- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Wells Fargo Sued By Navajo Nation For Unfair Sales Practices

Yesterday, Wells Fargo & Company (NYSE:WFC) was served with another lawsuit on its plate by Navajo Nation, a Native American territory, for having exploited its “most vulnerable population” into opening accounts they did not require.

It was only yesterday that investors were ready to put behind Wells Fargo’s disappointing past with renewed hopes on the banks’ performance, which is expected to get support from lower tax rates policy. The market’s positive attitude toward the San Francisco, CA-based bank helped it breach the 52-week high. However, this latest news of the bank’s misdeeds might act as a setback.

Major Allegations

This lawsuit can be considered a minor recap of the fake-accounts scandal Wells Fargo was involved in September 2016. The only difference being that the bank’s representatives fulfilled their sales targets by taking advantage of the elders who do not understand English. Also, they targeted the minors by opening accounts in their names and falsely reporting their ages.

In fact, the bank has been accused of having pushed locals into opening unnecessary accounts by following them into events such as flea markets and basketball games.

Russell Begaye, President of Navajo Nation, showed his disappointment in the bank by saying, “Wells Fargo’s actions toward the Navajo people have been of a uniquely outrageous nature.”

John Hueston has been appointed as the attorney and is directed “to seek restitution, damages and civil penalties” for the wrong doings of the bank. The community has been deeply impacted by this as Wells Fargo is the only major bank that has branches in the area.

Spokesperson of Wells Fargo refrained from comments on the matter.

Our Viewpoint

Currently, the bank has a lot to deal with on the litigation front. Further, Trump’s recent comments on Wells Fargo’s deeds are on legal matters reflect that the bank’s financial statements will be dominated by higher legal costs.

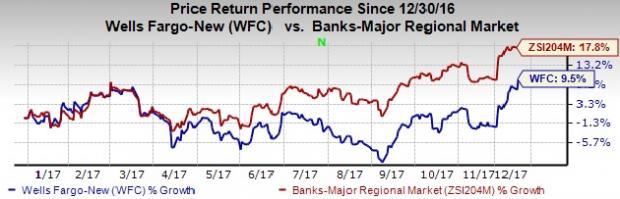

Shares of Wells Fargo have gained 9.5% year to date, underperforming the industry’s rally of 17.8%.

Currently, the stock carries a Zacks Rank #4 (Sell).

Stocks to Consider

Enterprise Financial Services Corporation (NASDAQ:EFSC) witnessed a 1.2% upward estimate revision for current-year earnings, over the last 60 days. Additionally, the stock has gained 4.9% over the past six months. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

First Financial Bancorp’s (NASDAQ:FFBC) current-year earnings estimates have been revised 2% upward in the last 60 days. Also, the company’s shares have risen nearly 1% in the past six months. It holds a Zacks Rank of 2, at present.

Federated Investors (NYSE:FII) witnessed 3.4% upward estimate revisions for current-year earnings, over the last 60 days. In six months’ time, the company’s share price has been up more than 23.8%. It also carries a Zacks Rank of 2.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Wells Fargo & Company (WFC): Free Stock Analysis Report

First Financial Bancorp. (FFBC): Free Stock Analysis Report

Enterprise Financial Services Corporation (EFSC): Free Stock Analysis Report

Federated Investors, Inc. (FII): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.