- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

VeriFone's (PAY) Q4 Earnings Beat Estimates, Revenues Up Y/Y

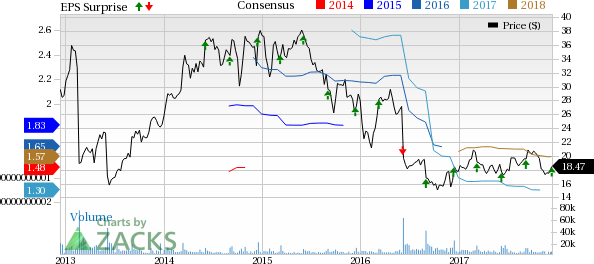

VeriFone Systems Inc. (NYSE:PAY) reported fourth-quarter fiscal 2017 non-GAAP earnings of 44 cents, beating the Zacks Consensus Estimate by a penny. The figure surged 47.7% from the year-ago quarter.

The year-over-year growth was primarily due to higher non-GAAP revenues, which increased 2.6% to $476.5 million and beat the Zacks Consensus Estimate of $472 million. The upside can be attributed to strong revenue growth in Latin America and Europe, Middle East and Africa (EMEA).

VeriFone recently completed the divestiture of the taxi business for approximately $30 million. However, the company retained minor interest in the business.

Moreover, Verifone’s board authorized an additional $100 million stock repurchase program which the company plans to execute over the upcoming 12-18 months.

VeriFone’s stock has gained 4.2% year to date, substantially underperforming the 36.7% rally of its industry.

Connected Device Footprint Expands

In fiscal 2017, VeriFone delivered earnings of $1.31 per share based on revenues of $1.874 billion. Total services revenues increased 8% in the year.

Connected device footprint totaled approximately 1.8 million terminals and generated more than $0.5 billion in recurring services revenues, which grew at a high-single digit annual run rate.

Payment-as-a service solution in North America more than doubled the company’s footprint of connected devices to approximately 400K.

Moreover, the company’s mPOS device has gained good traction within a short span of time. The device generated 25% revenue growth globally in the fiscal, primarily driven by the launch of a new midrange device.

Top-line Details

System revenues (56.3% of total revenues) increased 1.6% year over year to $268.4 million. Core North American business grew in the quarter. Moreover, Latin America and EMEA revenues contributed amply.

However, services (43.7% of total revenues) increased 4.1% year over year to $208.1 million. Excluding the results of Petro Media and the Taxi business in both periods, adjusted services growth was approximately 10% year over year.

Non-GAAP revenues from North America and Asia Pacific fell 9.6% and 3.8% from the year-ago quarter to $154.1 million and $46.2 million, respectively. However, EMEA and Latin America revenues surged 8.4% and 17.4% to $196 million and $80.2 million, respectively.

Operating Details

Non-GAAP gross margin was 41.4%, which expanded 160 basis points (bps) from the year-ago quarter.

Systems margins of 37.7% expanded 250 bps on a year-over-year basis, primarily due to favorable product mix. Services margins were 46.2%, up 180 bps on a year-over-year basis.

Non-GAAP operating expenses were 131 million, down sequentially and 3.5% year over year on the back of restructuring and efficiency initiatives.

Non-GAAP operating margin expanded 340 bps on a year-over-year basis to 13.9%.

Balance Sheet

As of Oct 31 2017, VeriFone had approximately $131 million in cash & cash equivalents compared with $159 million as of Jul 31 2017. Long-term debt totaled $762 million compared with $803.4 million at the end of the previous quarter.

Cash flow from operations in the quarter was $26 million compared with $13 million in the previous quarter.

Guidance

For first-quarter fiscal 2018, VeriFone projects non-GAAP revenues between $418 million and $420 million, adjusted to exclude divested business. The company expects earnings of 22 cents per share for the current quarter.

For fiscal 2018, Verifone estimates non-GAAP revenues between $1.775 billion and $1.800 billion. Management projects earnings between $1.47 and $1.50.

Management stated that robust backlog of business wins, accelerated sales and new channel expansion opportunities will help services business t grow organically at a double-digit rate in the long haul.

Verifone plans to surpass 2 million connected devices globally in fiscal 2018.

Zacks Rank & Key Picks

VeriFone carries a Zacks Rank #3 (Hold). Total System Services Inc (NYSE:TSS) , Visa Inc. (NYSE:V) and The Western Union Company (NYSE:WU) , all carrying a Zacks Rank #2 (Buy), are a few better-ranked stocks in the same industry. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate for Total System Services, Visa and The Western Union is currently pegged at 12.75%, 16.85% and 5.78%, respectively.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Verifone Systems, Inc. (PAY): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Total System Services, Inc. (TSS): Free Stock Analysis Report

Western Union Company (The) (WU): Free Stock Analysis Report

Original post

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.