- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Valeant (VRX) Down On Q4 Earnings Miss, Issues Drab '18 View

Shares of Valeant Pharmaceuticals Inc. (NYSE:VRX) tumbled 9.2% after the company reported disappointed results for the fourth-quarter results on Feb 28. The guidance for 2018 disappointed investors too.

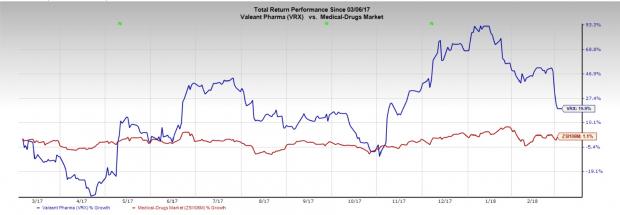

Notably, Valeant’s stock moved up 19.9% over a year compared with the industry’s gain of 1.1%.

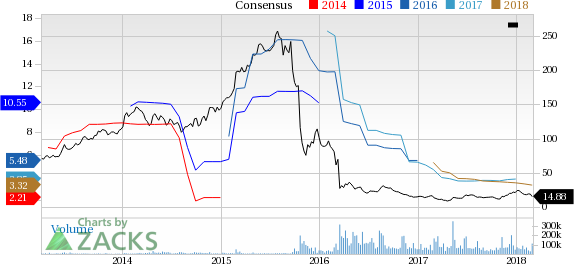

The company’s adjusted earnings per share of 98 cents missed the Zacks Consensus Estimate of 99 cents by a penny and was down from $1.11 per share in the year-ago quarter.

However, total revenues of $2.16 billion topped the Zacks Consensus Estimate of $2.20 billion but declined 10% from the year-ago quarter.

The impact of the discontinuation of divestitures and lower volumes in the Diversified Products segment along with the loss of exclusivity for a basket of products, and the Ortho Dermatologics business led to the disappointing results. Revenues were also negatively affected by the unfavorable impact of foreign exchange. The decline was partially offset by higher volumes and increased international pricing in Bausch + Lomb/International segment, primarily the U.S. Consumer Products business.

Quarter in Detail

Revenues in the Bausch + Lomb / International segment were $1.2 billion, down 5% year over year. Excluding the impact of discontinuation of divestitures, primarily the skin care divestiture, and foreign exchange, the Bausch + Lomb/International segment organically grew by approximately 4% year over year driven by increased volumes in the global Consumer, International and Global Vision Care businesses.

The Branded Rx segment revenues were $602 million, down 19% due to a decrease in sales which primarily reflects lower volumes in the Ortho Dermatologics business and the loss of sales due to the divestiture of Dendreon Pharmaceuticals LLC. This was partially offset by increased sales in Salix.

The U.S. Diversified Products segment revenues were $335 million, down 16% year over year due to decreases in volume and price attributed to the previously reported loss of exclusivity for a basket of products.

Research and development expenses were $90 million in the reported quarter, down 3.2% from the year-ago quarter.

Selling, General and Administrative costs were $632 million compared with $658 million in the year-ago quarter.

The company received clearance for the Thermage FLX System to non-invasively smooth skin on the face, eyes and body. Earlier, the company received the FDA filing acceptance for the NDA for Plenvu (NER1006), a novel, low volume polyethylene glycol-based bowel preparation for colonoscopies. The FDA also approved its new psoriasis treatment, Siliq, following which the drug was launched. The company inked a deal with AstraZeneca plc (NYSE:AZN) for Siliq but the agreement had to be amended. The company also obtained FDA approval of Vyzulta, a treatment option for glaucoma. The FDA also approved Lumify, the over-the-counter eye drop with low-dose brimonidine for the treatment of eye redness.

Valeant has completed 13 divestitures since the beginning of 2016, including skin care brands (CeraVe, AcneFree and AMBI), Dendreon Pharmaceuticals, iNova Pharmaceuticals, Obagi Medical Products and Sprout Pharmaceuticals.

2017 Results

Revenues declined 10% to $8.7 billion in 2017 from a year ago.

2018 Guidance

The company expects total revenues in the range of $8.10-$8.30 billion.

Our Take

Although fourth-quarter results missed earnings, the company beat on sales. The Bausch + Lomb/International segment and Salix businesses are doing well. Xifaxan achieved blockbuster status of $1 billion of sales as of January 2018. New drug approvals are also expected to boost growth and offset the weakness in the dermatology segment. The FDA recently approved Vyzulta for open-angle glaucoma which too should boost the topline given the potential of the targeted market ($11 billion by 2020).

After a tumultuous period, Valeant started a rebuilding process with its CEO, Joseph C. Papa. Even though it is still early to comment on the rebuilding process, but the company’s efforts to sell non-core assets and pay down huge levels of debt is commendable. As of Feb 28, 2018, the company has reduced total debt by approximately $6.7 billion since the end of first-quarter 2016. The dermatology market continues to be challenging and is expected to decline in 2018 as compared to 2017. Hence, it might be a while before the company turnarounds as management had projected.

Zacks Rank & Key Picks

Valeant currently carries a Zacks Rank #4 (Sell).

A couple of better-ranked stocks in the health care sector are Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) . While Regeneron sports a Zacks Rank #1 (Strong Buy), Ligand carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.37 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters, with an average beat of 9.15%.

Ligand’s earnings per share estimates have moved up from $3.78 to $4.15 for 2018 in the last 30 days. The company delivered a positive earnings surprise in three out of the trailing four quarters, with an average beat of 24.88%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Astrazeneca PLC (LON:AZN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Valeant Pharmaceuticals International, Inc. (VRX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.