Here are 5 stocks added to the Zacks Rank #1 (Strong Buy) List today:

Aerie Pharmaceuticals Inc (AERI): This clinical-stage pharmaceutical company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.5% over the last 30 days.

Agilent Technologies Inc (NYSE:A) (A): This provider of application focused solutions has seen the Zacks Consensus Estimate for its current year earnings improving 0.1% over the last 30 days.

Avista Corp (AVA): This electric and natural gas utility company has witnessed the Zacks Consensus Estimate for its current year earnings advancing 0.7% over the last 30 days.

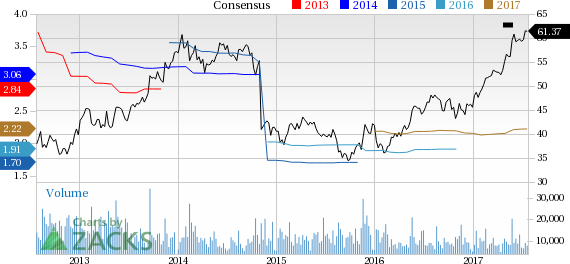

Chemours Co (CC): This provider of performance chemicals has seen the Zacks Consensus Estimate for its current year earnings surging 4.5% over the last 30 days.

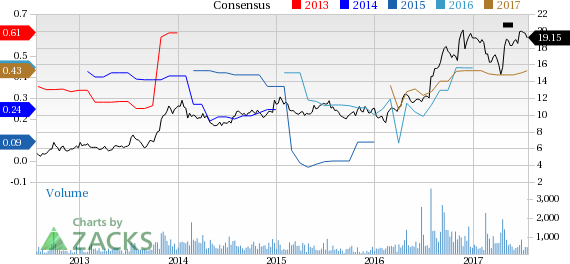

Cryolife Inc (CRY): This medical device manufacturer and processor has witnessed the Zacks Consensus Estimate for its current year earnings improving 2.4% over the last 30 days.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

CryoLife, Inc. (CRY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Avista Corporation (AVA): Free Stock Analysis Report

Aerie Pharmaceuticals, Inc. (AERI): Free Stock Analysis Report

Agilent Technologies, Inc. (A): Free Stock Analysis Report

Original post