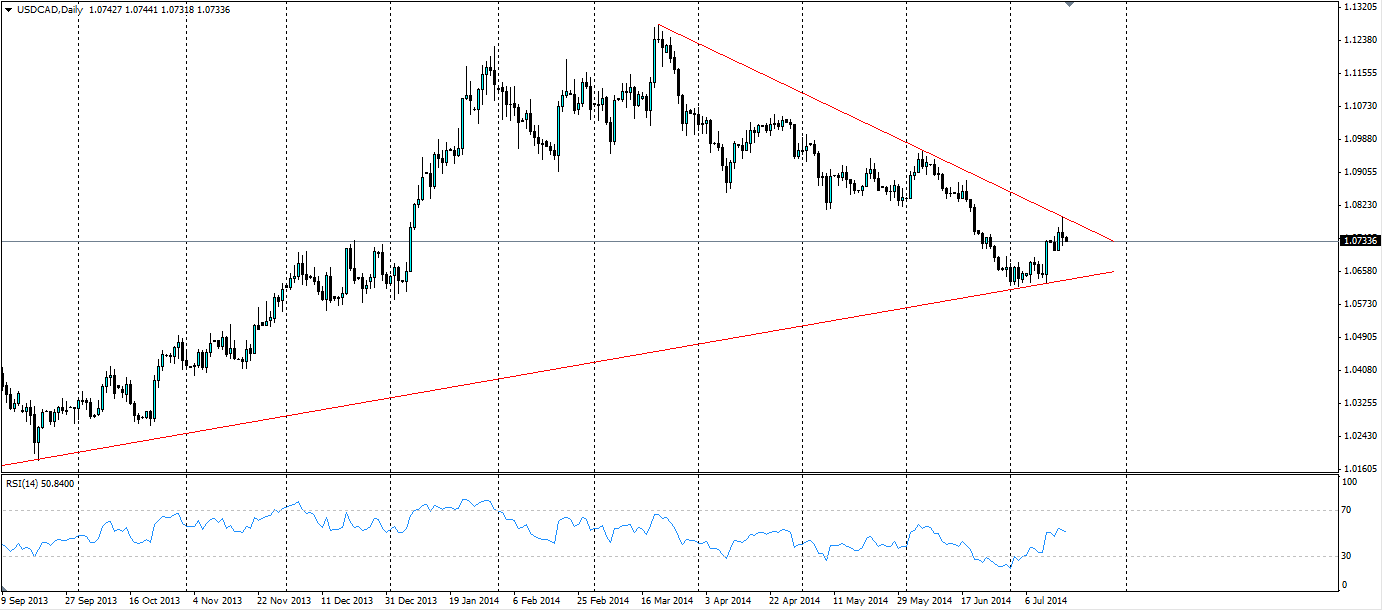

With both central banks speaking this week in very dovish tones, the USD/CAD has seen an increase in volatility recently and a breakout of the pennant shape that has formed on the chart is likely.

Both US Federal Reserve Chairwoman Janet Yellen and Bank of Canada (BoC) Governor Stephen Poloz maintained their stimulating monetary policies this week. Their dovish comments were expected by the markets, but it looks like the US dollar was the winner of the two. Yellen’s optimism about US labour markets seems to have given the US dollar a boost over its neighbour, as Poloz was “serially disappointed” with the world economy.

Yellen testified before Congress on Tuesday and Wednesday this week and said that the economic recovery is not complete and it still needs the FED’s support to help boost growth and the labour market. She did note that the labour market was recovering well and if conditions improve, the FED could raise interest rates sooner than expected. This impressed the market and sent the US dollar higher, with many in the market expecting interest rates to rise around mid-2015. She also said the disappointing GDP figure at the beginning of the year, where GDP fell by an annualised -2.9%, was caused by temporary factors.

