No question Tim Wentworth, Walgreens (NASDAQ:WBA) new CEO is moving quickly to dispose of some of the assets that have found themselves attached to Walgreens since Stefano Pessina and Roz Brewer were in charge. WBA’s stock price action on Thursday was positive.

The speed at which Tim put his team together, i.e. the new CFO and the various heads of US HealthCare and Retail is impressive, and they are making the changes they see as being necessary to right the ship.

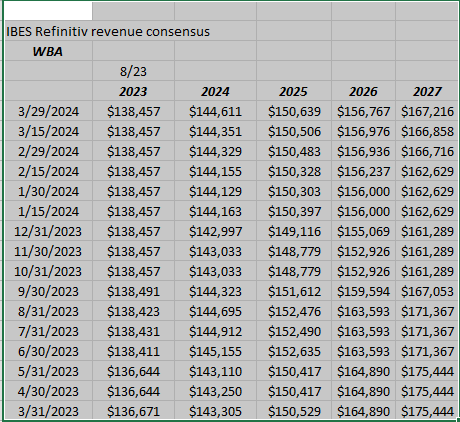

The unambiguous positive for Walgreens after the Thursday 3/28/24 earnings report: forward estimate revisions for WBA remain positive.

The analysts are still uncertain about fiscal ’26 revenue, but the estimate has been stable for calendar ’24, so that’s a plus with the two earnings releases under the belt. The 2026 fiscal year revenue estimates have regained the negative revisions seen last fall.

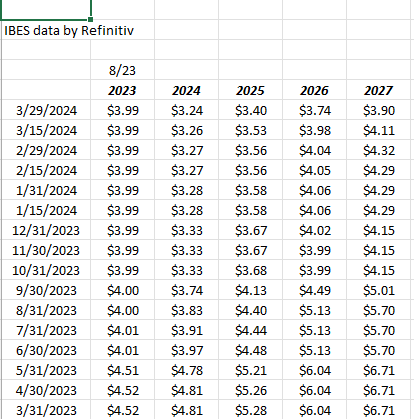

EPS Estimate Revisions Are Still a Worry:

One sell-side research report noted that – after Thursday night’s report – the fiscal ’25 EPS estimate might be at risk.

It’s still the case where sell-side analysts lack confidence to lift the forward EPS estimates on WBA, and that can’t be brushed aside.

Segment Look:

US Retail pharma (78% of revenue and 84% of operating income) as of fiscal Q2 ’24) saw q2 ’24 revenue increase 4.7%, while comp’s rose 4.8% for the quarter. Pharmacy sales and comp’s are still printing in the 8% area, which is a positive, or I’d consider it a positive.

Retail sales comp’s and the so-called front-end comp’s are not faring as well, with both being down -4% versus the year-ago quarter.

When the CEO and the team talked about the “weak economy” I’m assuming the front-end struggles and the negative comp’s are what are being referred to, (i.e. weak retail sales), but the press release also talked about the lower sale-leaseback gains, and higher shrink levels.

International: (positive surprise) (16% of total WBA revenue and 27% of op pft as of fiscal Q2 ’24)

Int’l sales rose 6.6% from the year-ago quarter, but half of that was a the currency impact. Boots UK pharma rose 1.7% and Boots UK retail sale rose 5.9%, which was a pleasant surprise.

My understanding was that Roz Brewer thought about selling Boots at one point, but it was may have been too soon after Covid to get a good value. The UK economy has improved under Rishi Sunak, and the pound has strengthened.

US Healthcare: Revenue rose 36% yoy, and adjusted EBITDA (per the press release) was positive. Frankly, I don’t know that much about the segment and am simply watching the numbers.

Segment Summary: the various one-time or multiple-quarter charges, like the sale-leaseback run-off, the ongoing shrink issue, and real-estate gains from sales in the UK, are still muddying the waters, and being an analyst at heart, I wonder when investors ultimately get to see “clean” numbers from WBA. My guess is the run-off of all this last for a few more quarters, and Q1 ’25, which ends late October ’24, might be the first quarter of less-crowded and simplified financials.

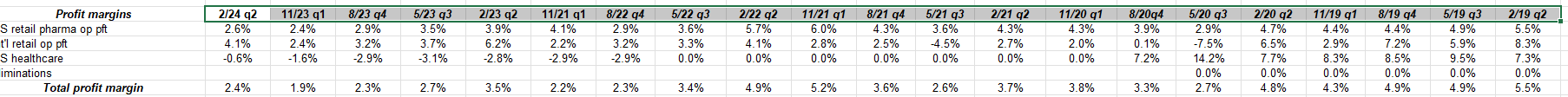

Profit Margin History:

(Click on the above s.sheet to see segment operating profit margins both pre and post-Covid.)

Conclusion:

In the earnings preview to WBA’s fiscal Q2 ’24, the blog post received some spirited responses, mainly post-earnings, and some good points were made.

