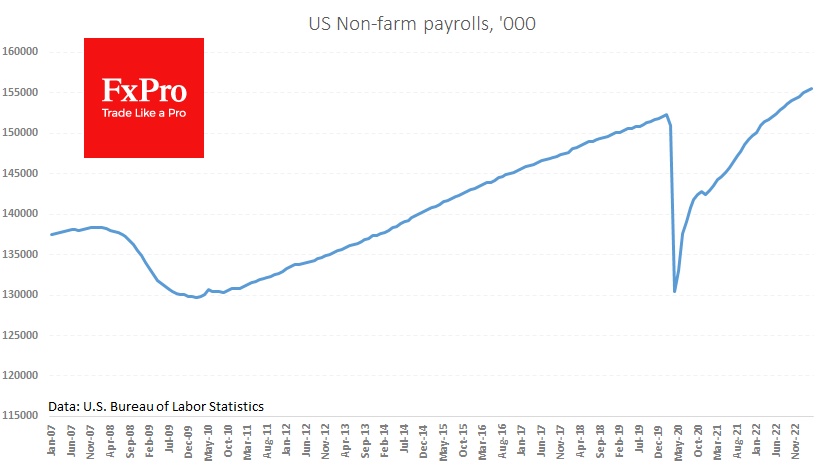

The US economy added 236K jobs in March, very close to the average forecast. The unemployment rate fell 0.1 percentage point to 3.5%, while the labour force participation rate rose from 62.5% to 62.6%, vs the expected fall to 62.4%.

Looking at this data, we can again see that the US labour market is in great shape, ignoring all the warning signs and threats. In the minutes following the release of the data, the interest rate futures market increased the odds of another Fed rate hike in early May from 50% to 70%. This should be good news for the dollar and not so good for the high-tech Nasdaq index, which is struggling to get a rate hike.

Digging deeper, however, the report is not so positive. The private sector added 189K jobs - the lowest number since December 2020. Construction and manufacturing saw net job losses of 9K and 1K, respectively. Not much, but it already looks like a turnaround, which often starts with these sectors.

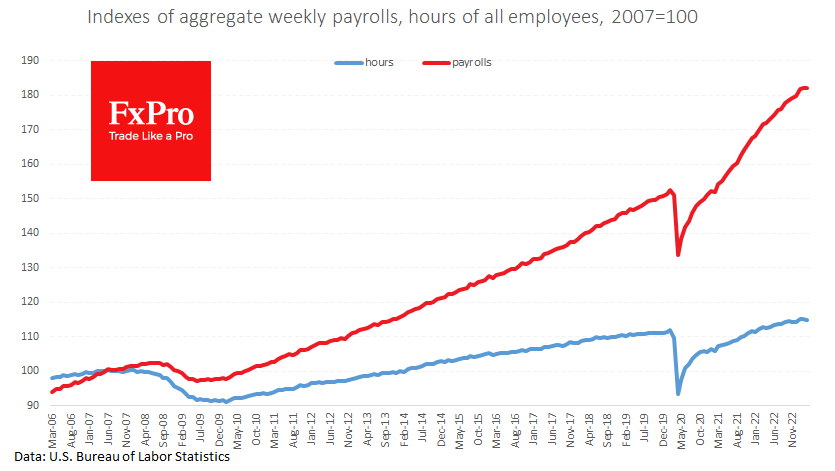

The index of weekly wages paid has been stagnant since the beginning of the year, as has the index of hours worked, as employment growth is offset by a fall in the average working week. Except for the first COVID-19 lockdowns, a similar pattern was only observed in 2008 and ended with a sharp decline.

We also note that the growth in total employment is not warming up wages. Its growth rate has fallen to 4.2% YoY as growth in the service sector absorbs low-paid workers returning to the labour market (as we can see from the rise in the participation rate).

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Employment Is Worse Than It Looks

Published 04/07/2023, 10:15 AM

Updated 03/21/2024, 07:45 AM

U.S. Employment Is Worse Than It Looks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.