VIX Non-Commercial Speculator Positions:

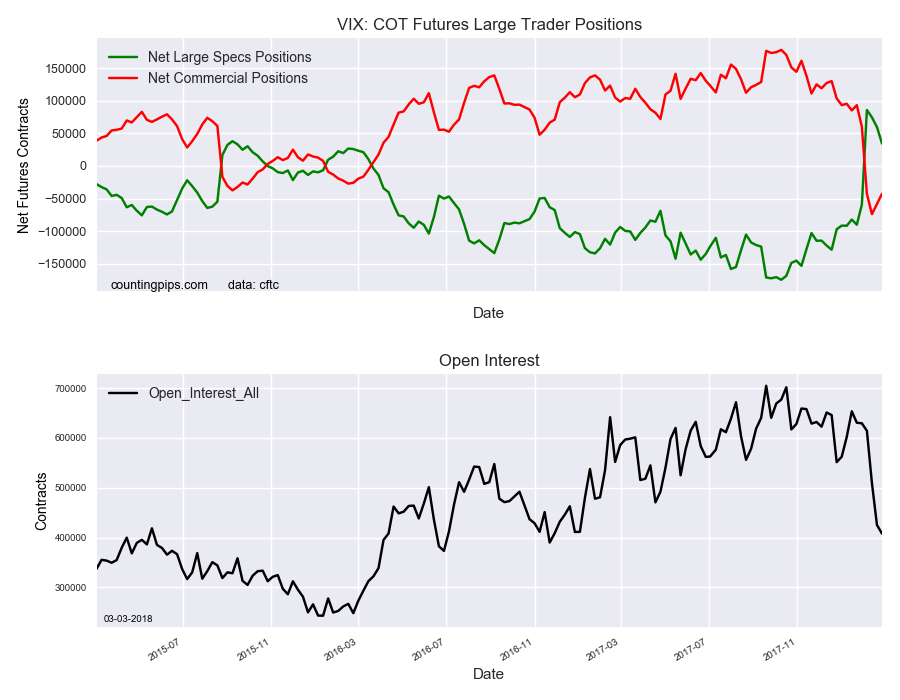

Large volatility speculators decreased their bullish net positions in the VIX Futures markets this week for a third straight week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

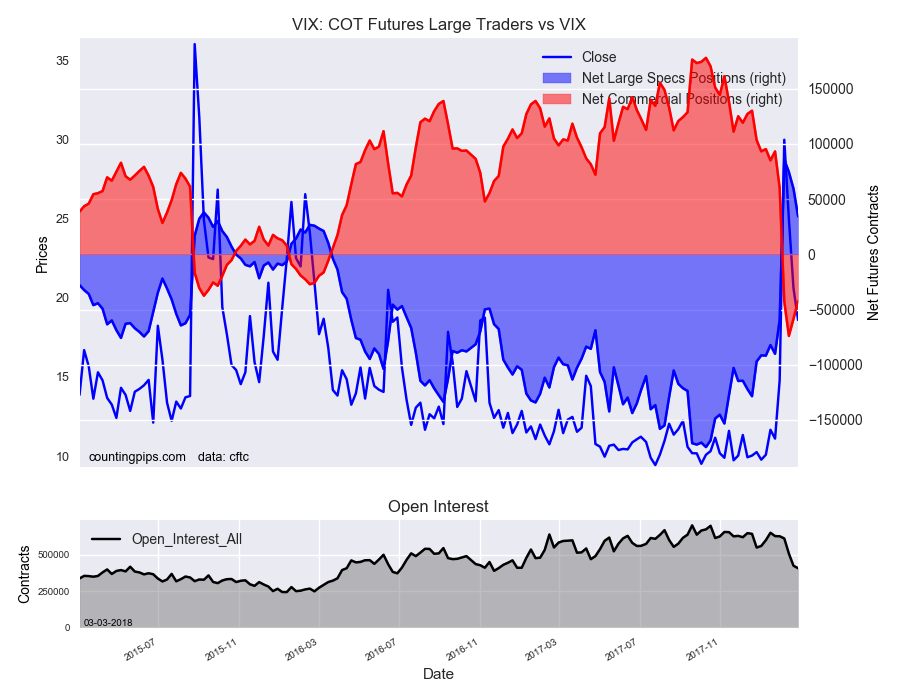

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of 34,383 contracts in the data reported through Tuesday February 27th. This was a weekly decline of -25,167 contracts from the previous week which had a total of 59,550 net contracts.

Speculative positions had spiked four weeks ago along with the selloff in the stock markets with a gain of +145,175 net positions but have been decreasing ever since with an overall decline of -51,435 net contracts in the three weeks since.

VIX Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -42,613 contracts on the week. This was a weekly rise of 15,879 contracts from the total net of -58,492 contracts reported the previous week.

VIX:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX, which tracks the volatility of the S&P 500, closed at approximately 18.59 which was a decrease of -2.01 from the previous close of 20.60, according to unofficial market data.