In mid July, the major indexes started making new highs. The Dow Jones Industrial Average (DJIA) and the S&P 500 Index (SPX) broke higher first, followed by the Nasdaq 100 (NDX) then the NASDAQ Composite.

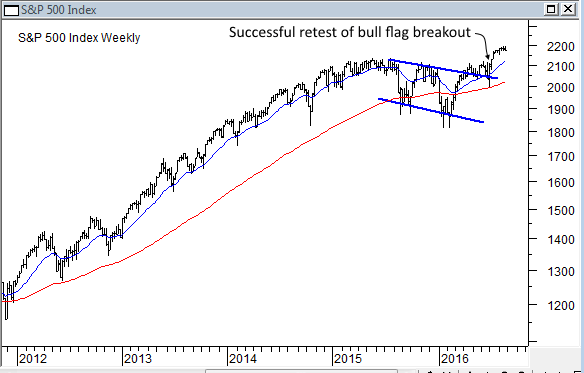

The pattern on a weekly chart of SPX shows a long consolidation followed by a breakout, retest, and subsequent rally. This suggests that the market should continue to move higher in the intermediate term.

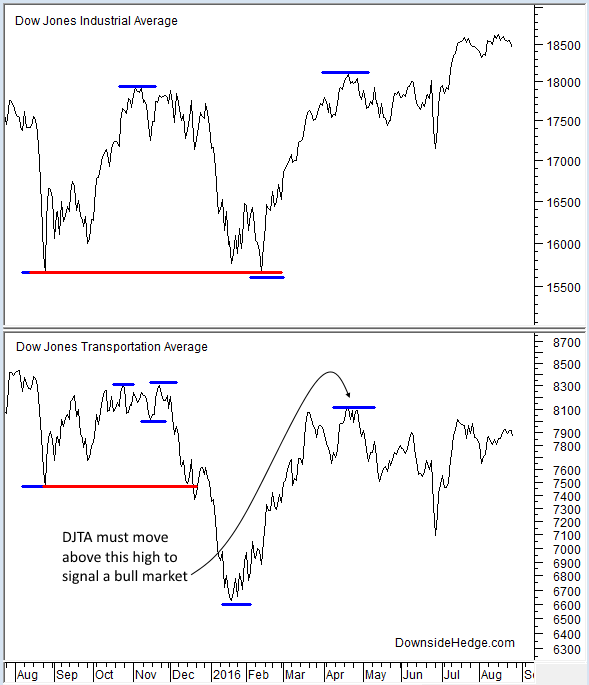

Although most of the major indexes have reached new highs, there are still a few holdouts. The most significant holdout is the Dow Jones Transportation Average (DJTA). It is still 17% below the December 2014 high. From a Dow Theory perspective, DJTA is still about 3.5% away from signaling a bull market (needs a move above its last secondary high).

The industrials however are above their last secondary high, so a Dow Theory non-confirmation is currently in place. With the SPX showing a strong bullish chart pattern, I suspect DJTA should signal a bull market in the coming weeks/months. Nevertheless, keep an eye on DJTA for the all clear signal.

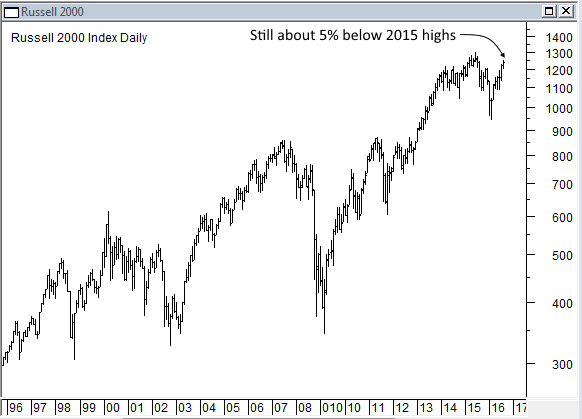

Another holdout is small cap stocks. The Russell 2000 Index (RUT) is still about 5% away from its 2015 high.

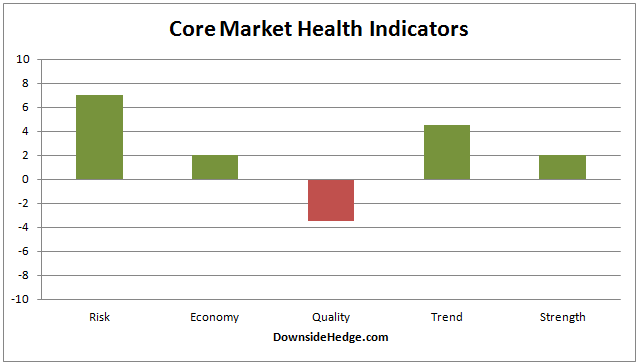

The last holdout is my measures of market quality. Earlier in the week, this category moved strongly higher, only to fall back again today (Friday). They just don’t want to move into positive territory. I suspect a rally after Labor Day will be needed to get this category positive.

Conclusion

Most of the major indexes have broken out to new highs, suggesting the market should continue higher over the intermediate term. Unfortunately, Dow Theory and my measures of market quality still haven’t given the all clear signal. Keep an eye on those to indicators going forward.