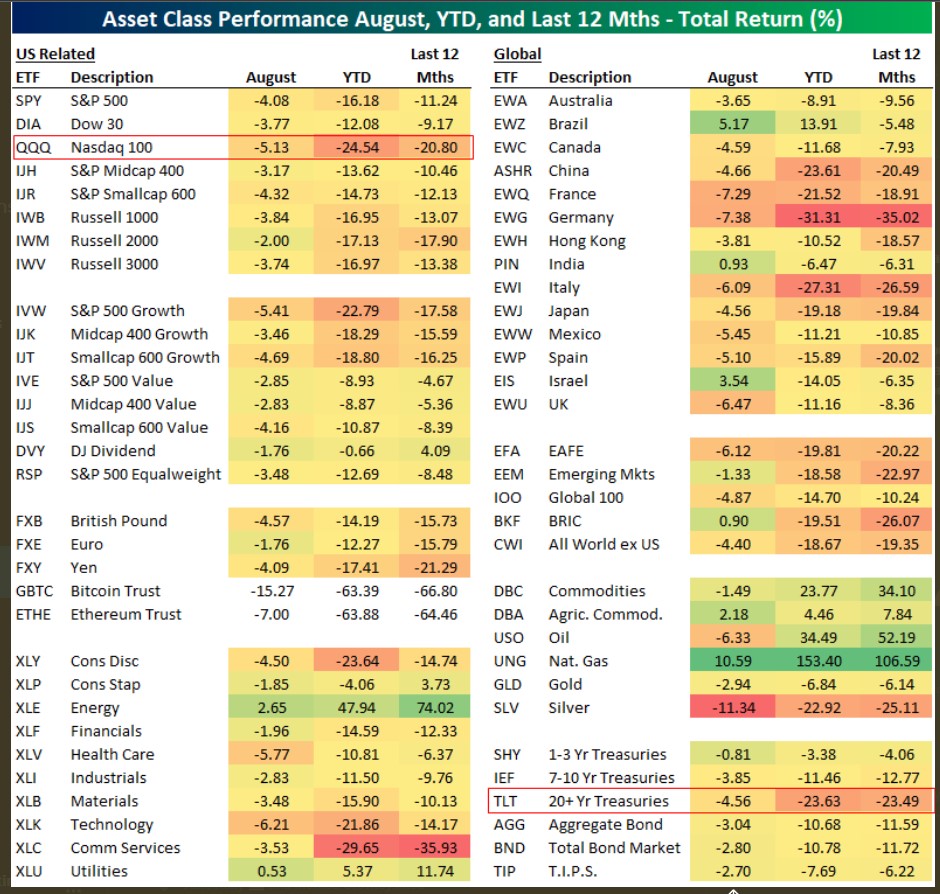

The table outlines Bespoke’s Asset Class Performance Matrix posted after the close Wednesday, August 31.

It’s tough to find positive returns for YTD or “last 12 months” periods.

It’s been tough to diversify client accounts. It’s a matter of finding “What’s going down the least?” and looking for relative performance.