BoC Governor Stephen Poloz was not as upbeat as Mrs Yellen. Canada’s economic growth projections for 2014 and 2015 were trimmed by one-tenth of a point — to 2.2 and 2.4 per cent respectively. Mr Poloz said "Right now, we do not have a sustainable growth picture in Canada," adding "Our serial disappointment with the global economic performance for the past several years means that we remain pre-occupied with downside risks,"

The end result is that the BoC has set mid-2016 as the timeframe for the Canadian economy to return to full capacity.Interest rates are not likely to rise until then, a full year after the market expects US interest rates to rise. It is now easy to see why the US dollar won the War of the Doves this week.

One important stat out this week is the Canadian CPI figure due on Friday (12:30 GMT). Inflation has been creeping to uncomfortably high levels for the BoC. Last month’s figure put it at 2.3%, however, with a shaky economy, the BoC will not want it to rise much higher as they cannot use interest rates to combat a high CPI. Governor Poloz yesterday said “inflation risks are balanced”, and “inflation is roughly on target”, however, anything higher than the 2.4% the market expects will put Mr Poloz in an awkward position.

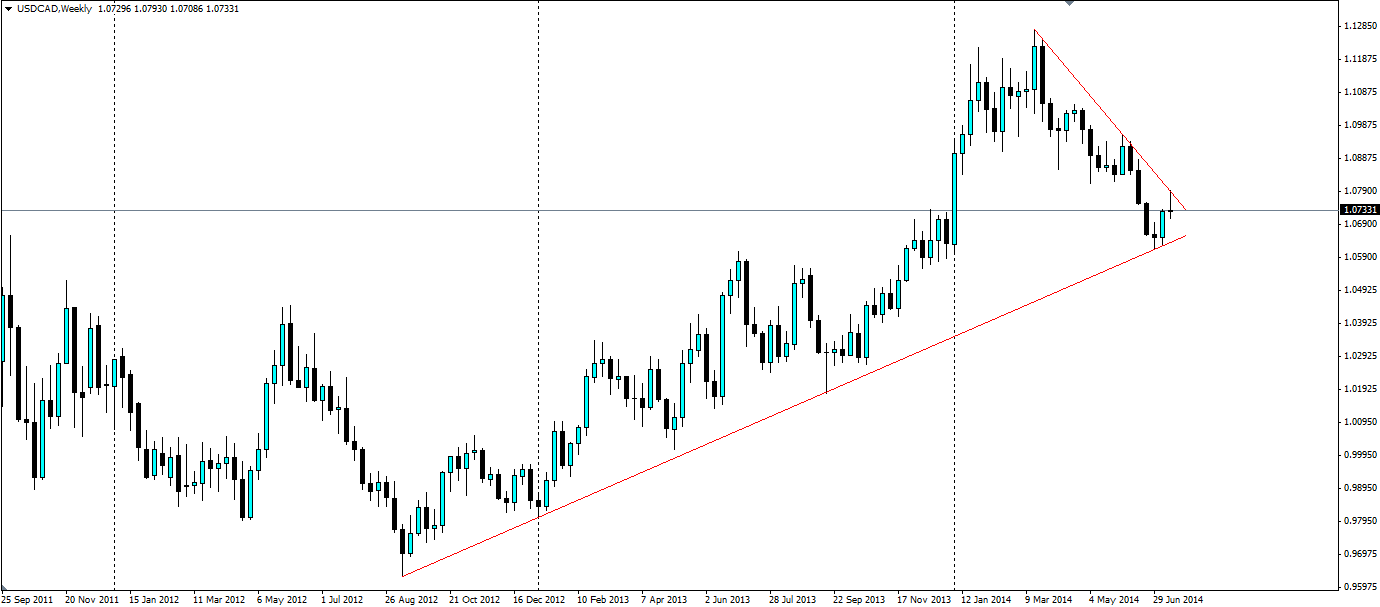

Looking at the weeklychart, we can see the convergence of two trend lines, one is a long term bullish trend and the other is a shorter term bearish trend. The bullish trend line stretches back to August 2012 and has been tested on many occasions, as recently as last week.

Comparing the interest rate outlook of the respective central bankers, the USD/CAD pair is likely to continue to respect the bullish trend line as speculation of higher returns on the USD boost demand. This is likely to result in a breakout of the current pennant shape to the upside.