forecast to be $16 million.

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space are Franco-Nevada Corporation (TSX:FNV) , NovaGold Resources Inc. (NYSE:NG) and Daqo New Energy Corp. (NYSE:DQ) .

Franco-Nevada has a projected earnings growth rate of 24.2% for 2020. The company’s shares have rallied roughly 30% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have surged roughly 62% in a year.

Daqo New Energy has a projected earnings growth rate of 336.1% for 2020. The company’s shares have rallied around 40% in a year. It currently carries a Zacks Rank #2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

FMC Corporation (FMC): Free Stock Analysis Report

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Novagold Resources Inc. (NG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Nvidia (NASDAQ:NVDA) shook things up by reporting revenue of $39.3 billion for the quarter while guiding next quarter to $43 billion. This was slightly below the pattern’s...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.