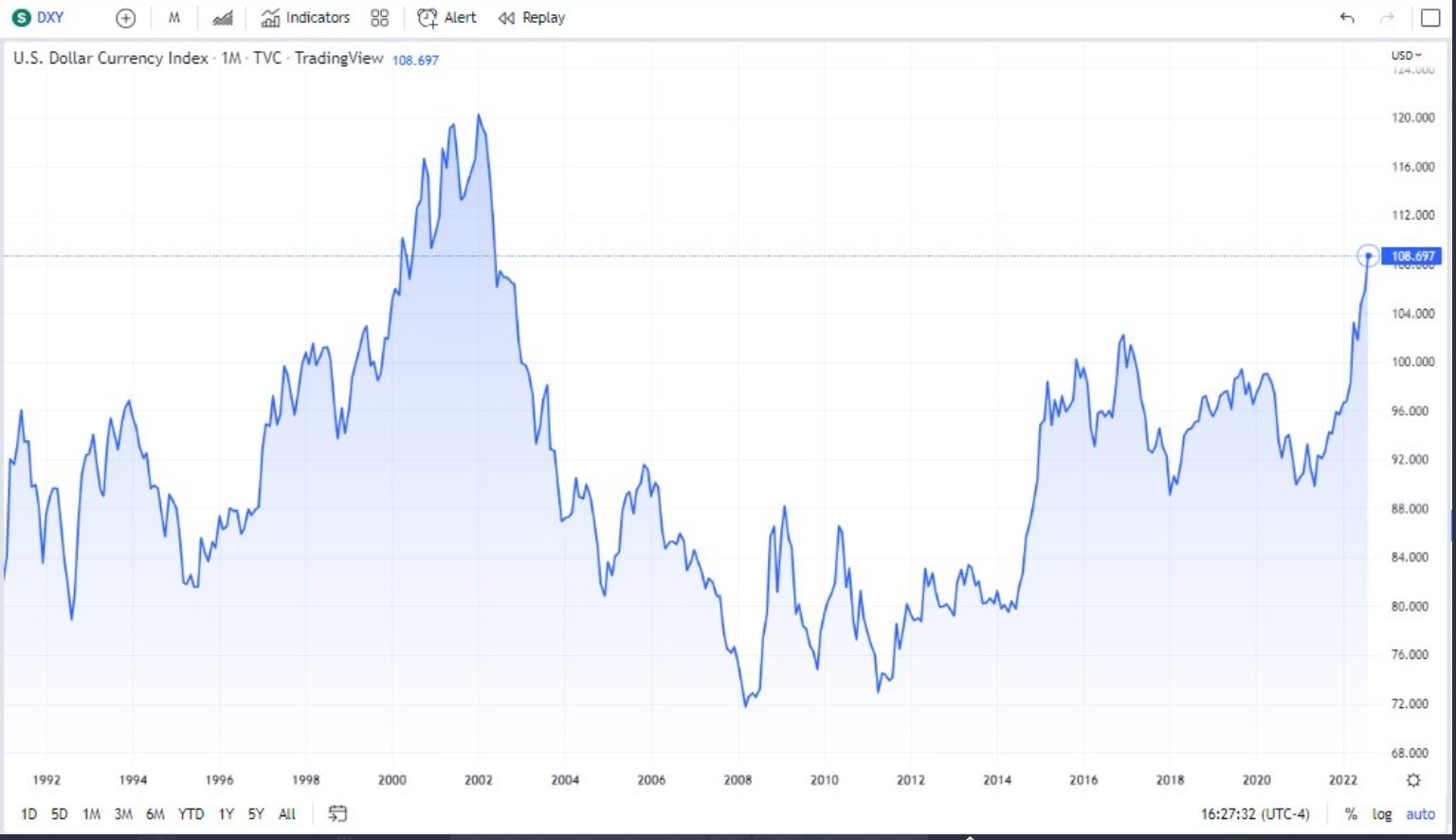

US Dollar

If you want one asset class that has had a very good year, it’s the greenback or US dollar.

The UUP ETF is tracked and it was up +13.66% as of last Friday, August 26’s close.

It cant be owned for clients because that ETF generates a K-1 and even if it’s held in IRA accounts, holding that ETF could have tax ramifications for the client.

What a shame – it’s a perfect hedge for this year’s action. With the 2-year Treasury closing the quarter at 3.45% range, it’s understandable why the dollar is strong. In times of global turmoil and uncertainty everyone comes home to mama and the US Treasury complex. There is no safer asset or currency in the world.

Being long cash and the UUP, you’d look like a genius.

Here’s the chart: this is how the dollar ended the month of August 2022:

If there’s one sign for a market reversal, I think it will eventually be accompanied by dollar weakness or a weaker UUP.

JC Parets concurs and calls the dollar “the stock market wrecking ball.”

One final point in terms of the US dollar and inflation: a strong dollar is actually deflationary.

