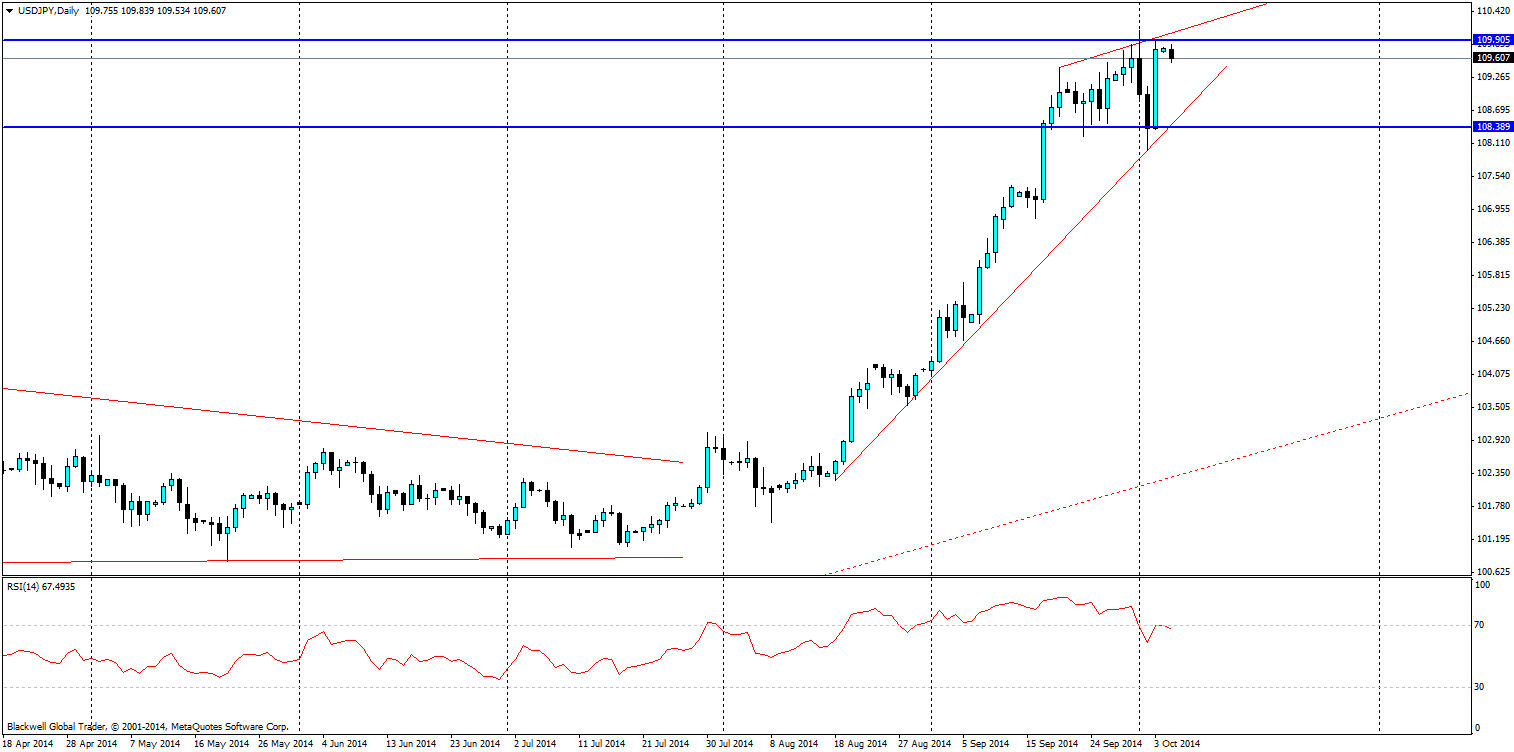

The USD/JPY has shot up the charts and as come to a rest after briefly pushing through the 110 yen barrier. This should come as no surprise for anyone, as the Yen likes to find room to breathe and currently that pause is warranted as cabinet reforms are not happening at the speed many would have liked.

With the start of the week, it’s time to look for trading opportunities and one finds many when looking at the charts at present. The USD/JPY has pushed up quite hard and at present is just below 110. This is pivotal as I am looking for a slight pullback downwards and further consolidation on the charts. Supporting this is the current modest wedge that is starting to form and consolidate together, despite the pressure of the USD.

