- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

US Dollar: Have Talks Of Its Downfall Been Exaggerated?

The US Dollar has been a little lacklustre for some time, but talks of its downfall may have been greatly exaggerated. It has been quite clear now that the U.S economy has had a bit of a tough time; especially with a painful winter which kept consumers at home and job opportunities sparse. But now we are in the summer and things are starting to shine brightly for the U.S economy as a whole and a result the US dollar is beginning to climb the charts.

A look at the week ahead for the US shows the magnitude of movements to come.

Monday

Pending home sales m/m – 14:00 GMT

Tuesday

Consumer Confidence – 14:00 GMT

Wenesday

ADP Non-farm employment change – 12:15 GMT

Thursday

Unemployment Claims – 12:30 GMT

Friday

Non-farm Employment Change m/m – 12:30 GMT

Unemployment Rate - 12:30 GMT

Final Michigan Consumer Sentiment – 13:55 GMT

ISM Manufacturing PMI – 14:00 GMT

All of the above are major events on the trading calendar; in fact there are quite a few more that I have not even listed currently. One thing is clear though when it comes to all of these forecasts, they are all currently positive over the previous month’s data. So markets are certainly expecting stronger results from the U.S. economy as a whole.

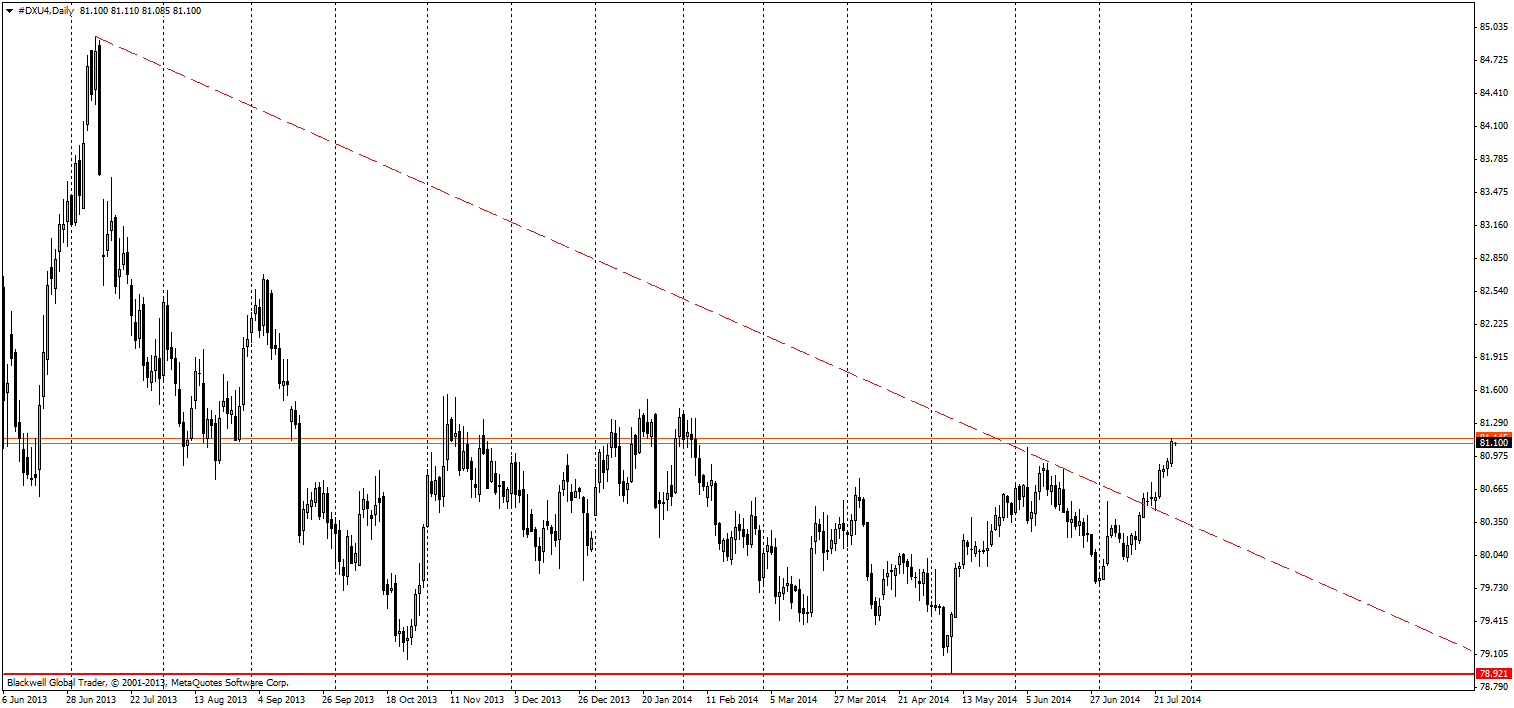

This can translate into a number of things on any given chart, but one that is plain to see is the dollar index at present, which has so far been looking more and more bullish, after breaking through a long term bearish trend line which has been in play for months.

