- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Is Church & Dwight (CHD) Up 6.1% Since Its Last Earnings Report?

A month has gone by since the last earnings report for Church & Dwight Company, Inc. (NYSE:CHD) . Shares have added about 6.1% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to its next earnings release, or is CHD due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Church & Dwight Beats on Q4 Earnings, Guides for FY18

Church & Dwight posted mixed fourth-quarter 2017 results, wherein adjusted earnings of 52 cents per share were up 18.2% year over year and topped the Zacks Consensus Estimate of 50 cents.

The company reported sales of $1,033.1 million that advanced 15.3% year over year but lagged the Zacks Consensus Estimate of $1,007 million.

Organic sales rose 3.4%, which was ahead of the company’s guidance of 2.5%. The uptick was driven by better-than-expected sales at all the three segments. Further, organic sales were fueled by volumes growth of 4.3%.

Adjusted gross margin expanded 50 basis points to 46.6% owing to gains from productivity programs, volume growth, and acquisitions and divestitures. Adjusted gross margin for the quarter excluded a prior-year Brazil charge. Adjusted operating margin also increased 90 bps to 20.8% driven by higher gross margin.

Segment Details

Consumer Domestic: Segment net sales were up 13.3% to $787.8 million and organic sales improved 2.7% benefiting from a 4% increase in volume, partly negated by a 1.3% negative impact from price. Volume gains in the quarter can be attributed to key product launches and increased personal care products sales.

VITAFUSION adult gummy vitamins, ARM & HAMMER liquid and unit dose laundry detergent, SPINBRUSH toothbrushes, ORAJEL oral analgesics, BATISTE dry shampoo and ARM & HAMMER baking soda continued to be the main growth drivers.

Consumer International: Segment net sales soared 33.3% to $170.1 million backed by recent acquisitions and broad-based sales growth for household and personal care products. Organic sales increased 5.8% driven by a 6% increase in volumes, partly mitigated by a 0.2% fall in price.

STERIMAR and OXICLEAN in the export business; STERIMAR, ARM & HAMMER toothpaste and OXICLEAN in Mexico; and ARM & HAMMER cat litter and BATISTE in Canada provided a major impetus to sales.

Specialty Products: Sales at this segment improved 3% to $75.2 million. Organic sales advanced 5.1% backed by 2.8% higher volumes and favorable pricing (up 2.3%), mainly in the animal productivity business.

Other Financial Updates

Church & Dwight ended 2017 with cash and cash equivalents of $278.9 million, long-term debt of $2,103.4 million and total shareholders’ equity of $2,218 million.

In 2017, the company generated cash flow from operations of $681.5 million and incurred capital expenditure of $45 million.

Concurrently, management raised quarterly cash dividend to 21.75 cents per share, marking a 14% increase from the previous dividend rate of 19 cents. This brings the annualized dividend to 87 cents per share, raising the dividend payout to nearly $215 million. The increased dividend is payable on Mar 1, 2018 to shareholders of record as on Feb 15. This marks the company’s 22nd straight year of dividend increase. Moreover, the company has regularly paid dividend for 117 years.

Guidance for 2018

Innovations have been a key growth driver for Church & Dwight. As part of its long-term strategy to boost top and bottom lines, the company announced several new product launches in various categories.

The company expects reported sales to grow about 8% and organic sales to rise 3% in 2018. Though recent acquisitions are anticipated to attract lower marketing, the company plans to increase spending to maintain marketing at nearly 12% of sales. Further, the company expects SG&A expenses to increase, as a percentage of sales, owing to lower intangible amortization expenses, integration costs and higher levels of SG&A from recent acquisitions.

As a result of the new tax reform, the company anticipates reduced tax burden. The effective tax rate is expected to be about 24-25% compared with 32% in 2017. Consequently, the company estimates earnings per share of $2.24-$2.28, reflecting adjusted earnings per share growth of 16-18%. However, reported earnings per share are expected to decline 21-23%. The company’s guidance assumes persistent business strength, a lower tax rate and reinvestment to accelerate growth, and other long-term objectives.

Q1 Outlook

For first-quarter 2018, the company expects reported and organic sales growth of 11% and 2%, respectively. It anticipates adjusted earnings per share of 61 cents in the quarter, reflecting year-over-year growth of 19.6%. Further, the company anticipates adjusted earnings per share for 2018 to 17.3% increase.

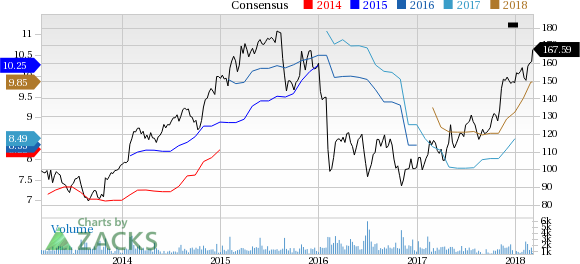

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower.

VGM Scores

Currently, CHD has an average Growth Score of C, though it is lagging a bit on the Momentum front with a D. Following the exact same course, the stock was also allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for growth based on our styles scores.

Outlook

CHD has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Church & Dwight Company, Inc. (CHD): Free Stock Analysis Report

Original post

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.