World’s largest brewer, Anheuser-Busch InBev SA/NV (NYSE:BUD) , or AB InBev has been losing investors’ attention, of late, due to a dismal surprise trend in recent quarters. Evidently, this Zacks Rank #4 (Sell) stock has underperformed the broader Zacks categorized Beverages – Alcoholic industry in the last one year. The company’s shares declined 7.2%, against the industry’s 2.2% growth. In fact, this Belgium-based brewer has lost about 4.5% since its last reported first-quarter 2017 results.

What’s Weighing Upon BUD?

AB InBev’s bearish run is largely accountable to its dismal earnings surprise history. Incidentally, the company has lagged earnings estimate in each of the trailing five quarters, at an average of 31.7%. In first-quarter 2017, results were majorly hurt by a disappointing Brazilian performance, which in turn was marred by difficult consumer trends and unfavorable currency movements.

Negative foreign currency translations were responsible for the 38.4% increase in AB InBev’s cost of sales in the quarter. Also, management anticipates cost of sales to escalate in 2017 on account of lingering currency woes, along with growth of premium brands. This remains a threat for the company’s bottom line. Additionally, a tough macroeconomic environment and volatility in some of the core regions remain concerns for the company, given its consumer-driven business.

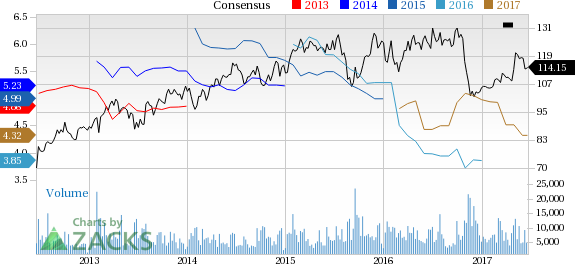

Apart from hurting investors’ sentiment, these worries also caused a downtrend in estimates. Evidently, the Zacks Consensus Estimate for the second quarter and 2017 has moved from $1.17 to $1.14 and from $4.50 to $4.32, respectively in the past 60 days.

Other than this, AB InBev continues to battle stiff competition in terms of its pace of undertaking innovations to keep track of the evolving consumer trends. Further, continued consolidation among retailers in the beer space could hurt the overall profit of the industry.

Can Growth Strategies Help?

To counter these hurdles, AB InBev remains focused on solidifying its strong image and market position of premium brands, to enhance relations with consumers. Well, the company has a robust brand portfolio and its products sold over 150 nations. The company’s combined portfolio with SABMiller (LON:SAB) includes more than 500 beer brands, including some of the renowned beer names, like Budweiser, Corona and Stella Artois. Moreover, the company keeps coming up with near beer alternatives, along with no- and low-alcohol beers to provide greater choices to consumers.

Also, AB InBev is on track with SABMiller’s integration (acquired in Oct 2016), and realized synergies worth $252 million in this regard, during first-quarter 2017. This buyout came part of AB InBev’s strategy to grow further in the brewing space. Notably, the combined entity is likely to control about one-third of the global beer market. Also, their robust geographical reach would enable the combined giant to serve all major beer markets that have sturdy growth potential.

However, the near-term headwinds cannot be ignored. While these growth strategies bode well, it remains to be seen if they can bear fruit, and help the stock revive. Until then, we prefer to remain on the sidelines and shift our focus to better-ranked stocks.

Investors can count on better-ranked stocks like Craft Brew Alliance, Inc. (NASDAQ:BREW) , Constellation Brands Inc. (NYSE:STZ) and Heineken NV (OTC:HEINY) .

Craft Brew’s shares have surged 68.7% in the last one year and it sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Constellation Brands, with long-term earnings per share growth rate of 17.8%, flaunts a superb earnings surprise history. The stock carries a Zacks Rank #2 (Buy).

Heineken, also with a Zacks Rank #2, has long-term earnings per share growth rate of 7.6%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Constellation Brands Inc (STZ): Free Stock Analysis Report

Anheuser-Busch Inbev SA (BUD): Free Stock Analysis Report

Craft Brew Alliance, Inc. (BREW): Free Stock Analysis Report

Heineken NV (HEINY): Free Stock Analysis Report

Original post

Zacks Investment Research