- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

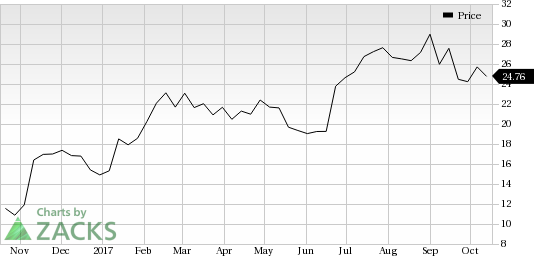

Exelixis (EXEL) Looks Good: Stock Adds 17.2% In Session

Exelixis, Inc. (NASDAQ:EXEL) was a big mover last session, as the company saw its shares rise more than 17% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This breaks the recent trend of the company, as the stock is now trading above the volatile price range of $23.35 to $28.27 in the past one-month time frame.

The move came after the company announced that its global phase 3 CELESTIAL trial met the primary endpoint to heal liver cancer patients with Cabometyx, which will provide significant improvement in comparison to placebo. Also, the company obtained the U.S. Food and Drug Administration approval for supplemental New Drug Application (sNDA) for the treatment of advanced renal cell carcinoma.

The company has seen one positive estimate revision in the past one month, while its Zacks Consensus Estimate for the current quarter has remained unchanged. So make sure to keep an eye on this stock going forward to see if this recent jump can turn into more strength down the road.

Exelixis currently has a Zacks Rank #3 (Hold), while its Earnings ESP is negative.

A better-ranked stock in the Medical - Biomedical and Genetics industry is Axovant Sciences Ltd. (NASDAQ:AXON) , which currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Is EXEL going up? Or down? Predict to see what others think: Up or Down

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Axovant Sciences Ltd. (AXON): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Nvidia (NASDAQ:NVDA) shook things up by reporting revenue of $39.3 billion for the quarter while guiding next quarter to $43 billion. This was slightly below the pattern’s...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.