International Quantum Epitaxy (LON:IQE)’s pre-close trading update noted that management expects FY17 revenues to be ahead of market expectations. Noting that the upgrade is driven by delivery of volume epitaxy on a programme that we infer is the new iPhone X, a programme which will continue throughout FY18, we raise our revenue estimates for both FY17 and FY18, but keep EPS numbers unchanged as the proportion of licence revenues in the mix is lower.

Photonics revenues double, while wireless stable

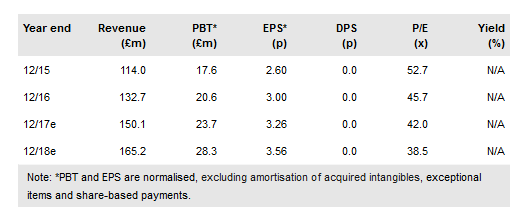

Management expects volume VCSEL ramp-up during H217 to result in photonics revenues approximately doubling for FY17 as a whole. Our estimates model photonics revenues remaining at H217 levels throughout FY18. Management expects wireless revenues to be broadly flat year-on-year, with favourable FX rates balancing an inventory reduction. Our estimates model growth from this segment in FY18. IQE expects the increase in wafer sales to drive an expansion of wafer margins in FY17, an effect which we model as continuing through FY18. We revise our group revenue estimates from £145.3m to £150.1m for FY17 and from £160.3m to £165.2m for FY18. We also increase the FY17 cash tax payment by £4.2m to reflect settlement of a prior year tax liability.

To read the entire report Please click on the pdf File Below: