Stock markets plunged on Friday after major banks warned of further losses. The culprit this time was Wachovia, the nation's fourth-largest bank, as it reported losses of $1.1 billion. Traders have begun to speculate that this is only the start of major problems in the economy, therefore expecting further problems to unravel. The fear in the equity markets contributed to the volatility in the currency markets as carry trades took major hits, sending them lower on profit taking. Despite all the bad news, the commerce Department reported that the trade deficit dipped 0.6% in September to $56.5 billion, the smallest level since May 2005. The improvement was due to a rise in exports cause by the current status of the Dollar.

Euro | Japanese Yen | British Pound | Swiss Franc

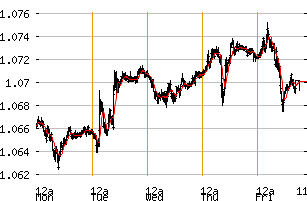

Euro

Compared to other currency pairs, the Euro managed to hold its ground during Friday’s trading session. Even though this currency pair started off on the right foot, heading up to touch an intraday high of $1.4751, it shortly turned around declining back to its opening price of $1.4670. This currency pair is receiving its strength from expectations of ECB monetary actions in the near future.

Support: 1.4650, 1.4610, 1.4545

Resistance: 1.4740, 1.4800, 1.4850

Euro | Japanese Yen | British Pound | Swiss Franc

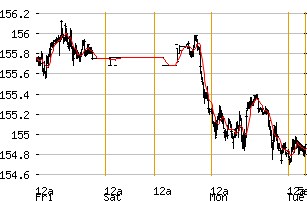

Japanese Yen

Volatility hitched up a gear on this pair as carry trades continued to unwind sending this pair plummeting. Even though it managed to stabilize towards the end of the session, the plunge is clearly showing trader’s confidence in the U.S economy.

Support: 110.50, 110.00, 109.75

Resistance: 111.00, 111.25, 111.75

Euro | Japanese Yen | British Pound | Swiss Franc

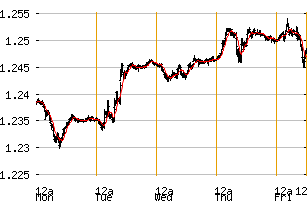

British Pound

The pound gave up around 200 pips on Friday as money flowed back to the dollar. Recent economic situations are bouncing this currency back and forth as traders seek for high yielding returns.

Even though the pound is currently offering a higher yield return it didn’t stop this currency pair from closing the session down at $2.0910 on profit taking.

Support: 2.0800, 2.0750, 2.0700

Resistance: 2.0900, 2.0950, 2.1000

Euro | Japanese Yen | British Pound | Swiss Franc

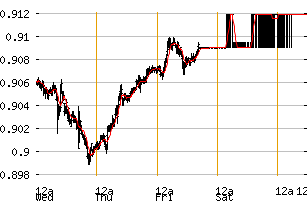

Swiss Franc

Support: 1.1210, 1.1150, 1.1100

Resistance: 1.1280, 1.1350, 1.1400