- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Welltower (WELL) Boosts Liquidity Amid Coronavirus Mayhem

In an effort to boost its liquidity profile and further strengthen the balance sheet, given current capital-market conditions and the uncertain impact of the COVID-19 pandemic, Welltower Inc. (NYSE:WELL) recently acquired commitment for new $1-billion term loan. The company has taken steps that helped it increase available near-term liquidity to $3.5 billion.

The company, which had $338 million of cash and cash equivalents and $1.5 billion of available borrowing capacity under its unsecured revolving credit facility as of Mar 20, 2020, obtained a two-year unsecured term loan of $1 billion with interest at a rate of 30-day LIBOR +1.20% (based on its credit rating).

The amount under the term loan can be increased up to an additional $200 million if Welltower exercises its right. With the proceeds, the company intends to repay borrowings under its unsecured revolving credit facility and commercial paper program, finance future growth opportunities and for general corporate needs.

Apart from these, Welltower received net proceeds totaling $694 million from dispositions as of Mar 20, 2020. Also, as of the same date, the company has forward sale agreements covering 6.8 million shares of common stock under its ATM program, at an initial weighted average price of $86.48 per share. This provides the option to generate up to $588 million in gross proceeds if the company, at its discretion, settles the forward sale agreements through Dec 31, 2020. The company also has no material unsecured notes maturing until 2023.

Notably, the coronavirus pandemic is wreaking havoc across the globe. The number of infected patients in the United States continues to spike, while the spread of the virus outside of mainland China continues.

Recently, Welltower noted that two of its residents tested positive for COVID-19 in the company’s U.S. properties as of Mar 16. The company also said that “elevated protocols” were placed since late January to contain the spread of the virus. Though elevated protocols might lead to slower new resident flow in the short term, the company has also observed a “commensurate decline” in voluntary move outs as well as higher lead-to-closing ratios.

Welltower has a differentiated portfolio of seniors housing and medical office assets, which positions it well to capitalize on growing demand for healthcare assets amid rising healthcare spending and a favorable demographic trend. Efforts to expand the outpatient medical portfolio through accretive acquisitions are encouraging and a decent balance sheet offers ample scope to pursue growth moves. However, high supply of seniors housing assets will likely stiffen competition, while large-scale sales might induce near-term earnings dilution. Also, the recent outbreak of coronavirus adds to its woes.

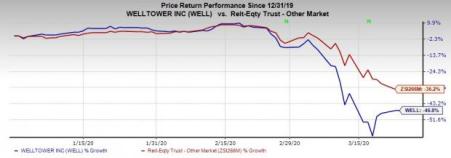

Shares of this Zacks Rank # 3 (Hold) company have depreciated 46.8%, which is wider than its industry’s decline of 35.2% year to date. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Highwoods Properties (NYSE:HIW) currently carries a Zacks Rank of 2 (Buy). The long-term growth rate of funds from operations (FFO) is projected at 4.6%.

Plymouth Industrial REIT (NYSE:PLYM) carries a Zacks Rank of 2. The Zacks Consensus Estimate for the ongoing-year FFO per share moved 2% north to $2.08 over the past month.

Piedmont Office Realty Trust (NYSE:PDM) also carries a Zacks Rank of 2. The company’s FFO per share estimate for 2020 moved up 3.2% to $1.96 in two months’ time.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Highwoods Properties, Inc. (HIW): Free Stock Analysis Report

Piedmont Office Realty Trust, Inc. (PDM): Free Stock Analysis Report

PLYMOUTH IND RE (PLYM): Free Stock Analysis Report

Welltower Inc. (WELL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Nvidia (NASDAQ:NVDA) shook things up by reporting revenue of $39.3 billion for the quarter while guiding next quarter to $43 billion. This was slightly below the pattern’s...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.