- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Verizon Inks Multi-Year Digital Streaming Deal With NFL

Verizon Communications Inc (NYSE:VZ) has reportedly inked a five-year digital streaming deal with the National Football League (NFL). The telecom service provider will pay approximately $2.25 billion to stream NFL’s content on its digital and mobile media platforms.

With this announcement, shares of Verizon gained 1.47% to $51.84 on Dec 11.

Per the deal, Verizon’s digital and mobile media properties will stream in-market and national games, including national pre-season, regular season, playoff games and the Super Bowl viewers, irrespective of mobile network. Additionally, the deal will enable mobile access to NFL highlights and coverage.

Under the five-year deal, Verizon renewed agreement to stream NFL games on all devices — internet-connected TVs, tablets and phones. The supposed deal is a follow up of the company’s previous contract with NFL, which allowed streaming in devices with screens of 7 inches or less. This limited the market base to smartphone users only.

Verizon has been a major NFL partner, both in the distribution of games on NFL mobile and as a sponsor, since 2010. Currently, the company has mobile streaming rights to NFL’s Sunday day games, along with night games on Monday, Thursday and Sunday. Verizon’s FiOS TV customers already have access to games on their screens at home, owing to networks like ESPN and NBC. The NFL content will attract a massive digital audience.

The new partnership will be effective from January 2018.

Digital Media Prospects

NFL games are one of the most-watched TV shows in the country. We expect this deal to boost Verizon’s digital content and online advertising suite, Oath.

Oath is Verizon’s newly formed company under Media and Telematics organization. The company oversees Yahoo and AOL. It has a diverse house of more than 50 media and technology sites like Yahoo News, HuffPost, Engadget, TechCrunch, MAKERS, Tumblr, BUILD Studios, Yahoo Sports, Yahoo Finance, Yahoo Mail and others. Verizon acquired AOL Inc in June 2015 and the core businesses of the Internet-company, Yahoo! Inc (NASDAQ:AABA). in June 2017. In October 2017, Verizon announced the offering of Go90 content across some of its Oath brands. Go90 is Verizon’s video streaming service.

With plans to include NFL streaming under Oath, Verizon is optimistic about the brand to generate $20-billion revenues by 2020. Important deals with NFL and the National Basketball Association should ramp up Verizon’s advertising revenues.

On the back of Oath and booming prospects, Verizon intends to compete against the dominant players in the online and digital video advertising market, which includes Facebook Inc. (NASDAQ:FB) and Alphabet Inc. (NASDAQ:GOOGL) .

Zacks Rank & Price Performance

Currently, Verizon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

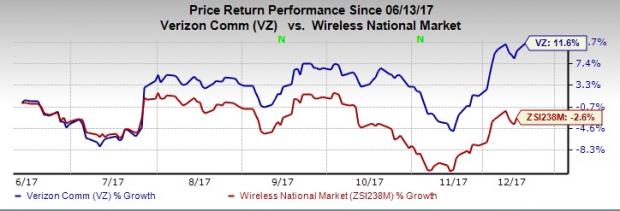

Verizon portrays an impressive price performance. In the past six months, shares of Verizon have gained 11.6% against the industry’s decline of 2.6%.

Valuation Indicates Some Upside

In terms of price-to-earnings ratio (P/E - F12M), which is often used to rate telecom sector stocks, Verizon’s valuation looks attractive. The stock currently has a trailing 6-month P/E ratio of 13.39 compared with 14.46 for the industry it belongs to.

Even when compared with the market at large, the stock looks favorable, as the P/E ratio for the S&P 500 index is at 18.99.

Verizon’s Recent Deals

Verizon and AT&T Inc (NYSE:T) have inked a joint deal with Tillman Infrastructure to build cell towers in the United States. Privately held Tillman is the owner and operator of towers, small cells and smart cities infrastructure. Per the deal, Tillman will construct customized towers and lease it to Verizon and AT&T. Construction of the towers will begin in the first quarter of 2018.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.