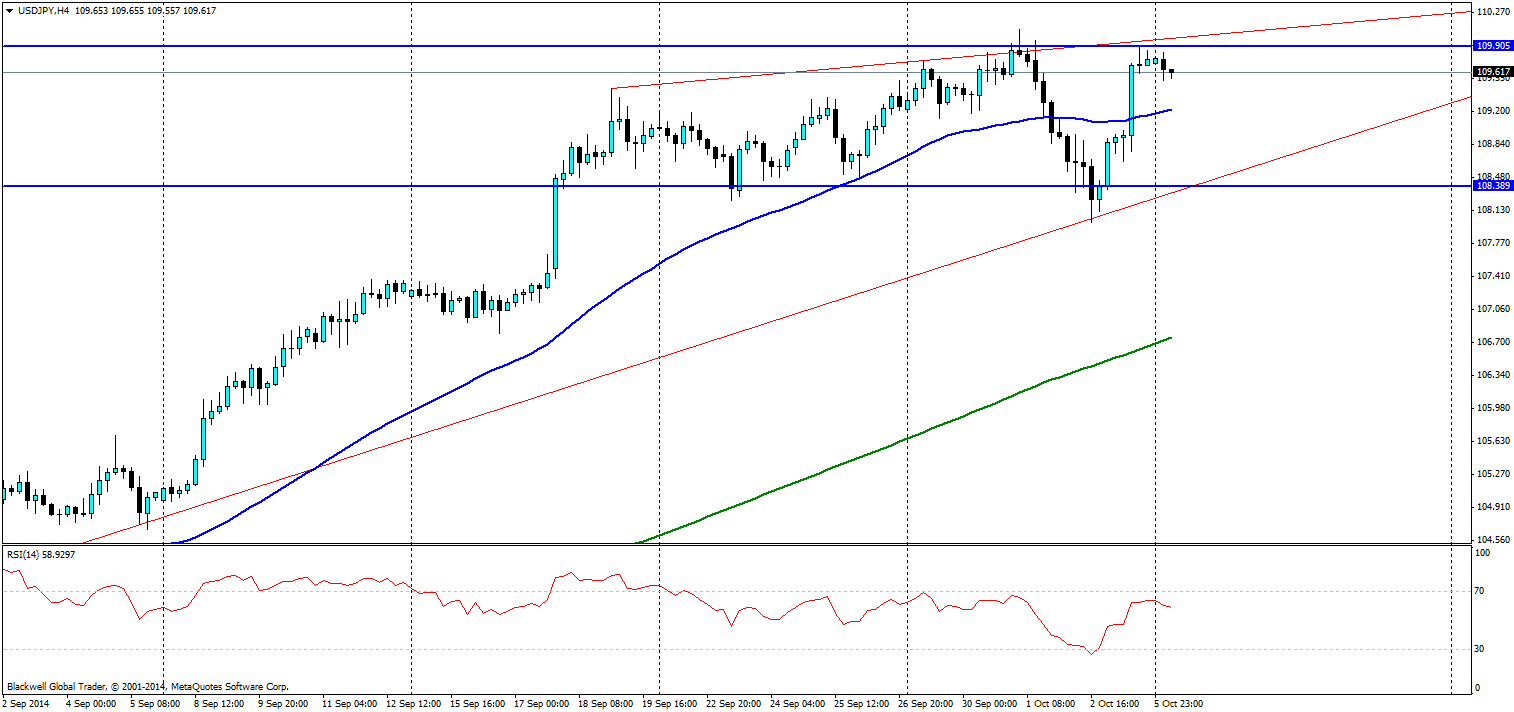

The H4 chart supports the idea that a drop is likely on the charts as the most recent wave was much more bearish than people anticipated, showing there is still strength for the idea of another push lower to the trend line before building momentum to go higher.

When looking for a target the 50 period MA is likely a good candidate as we have seen the Yen respond to this area when looking to fall lower, and using it as support.

However, in the coming hours we will find out, and I will be looking for the Yen to strengthen on the charts against the USD in the short term and offer some attractive trading movements going on from its reactions from the 50 day MA.