Only David Rosenberg, the Canadian economist (@EconGuyRosie on Twitter) has pointed this out in the last few months. For those of who were around and paying attention prior to the 1987 Crash on October 19, 1987, the dollar weakness for the second half of 1987 contributed greatly to the rising inflationary fears, which lead to real panic. Jim Baker, the then Treasury Secretary under Bush 41, subsequently noted the dollar weakness was a contributing cause to October 19, 1987.

The dollar matters.

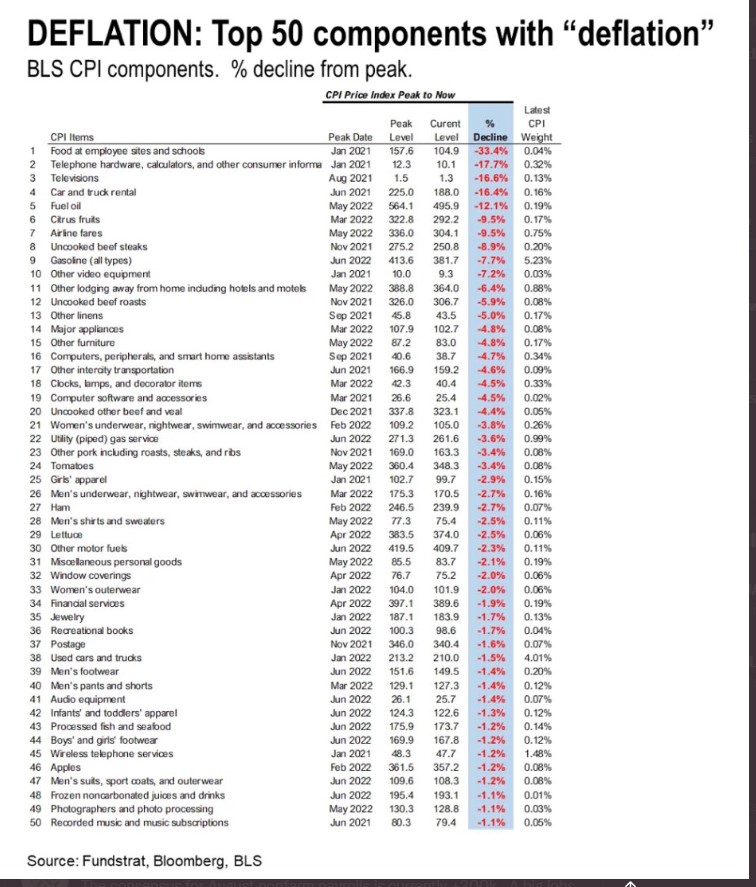

Tom Lee on Inflation: he thinks “we’re deflating fast.”

Thanks to Carl Quintanilla of @CNBC who posted this to Twitter (NYSE:TWTR) Wednesday night.

Tom Lee’s drawn many critics and it’s unfortunate because FundStrat’s work is top-notch. As a subscriber, I try and read it every day but it’s a lot to absorb.

The blog post from this weekend noted how “price” inflation was fading quickly and Tom’s table above supports that, and with housing starting to weaken, with a 30% weighting in the CPI, it will be one of the last shoes to fall in terms of the CPI “disinflating” but it will probably happen.

Conclusion

Jay Powell changed his mind quickly in December 2018 when it became apparent that the US economy had weakened and that he was probably hanging on too long to the monetary tightening that Janet Yellen started in December 2016.

The big difference today in these last two tightening cycles was that in 2018, Powell really was seeing no inflation. My own opinion was that they wanted to get back to some level of 2% – 2.5% fed funds rate and away from 0% fed funds that had been with us for 6 – 7 years.

The 50% retracement level for the S&P 500 in terms of the June – August rally was 3,985 so closing below that today was not a plus.

The JOLTS report showed that US corporations increased their job openings or jobs available. We want to see that metric move the other way.

Friday’s jobs report is a big deal and yet the stock market is short-term oversold and it’s getting extreme.

Sentiment is as negative as I’ve ever seen it. We used to be happy too. Bonds, stocks, international, all down this year.