Here’s another perspective:

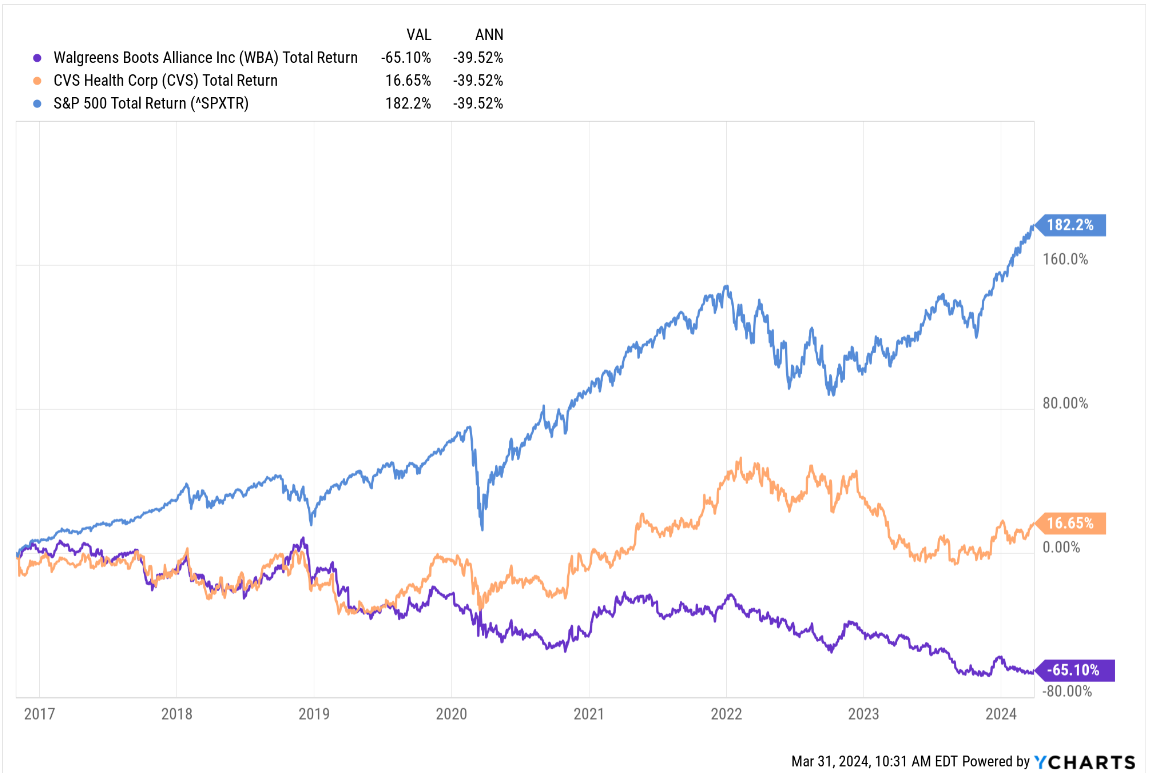

This Ycharts post shows the performance of CVS, Walgreens, and the S&P 500’s total return since 10/31/16. The reason that date was selected was CVS had been performing well up until the morning of the November 2016 Presidential election, when CVS released earnings and the stock fell from near $90 to $75, and as the total return charts show, hasn’t done much since.

I’d feel better about Walgreens having a “management” or an “operating” problem if CVS had performed better over the last 8 years. Now WBA dramatically underperformed both CVS and the S&P 500, so it demonstrated bigger issues, but that also represents an opportunity for upside if the new CEO and the team can get the business reconfigured, however, the two biggest retail drug store firms aren’t really shooting the lights out in terms of stock market returns.

Most people are surprised by the fact that the “convenience” or non-scrip retail part of every Walgreens – the so-called, “front-end” – has always been the higher margin business for the drugstore giant. The prescription business has been under pressure from Medicare reimbursement for years, and that’s happening again in ’24, given it’s a Presidential election year and the current administration wants to get more drugs covered under Medicare before the election. If Tim Wentworth rationalizes store payroll and staffing, my guess is the front end is impacted first. (As someone who is still a loyal Walgreens user, it’s tough to talk about “cost and expense rationalization”. The pharmacies and the pharmacists do a great job: prescriptions, inoculations, and vaccines, they get it done for customers. Some of the front-end and whatever costs are associated with that “convenience item” support, might be the first to go, but I hope that’s not the case, however, that US Retail margin should eventually rise,)

Cash-flow and free cash flow are scheduled to improve over the next few quarters but I wish the team would have given some guidance. They mentioned the one-time drags on cash-flow and free cash flow (and EPS for that matter) but didn’t put a number to the expected cash flow by fiscal year-end ’24 or August ’24.

I think the jury’s still out on Walgreens for the next quarter or two. The stock price action was positive on Thursday, March 29th, 2024, as the stock ended 3% higher on 2.5x average volume. That’s a plus, but current shareholders should still keep that 52-week low and $19 stop loss in mind.

Tim Wentworth and his team are moving quickly: there were some positives in this quarter’s results, but I think it will take another quarter or two, so that forward EPS estimates can stabilize, and some solid guidance can be heard from management to convince investors that the bottom is in.

No client positions have changed since the earnings preview disclosure.

None of this is advice or a recommendation. Past performance is no guarantee of future results. Investing can involve loss of principal even over short periods of time. All EPS and revenue estimates sourced from LSEG.

Thanks for reading.