- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Is AmerisourceBergen (ABC) Up 1.5% Since Its Last Earnings Report?

A month has gone by since the last earnings report for AmerisourceBergen Corporation (NYSE:ABC) . Shares have added about 1.5% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is ABC due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Recent Earnings

AmerisourceBergen posted adjusted earnings of $1.55 per share in the first quarter of fiscal 2018, beating the Zacks Consensus Estimate of $1.35 and improving 14% year over year.

The upside can be attributed to strong growth in the company’s Pharmaceutical Distribution Segment and World Courier business.

Revenues improved almost 6% to $40.47 billion in the reported quarter. Revenues also beat the Zacks Consensus Estimate of $40.37 billion.

Segmental Analysis

Pharmaceutical Distribution Segment

Revenues in the segment were $38.94 billion, up 5.8% on a year-over-year basis. Operating income was $388.2 million, up 2.4% year over year.

However, the segment was affected by lower-than-expected production at PharMEDium's Memphis 503B outsourcing facility. Notably, operations in the facility were voluntarily suspended by the company following a few inspections by the FDA in the quarter.

Other Segment

This segment includes AmerisourceBergen Consulting Services (“ABCS”), World Courier and MWI Veterinary Supply. Revenues at the segment came in at $1.54 billion, up 11.6% year over year. Operating income in the segment was $100.3 million in the quarter, down 6.4% year over year.

Despite strong performance in the World Courier unit, sluggishness in the ABCS dampened segmental growth in the first quarter.

Margin Details

In the quarter under review, AmerisourceBergen registered gross profit of $1.1 billion, up 4.5% on a year-over-year basis. As a percentage of revenues, gross margin was 2.8%, down 4 basis points (bps) from the prior-year quarter.

Operating expenses in first-quarter fiscal 2018 were $626 million, up 8% year over year.

AmerisourceBergen registered operating income of $488.1 million, up 0.4% year over year. As a percentage of revenues, operating margin contracted 4 bps to 1.2%.

Guidance Raised

Based upon the expectations from the recently legislated U.S. tax reform, AmerisourceBergen raised guidance for fiscal 2018. The company expects adjusted earnings per share in the range of $6.45-$6.65, up from the previously range of $5.90-$6.15. Revenue growth for fiscal 2018 is expected in the range of 8-11%, higher than the previous range of 7-9%.

However, the company expects adjusted operating expenses to increase in the range of 6-8%, up from the previous range of 4-6%. Adjusted operating income growth is estimated in the range of 1-4%, lower than the previous range of 3-5%.

In January, AmerisourceBergen declared that it has completed the acquisition of H.D. Smith, the largest independent wholesaler in the United States, for $815 million in cash. The deal was initiated in November 2017. The acquisition is expected to be slightly accretive to adjusted earnings per share in fiscal 2018. Further, the deal is expected to return 15 cents to adjusted earnings per share in fiscal year 2020. It is expected to strengthen the company’s support to community pharmacy and drive long-term, durable value.

How Have Estimates Been Moving Since Then?

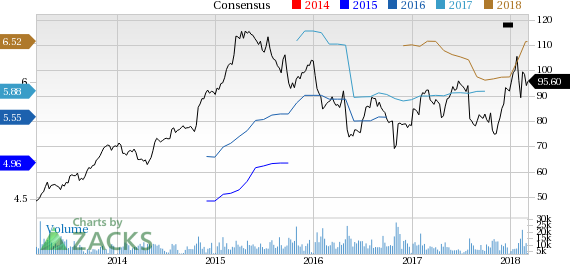

In the past month, investors have witnessed a downward trend in fresh estimates. There have been two revisions higher for the current quarter compared to three lower.

VGM Scores

At this time, ABC has a poor Growth Score of F. However, its Momentum is doing a lot better with an A. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than value investors.

Outlook

Estimates have been broadly trending downward for the stock, and the magnitude of these revisions looks promising. Notably, ABC has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

AmerisourceBergen Corporation (Holding Co) (ABC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.