V.F. Corp. (NYSE:VFC) is remaining true to its portfolio management promise as it has agreed to sell its underperforming Contemporary Brands business to Israel’s Delta Galil Industries Ltd. for $120 million. Brands put up for sale under the transaction include the denim brand 7 For All Mankind and lifestyle apparel brands such as Splendid and Ella Moss.

The company’s idea behind offloading this business is to continue with its active portfolio management strategy, wherein it constantly reviews its brands portfolio and retains the best performing ones while discarding the troubled ones. The company has recently shifted its focus to the composition of its brands portfolio and aims to maximize its growth and shareholders' returns.

While the brands mentioned above hold significant potential to grow, the company’s Contemporary Brands segment has recently been facing challenges due to the declining demand for casual and basic apparel. The segment reported a 14% drop in revenue to $344 million in 2015 and represented only 2.8% of the company’s total revenue.

V.F. Corp. expects the transaction to close in the third quarter of 2016, following necessary approvals and fulfillment of customary conditions.

While the transaction means departure from underperforming businesses for V.F. Corp., it represents a strategic way for Delta Galil to expand its branded business and global portfolio. This manufacturer and marketer of branded and private label apparel products for men, women and children, sees this acquisition as a source to diversify its merchandise offering and distribution channel, while strengthening its structure. With this acquisition, the company expects to add over $300 million to its annual sales and be accretive to earnings in 2017.

In an earlier attempt to enhance its portfolio structure, in March, V.F. Corp. revealed plans to seek strategic options for its Licensed Sports Group (“LSG”) unit, which forms a part of the company’s Imagewear segment. LSG, which includes the Majestic brand, mainly generates revenues through demand for products related to Major League Baseball and the National Basketball Association.

However, this transaction excludes the segment’s Image unit, which manufactures workwear for industrial, government and service sectors.

V.F. Corp.’s practice of regularly checking its composition and ensuring that its portfolio is well aligned with its strategic plans positions it well for boosting growth and elevating shareholders' value. The company currently holds a Zacks Rank #3 (Hold).

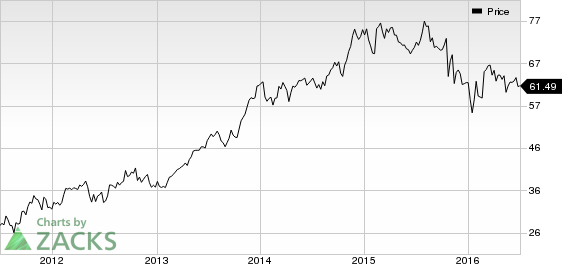

V.F. Corp. closed up 1.4% to $61.49 on Jun 30, 2016.

Stocks to Consider

Some better-ranked stocks in the same industry include Coach Inc. (NYSE:COH) , Hanesbrands Inc. (NYSE:HBI) and Perry Ellis International Inc. (NASDAQ:PERY) , each carrying a Zacks Rank #2 (Buy).

V F CORP (VFC): Free Stock Analysis Report

COACH INC (COH): Free Stock Analysis Report

HANESBRANDS INC (HBI): Free Stock Analysis Report

PERRY ELLIS INT (PERY): Free Stock Analysis Report

Original post

Zacks Investment Research