It’s clear on the chart above that the US dollar Index is looking to move higher and the bullish breakout has been greeted strongly by markets. What has been leading the charge higher as well has been the recent collapse of the Euro against major trading partners, as Draghi has talked down the Euro and looked to provide stimulus.

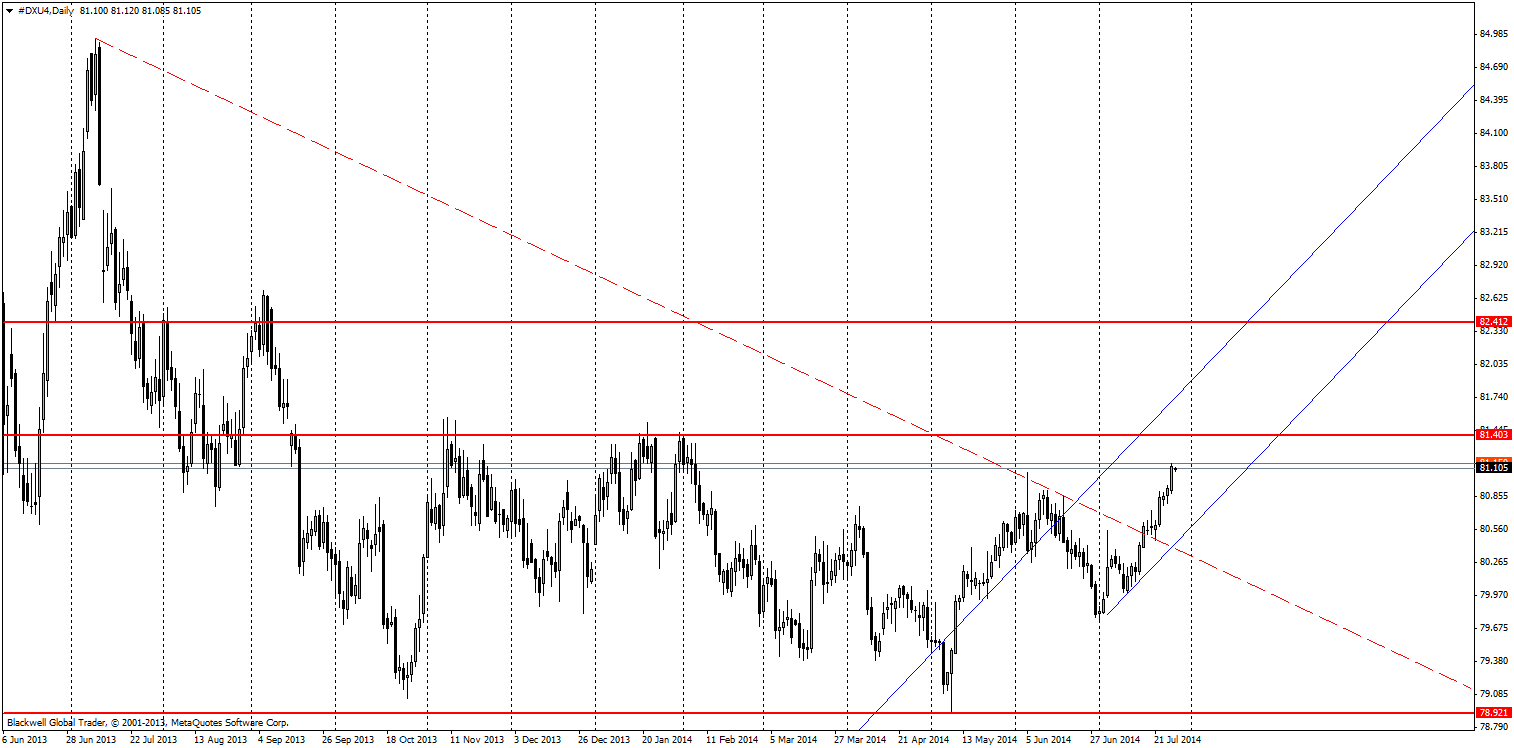

For people now looking to trade the dollar index it’s clear that it aims to go higher and resistance levels should be noted.

Currently the dollar index is looking to range higher on the charts and is looking likely to form a bullish channel in the short term. Resistance levels can be found at 81.403 and 82.412 as both these points are major levels of resistance and markets will likely look for points to exit.

However, in the long run, the dollar index is quite undervalued and there is certainly a lot of room for further movement higher and for markets to hit higher highs. Any long term play should be looked at in the present market; especially as the euro looks set for a fall and as the US economy starts to make inroads again on the path to recovery.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.